Memorex 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

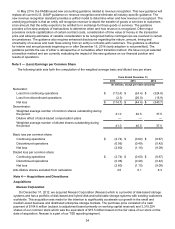

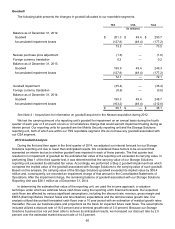

The preliminary purchase price allocation during the fourth quarter of 2012 resulted in goodwill of $65.5 million,

primarily attributable to strategic synergies and intangible assets that did not qualify for separate recognition and

are not deductible for tax purposes. During 2013, we recorded an adjustment to the purchase price related to

working capital in the amount of $1.6 million. This adjustment resulted in a decrease to goodwill and a cash receipt

for this amount. Goodwill associated with the acquisition of Nexsan is included in our Storage Solutions reporting

unit, which consists exclusively of the Nexsan business, for the purposes of goodwill impairment testing. See Note

6 - Intangible Assets and Goodwill for more information regarding goodwill. The purchase accounting for this

acquisition was final as of December 31, 2013. The purchase price remained preliminary prior to December 31,

2013 pending final evaluation of income tax balances of which there were no further adjustments upon finalization

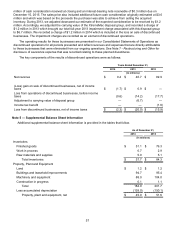

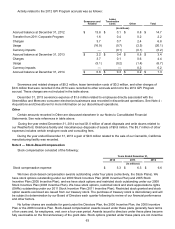

of these balances. The following table illustrates our allocation of the purchase price to the assets acquired and

liabilities assumed as of December 31, 2013:

Amount

(In millions)

Cash $ 0.8

Accounts receivable 14.6

Inventory 6.9

Prepaid and other 9.0

Property, plant and equipment 5.2

Intangible assets 42.6

Goodwill 63.9

Other assets 0.6

Accounts payable (5.3)

Accrued expenses (10.0)

Deferred revenue - current (4.3)

Deferred revenue - non-current (2.5)

Other long-term liabilities (3.0)

$ 118.5

Our allocation of the purchase price to the assets acquired and liabilities assumed resulted in the recognition

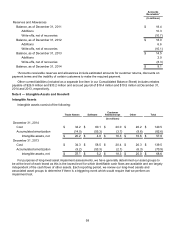

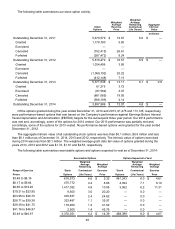

of the following intangible assets:

Weighted

Average

Amount Life

(In millions)

Trade names $ 3.1 5 years

Other - developed technology 19.4 3-7 years

Other - research and development technology 1.7 NA

Customer relationships 18.4 12 years

$ 42.6