Memorex 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51

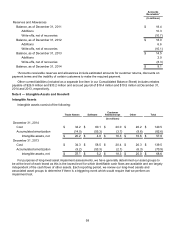

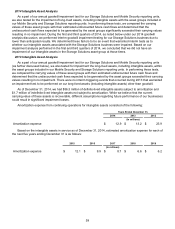

the future using certain valuation methods. See Note 6 - Intangible Assets and Goodwill for further information on

our intangible assets and impairment testing.

We capitalize costs of software developed or obtained for internal use, once the preliminary project stage has

been completed, management commits to funding the project and it is probable that the project will be completed

and the software will be used to perform the function intended. Capitalized costs include only (1) external direct

costs of materials and services consumed in developing or obtaining internal-use software, (2) payroll and payroll-

related costs for employees who are directly associated with and who devote time to the internal-use software

project and (3) interest costs incurred, when material, while developing internal-use software. Capitalization of costs

ceases when the project is substantially complete and ready for its intended use.

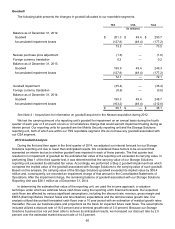

Goodwill. Goodwill is the excess of the cost of an acquired entity over the estimated fair value of assets

acquired and liabilities assumed in a business combination. Goodwill is not amortized. Goodwill is tested for

impairment annually as of November 30th, or whenever events or changes in circumstances indicate that the

carrying amount may not be recoverable. Goodwill is considered impaired when its carrying amount exceeds its

implied fair value. The Company may assess qualitative factors to determine whether it is more likely than not that

the fair value of the reporting unit is less than its carrying amount, including goodwill. If we determine in this

assessment that the fair value of the reporting unit is more than its carrying amount we may conclude that there is

no need to perform Step 1 of the impairment test. We have an unconditional option to bypass the qualitative

assessment for any reporting unit in any period and proceed directly to performing Step 1 of the goodwill

impairment test.

Step 1 of the impairment test involves comparing the fair value of the reporting unit to which goodwill was

assigned to its carrying amount. If fair value is deemed to be less than carrying value, Step 2 of the impairment test

compares the implied fair value of the reporting unit's goodwill with the carrying amount of the reporting unit's

goodwill. If the carrying amount of the reporting unit's goodwill is greater than the implied fair value of the reporting

unit's goodwill, an impairment loss must be recognized for the excess. This involves measuring the fair value of the

reporting unit's assets and liabilities (both recognized and unrecognized) at the time of the impairment test. The

difference between the reporting unit's fair value and the fair values assigned to the reporting unit's individual assets

and liabilities is the implied fair value of the reporting unit's goodwill. See Note 6 - Intangible Assets and Goodwill for

further information on our goodwill and impairment testing.

Impairment of Long-Lived Assets. We periodically review the carrying value of our property and equipment and

our intangible assets to test whether current events or circumstances indicate that such carrying value may not be

recoverable. For the testing of long-lived assets that are "held for use," if the tests indicate that the carrying value of

the asset group that contains the long-lived asset being evaluated is greater than the expected undiscounted cash

flows to be generated by such asset or asset group, an impairment loss would be recognized. The impairment loss

is determined by the amount by which the carrying value of such asset group exceeds its estimated fair value. We

generally measure fair value by considering sale prices for similar assets or by discounting estimated future cash

flows from such assets using an appropriate discount rate. See Note 6 - Intangible Assets and Goodwill for further

information on impairment testing.

Assets to be disposed of and qualify as being "held for sale" are carried at the lower of their carrying value or

fair value less costs to sell. Management judgment is necessary to estimate the fair value of assets and,

accordingly, actual results could vary significantly from such estimates.

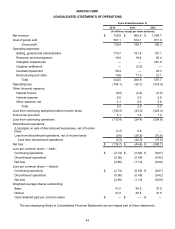

Revenue Recognition. We sell a wide range of data storage, mobile security and consumer storage solutions

audio products and accessories. Net revenue consists primarily of data storage, mobile security, magnetic, optical,

flash media, consumer electronics and accessories sales. We recognize revenue when persuasive evidence of an

arrangement exists, delivery has occurred, installation has been completed (if applicable) or services have been

rendered, fees are fixed or determinable and collectability is reasonably assured. For product sales, delivery is

considered to have occurred when the risks and rewards of ownership transfer to the customer. For inventory

maintained at the customer site, revenue is recognized at the time these products are sold by the customer. We

base our estimates for returns on historical experience and have not experienced significant fluctuations between

estimated and actual return activity. Non-income based taxes collected from customers are also recorded as

revenue and include levies and various excise taxes, mainly in non-U.S. jurisdictions. These taxes included in

revenue in 2014, 2013, and 2012 were $7.1 million, $10.3 million, and $13.8 million, respectively.

The majority of the Company’s Storage and Security Solutions products have both software and non-software

components that together deliver the products’ essential functionality. The software is embedded within the

hardware and sold together as a single storage solution to the customer. Accordingly, the software and non-

software components do not qualify as separate units of accounting as prescribed in Accounting Standards