Memorex 2014 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.5

The TREK brand was launched in late 2013 to better position Imation’s speaker products in the competitive

marketplace. Today, the TREK brand is dedicated to producing high quality audio products that are portable,

wireless and weatherproof. TREK brand speakers include the TREK Max, TREK Micro and TREK Flex.

Geographic Regions

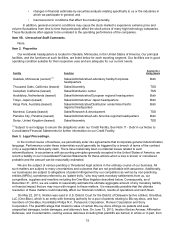

Both of our reporting segments serve customers in all geographic regions worldwide. The United States

represents the largest current individual market for our products however, most of our revenue comes from markets

outside the United States. It has a great variety and sophistication of distribution channels including VARs, OEMs

and retail outlets. The Western Europe region exhibits traits similar to North America in terms of overall breadth of

product offerings, high penetration of end user markets and range of sophistication of distribution channels.

Emerging markets in Eastern Europe represent potential growth markets for our products as Information Technology

(IT) end user and consumer markets grow. Our Asian and Pacific region serves China, Hong Kong, Korea,

Australia, Singapore, India and Taiwan. Japan is the single largest market outside the United States. We also sell

our products in the Middle East and parts of Africa.

Seasonality

Our revenues are subject to some levels of seasonality. Historically, our fourth quarter has been the highest

revenue quarter of the year due to the trends of stronger consumer and information technology spending in the

fourth quarter of the calendar year. Our revenues are also subject to secular decline of the markets for magnetic

tape products as well as for optical media products.

Customers, Marketing and Distribution

Our products are sold to businesses and individual consumers. No one customer accounted for 10 percent or

more of our revenue in 2014, 2013 or 2012.

We market Imation products through a combination of distributors, wholesalers, VARs, OEMs and retail outlets.

Worldwide, approximately 68 percent of our 2014 revenue came from distributors and VARs, 28 percent came from

the retail channel and 4 percent came from OEMs. We maintain a Company sales force and a network of

distributors and VARs to generate sales of our products around the world.

Market and Competition

The global market for our products is highly competitive and characterized by continuing technology changes,

frequent new product introductions and performance improvements, diverse distribution channels, aggressive

marketing and pricing practices, and ongoing variable price erosion. Competition is based on many factors,

including product design, brand strength, distribution presence and capability, channel knowledge and expertise,

geographic availability, breadth of product line, product cost, media capacity, access speed and performance,

durability, reliability, scalability, intellectual property, compatibility and global product support capability.

Imation Nexsan storage system products operate in a large and competitive data storage market. Demand for

data storage capacity is expected to grow, and flexible customer solutions are required that include data security

and protection, performance and scalability. We believe we have a diverse and competitive product portfolio that

addresses a wide range of customer needs. Our primary competitors for our Nexsan products include mid-range

storage systems and products from EMC, NetApp, Pure Storage, Overland, Violin, Dot Hill, Nimble and a number of

smaller, privately held storage system companies.

Imation IronKey products compete in the mobile workspace market and the secure mobile security market.

Demand for mobile workspace, especially given the BYOD trend, is expected to grow, and customer solutions are

required that include security, ease of use, performance and central management, which IronKey products provide.

Secure storage demand is flat, but is seeing an extended life. We believe we have a diverse and competitive

product portfolio that addresses current and emerging customer needs. Our primary competitors in mobile security

products include other Microsoft Windows-certified providers, such as Spyrus and Kingston.

The magnetic tape industry has consistently addressed the growth in demand for storage capacity with higher

capacity cartridges, resulting in a lower cost per gigabyte, which leads to a decline in the actual number of media

units shipped. In addition, lower cost disk and storage optimization strategies, such as virtual tape and de-

duplication, continue to compete with magnetic tape. Therefore, we expect and are planning for our tape revenue to

continue to decline. Our major competitors include Fuji, Sony, Maxell and HP.

Our main competitors in recordable optical media include Maxell, JVC, Sony and Verbatim. The optical market

is in secular decline as digital streaming, hard disk and flash media replace optical media in some applications such