Memorex 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.79

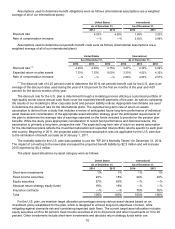

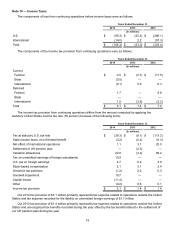

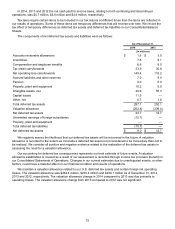

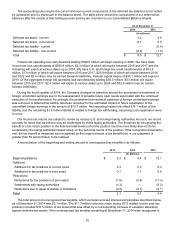

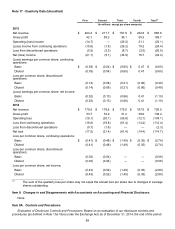

Note 12 — Fair Value Measurements

Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability, or

the exit price in an orderly transaction between market participants on the measurement date. A three-level

hierarchy is used for fair value measurements based upon the observability of the inputs to the valuation of an asset

or liability as of the measurement date. Level 1 measurements consist of unadjusted quoted prices in active

markets for identical assets or liabilities. Level 2 measurements include quoted prices in markets that are not active

or model inputs that are observable either directly or indirectly for substantially the full term of the asset or liability.

Level 3 measurements include significant unobservable inputs. A financial instrument's level within the hierarchy is

based on the highest level of any input that is significant to the fair value measurement. Following is a description of

our valuation methodologies used to estimate the fair value for our assets and liabilities.

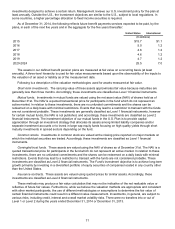

Assets and Liabilities that are Measured at Fair Value on a Nonrecurring Basis

The Company's non-financial assets such as goodwill, intangible assets and property, plant and equipment are

recorded at fair value when an impairment is recognized or at the time acquired in a business combination. As

discussed in Note 6 - Intangible Assets and Goodwill and Note 7 - Restructuring and Other Expense, during 2014

and 2012, we recorded impairment charges associated with goodwill, intangible assets or property, plant and

equipment and reduced the carrying amount of such assets subject to the impairment to their estimated fair value.

Additionally, as discussed in Note 4 - Acquisitions, the Company acquired Nexsan Corporation during 2012 and

recorded the acquired assets and liabilities, including goodwill, intangible assets and property, plant and equipment

at their estimated fair value. The determination of the estimated fair value of such assets required the use of

significant unobservable inputs which would be considered Level 3 fair value measurements.

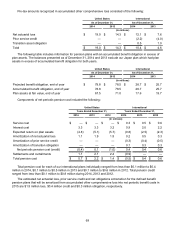

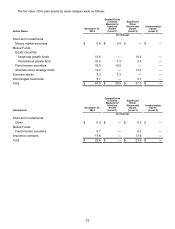

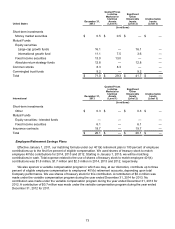

Assets and Liabilities that are Measured at Fair Value on a Recurring Basis

The Company measures certain assets and liabilities at their estimated fair value on a recurring basis, including

cash and cash equivalents, derivative instruments and our contingent consideration obligations associated with

certain acquisitions.

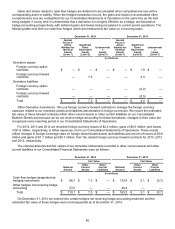

Derivative Financial Instruments

We maintain a foreign currency exposure management policy that allows the use of derivative instruments,

principally foreign currency forward, option contracts and option combination strategies to manage risks associated

with foreign exchange rate volatility. Generally, these contracts are entered into to fix the U.S. dollar amount of the

eventual cash flows. The derivative instruments range in duration at inception from between one to 16 months. The

fair value of our derivative instruments is determined based on inputs that are observable in the public market, but

are other than publicly quoted prices (Level 2). We are exposed to the risk of nonperformance by our counter-

parties, but we do not anticipate nonperformance by any of these counter-parties. We actively monitor our exposure

to credit risk through the use of credit approvals and credit limits and by using major international banks and

financial institutions as counter-parties.

Cash Flow Hedges. We attempt to substantially mitigate the risk that forecasted cash flows denominated in

foreign currencies may be adversely affected by changes in the currency exchange rates through the use of option,

forward and combination option contracts. The degree of our hedging can fluctuate based on management

judgment and forecasted projections. We formally document all relationships between hedging instruments and

hedged items, as well as our risk management objective and strategy for undertaking the hedged items. This

process includes linking all derivatives to forecasted transactions. We formally assess, both at the hedge's inception

and on an ongoing basis, whether the derivatives used in hedging transactions are highly effective in offsetting

changes in the cash flows of hedged items. At December 31, 2014 and 2013, our contracts had durations of 12

months or less. The fair value of these contracts is recorded in other current assets and other current liabilities on

our Consolidated Balance Sheets.