Memorex 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

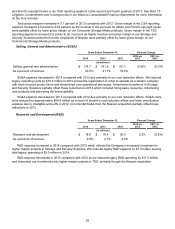

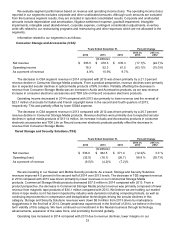

Commercial Storage Media business, and an increased investment in R&D and SG&A in our Storage and Security

Solutions businesses driven by hiring sales and engineering resources and value-added resellers, introducing new

products and promoting the brand globally.

The increase in TSS segment revenue in 2013 compared with 2012 was driven by the addition of revenue from

Nexsan, which was acquired on December 31, 2012. Lower revenue in our Commercial Storage Media products

partially offset the incremental revenue from Nexsan for 2013. Commercial Storage Media product revenue

decreased $60.6 million in 2013 compared with 2012. From a product perspective, the decrease in Commercial

Storage Media product revenue was primarily composed of lower revenue from magnetic tape products of $55.2

million compared with 2012. During the last half of 2013 we did see some effect from the disruption in U.S.

government spending. Additionally, during the last half of 2013 our Nexsan business as well as some other storage

solution providers saw weakness in revenues due to some marketplace sluggishness with certain customers

delaying orders. Revenue in our Mobile Security products showed a decrease from 2012 as they were also

constrained by the disruption in U.S. government spending.

Operating loss decreased in 2013 compared with 2012 due to an increase in gross profit driven by the

acquisition of Nexsan that was partially offset by lower gross profit on Commercial Storage Media products and

slightly higher R&D expense and SG&A expense.

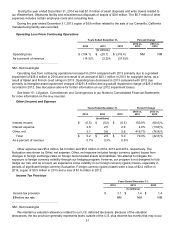

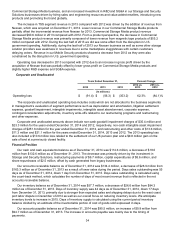

Corporate and Unallocated

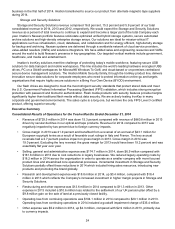

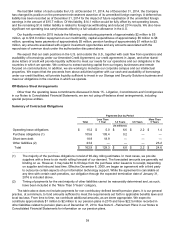

Years Ended December 31, Percent Change

2014 2013 2012 2014 vs.

2013 2013 vs.

2012

(In millions)

Operating loss $ (91.4) $ (56.3) $ (353.2) 62.3% (84.1)%

The corporate and unallocated operating loss includes costs which are not allocated to the business segments

in management’s evaluation of segment performance such as depreciation and amortization, litigation settlement

expense, goodwill impairment, intangible impairments, intangible asset abandonment, corporate expense,

contingent consideration adjustments, inventory write-offs related to our restructuring programs and restructuring

and other expenses.

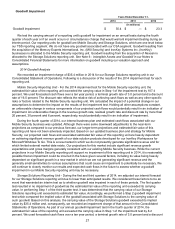

Corporate and unallocated amounts above include non-cash goodwill impairment charges of $35.4 million and

$23.3 million for the years ended December 31, 2014 and 2012, respectively, non-cash intangible asset impairment

charges of $251.8 million for the year ended December 31, 2012, and restructuring and other costs of $13.6 million,

$11.3 million and $21.1 million for the years ended December 31, 2014, 2013 and 2012. The 2013 operating loss

also included a $10.6 million loss related to the settlement of our UK pension plan and a $9.8 million gain on the

sale of land at a previously closed facility.

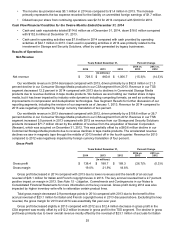

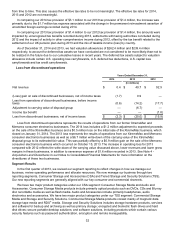

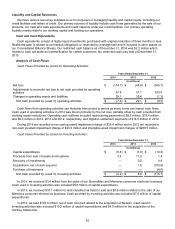

Financial Position

Our cash and cash equivalents balance as of December 31, 2014 was $114.6 million, a decrease of $18.0

million from $132.6 million as of December 31, 2013. The decrease was primarily driven by the investment in

Storage and Security Solutions, restructuring payments of $6.7 million, capital expenditures of $5.6 million, and

share repurchases of $2.5 million, offset by cash generated from legacy businesses.

Our accounts receivable balance as of December 31, 2014 was $134.4 million, a decrease of $28.9 million from

$163.3 million as of December 31, 2013 as a result of lower sales during the period. Days sales outstanding was 55

days as of December 31, 2014, down 1 day from December 31, 2013. Days sales outstanding is calculated using

the count-back method, which calculates the number of days of most recent revenue that is reflected in the net

accounts receivable balance.

Our inventory balance as of December 31, 2014 was $57.7 million, a decrease of $26.6 million from $84.3

million as of December 31, 2013. Days of inventory supply was 44 days as of December 31, 2014, down 17 days

from December 31, 2013, primarily due to stronger than expected sales and shipping delays due to the west coast

port labor dispute in December of 2014 as well as our overall focus on reducing inventory levels. We anticipate

inventory levels to increase in 2015. Days of inventory supply is calculated using the current period inventory

balance divided by an estimate of the inventoriable portion of cost of goods sold expressed in days.

Our accounts payable balance as of December 31, 2014 was $95.5 million, an increase of $0.8 million from

$94.7 million as of December 31, 2013. The increase in accounts payable was mainly due to the timing of

payments.