Memorex 2014 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.23

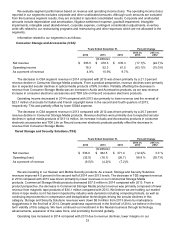

to maximize shareholder value and the value of each of our business units. There can be no assurance that this

review will result in any transaction or that any transaction, if pursued, will be consummated and result in enhanced

shareholder value or the value of any of our business units. We do not intend to provide updates or make any

comments regarding the evaluation of strategic alternatives unless our Board of Directors has approved a specific

transaction or management otherwise deems disclosure appropriate.

Segment Overview

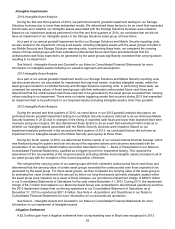

Consumer Storage and Accessories

Our CSA business continues to be impacted by lower revenues from the expected secular declines in optical

media products as the optical market continues to progress through its life cycle. Despite these declines, our gross

margins remained in excess of 20.0 percent for this segment, and our cash generation was strong in 2014 as a

result of the margin generated and reductions in working capital.

Tiered Storage and Security Solutions

We are investing in our Storage and Security Solutions portfolio with aggressive hiring of technical support and

sales talent and the introduction of new products. Our magnetic tape revenues continue to decrease consistent with

the overall market and we have been able to maintain our market share through 2014. Ongoing emphasis on

working capital and cost management will be a key focus for our magnetic tape business. Long term we expect

growth from our Storage and Security Solutions portfolio products as we continue our investment in this business.

Product Overview

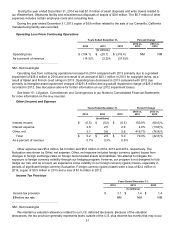

Consumer Storage Media

Consumer Storage Media revenue comprised 59.0 percent, 50.6 percent and 47.0 percent of our total

consolidated revenue in 2012, 2013 and 2014, respectively. This reduction is expected and consistent with our

strategy as we become less reliant on revenues from legacy products. Our Consumer Storage Media includes

optical products, USB flash drives, flash cards and external hard disk drives. Our optical products consist of DVDs,

CDs and Blu-ray™ recordable media. We have the leading global market share for recordable optical media;

however, the overall market for CDs and DVDs is declining as digital streaming, hard disk and flash media replace

optical media in some applications such as music and video recording. Our strategy is to maximize cash flows,

extract working capital from this business and manage our cost structure efficiently. We sell our recordable optical

media products through a variety of retail and commercial distribution channels and source from manufacturers in

Taiwan and India. Our optical media is marketed worldwide under brands we own or control, including Imation,

Memorex and TDK Life on Record. We also sell standard USB flash drives, flash cards and external hard disk

drives under our Imation, Memorex and TDK Life on Record brands. We source these products from manufacturers

primarily in Asia and sell them through a variety of retail and commercial distribution channels globally.

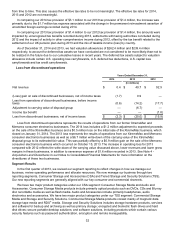

Audio and Accessories

Audio and Accessories revenue comprised 6.9 percent, 4.9 percent and 4.1 percent of our total consolidated

revenue in 2014, 2013 and 2012, respectively. Our Audio and Accessories include headphones and speakers sold

under the TDK Life on Record brand. The portfolio continues to evolve as we focus on higher-margin, differentiated

accessories products and respond to customer demand. We design products to meet user needs and source these

products from manufacturers throughout Asia.

Commercial Storage Media

Commercial Storage Media revenue comprised 31.0 percent, 29.2 percent and 29.3 percent of our total

consolidated revenue in 2012, 2013 and 2014, respectively. Our magnetic tape media products are used for

business and operational continuity planning, disaster recovery, data backup, near-line data storage and retrieval,

and for cost-effective mass and archival storage. Imation has a solid industry reputation and strong relationships

with original equipment manufacturers (OEMs). However, the market for magnetic tape products has been in

secular decline. Therefore, our focus has been on maintaining a leading market share and maximizing cash

generation. We have a significant portfolio of intellectual property that offers monetization opportunities. In 2011, we

signed a strategic agreement with TDK to jointly develop and manufacture magnetic tape technologies, and Imation

discontinued tape coating operations at our Weatherford, Oklahoma facility. Under the agreement, we collaborated

on the research and development of future tape formats in both companies’ research centers in the U.S. and Japan,

and consolidated tape coating operations to the TDK Group Yamanashi manufacturing facility. At the end of 2013,

TDK announced its intent to cease manufacturing of magnetic tape, and TDK then exited the tape manufacturing