Memorex 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114

|

|

72

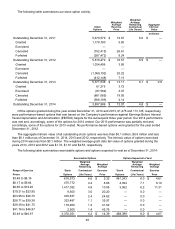

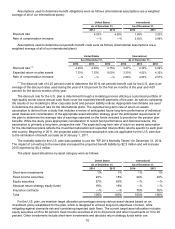

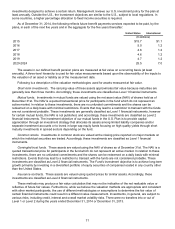

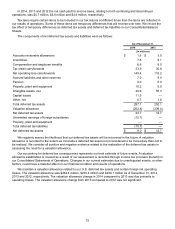

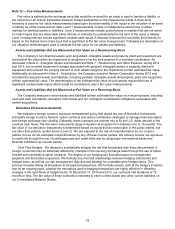

The fair value of the plan assets by asset category were as follows:

United States December 31,

2014

Quoted Prices

in Active

Markets for

Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Unobservable

Inputs

(Level 3)

(In millions)

Short-term investments

Money market securities $ 0.4 $ 0.4 $ — $ —

Mutual Funds

Equity securities

Large-cap growth funds 14.6 — 14.6 —

International growth fund 10.8 7.3 3.5 —

Fixed income securities 15.5 15.5 — —

Absolute return strategy funds 13.2 — 13.2 —

Common stocks 7.3 7.3 — —

Commingled trust funds 5.7 — 5.7 —

Total $ 67.5 $ 30.5 $ 37.0 $ —

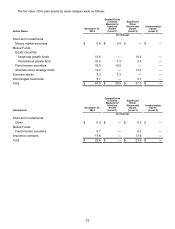

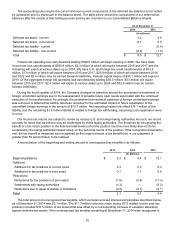

International December 31,

2014

Quoted Prices

in Active

Markets for

Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Unobservable

Inputs

(Level 3)

(In millions)

Short-term investments

Other $ 0.3 $ — $ 0.3 $ —

Mutual Funds

Fixed income securities 5.7 — 5.7 —

Insurance contracts 17.6 — 17.6 —

Total $ 23.6 $ — $ 23.6 $ —