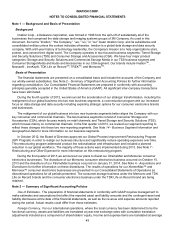

Memorex 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52

Codification (ASC) 605-25 and are combined as a single unit of accounting. There are no situations where revenue

is recognized separately for software.

We also offer services in conjunction with our Storage and Security Solutions products which may include

installation, training, hardware maintenance and software support. For such services that are determined to be

essential to the functionality of the product, such as certain installation services, the product and services do not

qualify as separate units of accounting as prescribed in ASC 605-25 and are combined as a single unit of

accounting. In situations where the sale of our Storage and Security Solutions products and associated services

qualify as multiple element arrangements, we allocate arrangement consideration to each unit of accounting based

on its relative selling price, and revenue is recognized for each element when all of the criteria for revenue

recognition for such elements have been met. Revenue from services is not a significant component of total

consolidated revenues.

Revenue associated with stand-alone service arrangements (such as maintenance arrangements) that are sold

separately is recorded ratably over the service period.

Rebates that are provided to our customers are accounted for as a reduction of revenue at the time of sale

based on an estimate of the cost to honor the related rebate programs. The rebate programs that we offer vary

across our businesses as we serve numerous markets. The most common incentives relate to amounts paid or

credited to customers that are volume-based and rebates to support promotional activities.

Concentrations of Credit Risk. We sell a wide range of products and services to a diversified base of customers

around the world and perform ongoing credit evaluations of our customers’ financial condition. Therefore, we

believe there is no material concentration of credit risk. No single customer represented more than 10 percent of

total net revenue or accounts receivable in 2014, 2013, or 2012.

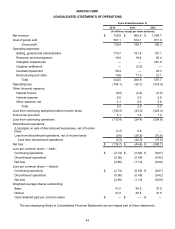

Cost of Goods Sold. Cost of goods sold includes raw materials, direct labor, manufacturing overhead, shipping

and receiving costs, freight costs, depreciation of manufacturing equipment and other less significant indirect costs

related to the production of our products.

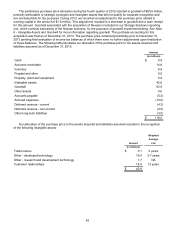

Selling, General and Administrative (SG&A) Expenses. SG&A expenses include sales and marketing,

customer service, finance, legal, human resources, information technology, general management and similar

expenses.

Research and Development Costs. Research and development costs are expensed as incurred. Research and

development costs include salaries, payroll taxes, employee benefit costs, supplies, depreciation and maintenance

of research equipment.

Rebates Received. We receive rebates from some of our inventory vendors if we achieve pre-determined

purchasing thresholds. These rebates are accounted for as a reduction of the price of the vendor's products and are

included as a reduction of our cost of goods sold in the period in which the purchased inventory is sold.

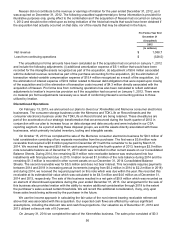

Income Taxes. We are required to estimate our income taxes in each of the jurisdictions in which we operate.

This process involves estimating our actual current tax obligations based on expected taxable income, statutory tax

rates and tax credits allowed in the various jurisdictions in which we operate. Tax laws require certain items to be

included in our tax returns at different times than the items are reflected in our results of operations. Some of these

differences are permanent, such as expenses that are not deductible in our tax returns, and some are temporary

differences that will reverse over time. Temporary differences result in deferred tax assets and liabilities, which are

included in our Consolidated Balance Sheets. We must assess the likelihood that our deferred tax assets will be

realized and establish a valuation allowance to the extent necessary.

We record income taxes using the asset and liability approach. Under this approach, deferred tax assets and

liabilities are recognized for the expected future tax consequences of temporary differences between the book and

tax basis of assets and liabilities. We measure deferred tax assets and liabilities using the enacted statutory tax

rates that are expected to apply in the years in which the temporary differences are expected to be recovered or

paid.

We regularly assess the likelihood that our deferred tax assets will be recovered in the future. In accordance

with accounting rules, a valuation allowance is recorded to the extent we conclude a deferred tax asset is not

considered to be more-likely-than-not to be realized. We consider all positive and negative evidence related to the

realization of the deferred tax assets in assessing the need for a valuation allowance. If we determine it is more-

likely-than-not that we will not realize all or part of our deferred tax assets, an adjustment to the deferred tax asset

will be charged to earnings in the period such determination is made.