Memorex 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40

the carrying amount of a reporting unit's goodwill for impairment on an annual basis during the fourth quarter of

each year (as of November 30th) or if an event occurs or circumstances change that would warrant impairment

testing during an interim period.

Goodwill is considered impaired when its carrying amount exceeds its implied fair value. The first step of the

impairment test involves comparing the fair value of the reporting unit to which goodwill was assigned to its carrying

amount. The second step of the impairment test compares the implied fair value of the reporting unit’s goodwill with

the carrying amount of the reporting unit’s goodwill. If the carrying amount of the reporting unit’s goodwill is greater

than the implied fair value of the reporting unit’s goodwill an impairment loss must be recognized for the excess.

This involves measuring the fair value of the reporting unit’s assets and liabilities (both recognized and

unrecognized) at the time of the impairment test. The difference between the reporting unit’s fair value and the fair

values assigned to the reporting unit’s individual assets and liabilities is the implied fair value of the reporting unit’s

goodwill.

Our reporting units for goodwill are the Mobile Security reporting unit and the Storage Solutions reporting unit

which are each one level below our TSS reporting segment and for which goodwill of $8.0 million and $28.1 million,

respectively, was recorded as of December 31, 2014. We do not have any goodwill associated with our CSA

segment. See Note 6 - Intangible Assets and Goodwill for information on our 2014 and 2013 goodwill.

In determining the estimated fair value of the reporting units, we used the income approach, a valuation

technique under which we estimate future cash flows using the reporting unit's financial forecasts and the market

approach, a valuation technique that provides an estimate of the value of the reporting unit based on a comparison

to other similar businesses. Our expected cash flows are affected by various significant assumptions, including

projected revenue, gross margin and expense expectations, terminal growth rate and a discount rate. Our analyses

utilize discounted forecasted cash flows over a multi-year period depending on the reporting unit with an estimation

of residual growth rates thereafter. We use our business plans and projections as the basis for these cash flow

assumptions. We recorded an impairment charge of $35.4 million during 2014 for our Storage Solutions reporting

unit in our Consolidated Statement of Operations. See Results of Operations - Goodwill Impairment above for a

discussion of the results of the 2014 impairment test for each of these reporting units.

Copyright Levies. In many European Union (EU) member countries, the sale of recordable optical media is

subject to a private copyright levy. The levies are intended to compensate copyright holders with "fair

compensation" for the harm caused by private copies made by natural persons of protected works under the

European Copyright Directive, which became effective in 2002 (Directive). Levies are generally charged directly to

the importer of the product upon the sale of the products. Payers of levies remit levy payments to collecting

societies which, in turn, are expected to distribute funds to copyright holders. Levy systems of EU member countries

must comply with the Directive, but individual member countries are responsible for administering their own

systems. Since implementation, the levy systems have been the subject of numerous litigation and law making

activities. On October 21, 2010, the European Court of Justice (ECJ) ruled that fair compensation is an autonomous

European law concept that was introduced by the Directive and must be uniformly applied in all EU member states.

The ECJ stated that fair compensation must be calculated based on the harm caused to the authors of protected

works by private copying. The ECJ also stated that the indiscriminate application of the private copying levy to

devices not made available to private users and clearly reserved for uses other than private copying is incompatible

with the Directive. The ECJ ruling made clear that copyright holders are only entitled to fair compensation payments

(funded by levy payments made by importers of applicable products, including the Company) when sales of optical

media are made to natural persons presumed to be making private copies. Within this disclosure, we use the term

"commercial channel sales" when referring to products intended for uses other than private copying and "consumer

channel sales" when referring to products intended for uses including private copying.

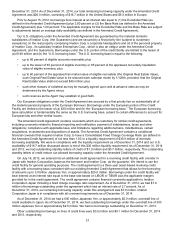

Since the Directive was implemented in 2002, we estimate that we have paid in excess of $100 million in levies

to various ongoing collecting societies related to commercial channel sales. Based on the ECJ's October 2010

ruling and subsequent litigation and law making activities, we believe that these payments were not consistent with

the Directive and should not have been paid to the various collecting societies. Accordingly, subsequent to the

October 21, 2010 ECJ ruling, we began withholding levy payments to the various collecting societies and, in 2011,

we reversed our existing accruals (totaling $7.8 million) for unpaid levies related to commercial channel sales.

However, we continued to accrue, but not pay, a liability for levies arising from consumer channel sales, in all

applicable jurisdictions except Italy and France due to recent court rulings. See Note 15 - Commitments and

Contingencies in our Notes to Consolidated Financial Statements for discussion of these court rulings. As of

December 31, 2014 and 2013, we had accrued liabilities of $9.3 million and $10.0 million, respectively, associated

with levies related to consumer channel sales for which we are withholding payment.