Memorex 2014 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.24

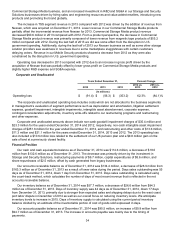

business in the first half of 2014. Imation transitioned to source our product from alternate magnetic tape suppliers

during 2014.

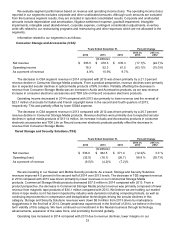

Storage and Security Solutions

Storage and Security Solutions revenue comprised 16.8 percent, 15.3 percent and 5.9 percent of our total

consolidated revenue in 2014, 2013 and 2012, respectively. We would expect the Storage and Security Solutions

revenue as a percent of total revenue to continue to expand and become a larger part of the total Company each

year. Imation’s Nexsan portfolio features solid-state optimized unified hybrid storage systems, secure automated

archive solutions and high-density enterprise storage arrays. Our solutions are ideal for mission-critical IT

applications such as virtualization, cloud, databases, and collaboration and for energy efficient, high-density storage

for backup and archiving. Nexsan systems are delivered through a worldwide network of cloud service providers,

value-added resellers (VARs) and solutions integrators. We have added sales and engineering resources and VARs

around the world to build Nexsan’s presence in key geographies. Our targeted vertical markets include government,

healthcare, and media and entertainment.

Imation’s IronKey solutions meet the challenge of protecting today’s mobile workforce, featuring secure USB

solutions for data transport and mobile workspaces. This line includes the world’s leading hardware encrypted USB

drives, PC on a Stick® workspaces for Microsoft® Windows To Go®, and cloud-based or on-premises centralized

secure device management solutions. The Imation Mobile Security family, through the IronKey product line, delivers

innovative secure data solutions for corporate employees who need to protect information on-the-go and targets

organizations that require highly secure solutions in a Bring Your Own Device (BYOD) environment.

Our flash drives are designed to meet the most stringent security standards that protect stored data and meet

the U.S. Government Federal Information Processing Standard (FIPS) validation, which includes strong encryption

protection with password and biometric authentication. Flash media products with security features provide margins

significantly higher than traditional flash media without data security. We are actively testing IronKey in many

corporate and government environments. The sales cycle is a long one, but we have the only FIPS Level 3 certified

product, offering superior security.

Executive Summary

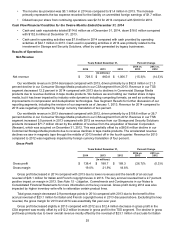

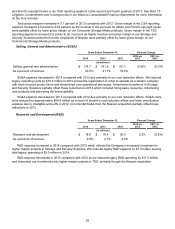

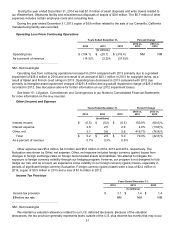

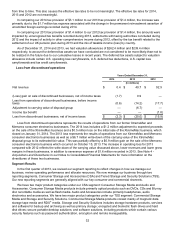

Consolidated Results of Operations for the Twelve Months Ended December 31, 2014

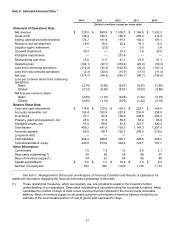

• Revenue of $729.5 million in 2014 was down 15.3 percent compared with revenue of $860.8 million in 2013

driven by secular declines in our optical and tape products. Revenue for 2014 compared to 2013 was

negatively impacted by two percent due to foreign currency impacts.

• Gross margin in 2013 was 21.9 percent and benefited from a reversal of an accrual of $23.1 million for

European copyright levies as a result of favorable court rulings in Italy and France. The levy accrual

reversals had a 2.7 percent positive impact on gross margin in 2013. Gross margin in 2014 was

19.0 percent. Excluding the levy reversal, the gross margin for 2013 would have been 19.2 percent and was

essentially flat year over year.

• Selling, general and administrative expense was $174.7 million in 2014, down $6.9 million compared with

$181.6 million in 2013 due to cost reductions in legacy businesses. We reduced legacy operating costs by

$18.2 million in 2014 across the organization in order to operate as a smaller company with more focused

product lines and streamlined core operational processes. Incremental investment in Storage and Security

Solutions partially offset these reductions in 2014 which included hiring sales resources, introducing new

products and promoting the brand globally.

• Research and development expense was $18.8 million in 2014, up $0.4 million, compared with $18.4

million in 2013 which reflects the Company's increased investment in higher margin projects in Storage and

Security Solutions.

• Restructuring and other expense was $13.6 million in 2014 compared to $11.3 million in 2013. Other

expense in 2013 included a $10.6 million loss related to the settlement of our UK pension plan offset by a

$9.8 million gain on the sale of land at a previously closed facility.

• Operating loss from continuing operations was $104.1 million in 2014 compared to $20.1 million in 2013.

Operating loss from continuing operations in 2014 included a goodwill impairment charge of $35.4 million.

• Other expense was $5.2 million in 2014, up $2.3 million, compared with $2.9 million in 2013, primarily due

to currency impacts.