Memorex 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

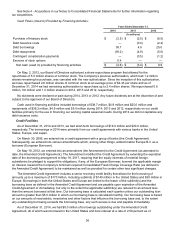

See Note 4 - Acquisitions in our Notes to Consolidated Financial Statements for further information regarding

our acquisitions.

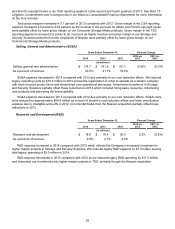

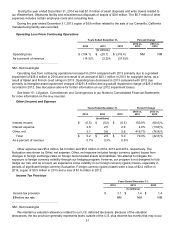

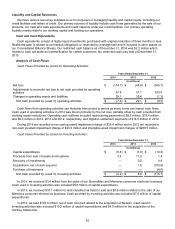

Cash Flows (Used in) Provided by Financing Activities:

Years Ended December 31,

2014 2013 2012

(In millions)

Purchase of treasury stock $ (2.5) $ (2.5) $ (6.5)

Debt issuance costs — (0.4) (2.4)

Debt borrowings 38.7 4.9 25.0

Debt repayments (39.2) (4.9) (5.0)

Contingent consideration payments — (0.5) (1.2)

Exercise of stock options 0.4 — —

Net cash (used in) provided by financing activities $ (2.6) $ (3.4) $ 9.9

On May, 2, 2012, our Board of Directors authorized a share repurchase program that allowed for the

repurchase of 5.0 million shares of common stock. The Company's previous authorization, which had 1.2 million

shares remaining for purchase, was canceled with the new authorization. Since the inception of this authorization,

we have repurchased 2.6 million shares of common stock at an average price of $4.43 per share and as of

December 31, 2014 we had remaining authorization to repurchase up to 2.4 million shares. We repurchased 0.8

million, 0.6 million and 1.2 million shares in 2014, 2013 and 2012, respectively.

No dividends were declared or paid during 2014, 2013 or 2012. Any future dividends are at the discretion of and

subject to the approval of our Board of Directors.

Cash used in financing activities included borrowings of $38.7 million, $4.9 million and $25.0 million and

repayments of $39.2 million, $4.9 million and $5.0 million during 2014, 2013 and 2012, respectively on our credit

facilities primarily for the use in financing our working capital seasonal needs. During 2014 we did not capitalize any

debt issuance costs.

Credit Facilities

As of December 31, 2014 and 2013, we had short-term borrowings of $18.9 million and $20.0 million,

respectively. The borrowings in 2014 were primarily from our credit agreements with various banks in the United

States, Europe, and Japan.

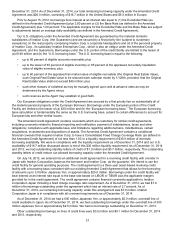

On March 30, 2006, we entered into a credit agreement with a group of banks (the Credit Agreement).

Subsequently, we entered into various amendments which, among other things, added Imation Europe B.V. as a

borrower (European Borrower).

On May 18, 2012, we entered into an amendment (the Amendment) to the Credit Agreement (as amended to

date, the Amended Credit Agreement). The Amendment modified the Credit Agreement by extending the expiration

date of the borrowing arrangement to May 18, 2017, requiring that the equity interests of material foreign

subsidiaries be pledged to support the obligations, if any, of the European Borrower, lowered the applicable margin

on interest, lowered the Company's minimum required Consolidated Fixed Charge Coverage Ratio (as defined in

the Amended Credit Agreement) to be maintained as well as provided for certain other less significant changes.

The Amended Credit Agreement includes a senior revolving credit facility that allows for the borrowing of

amounts up to a maximum of $170 million, including sublimits of $140 million in the United States and $30 million in

Europe. Borrowings in both the United States and Europe are limited to the lesser of the sublimit(s) and the

borrowing base as defined in the Amended Credit Agreement and are payable upon expiration of the Amended

Credit Agreement or immediately, but only to the extent the applicable sublimit(s) are reduced to an amount less

than the amount borrowed at that time. Our borrowing base is calculated each quarter unless our outstanding loan

amount is greater than $5.0 million in which our borrowing base is calculated monthly. Our borrowing base is based

on our amounts of receivables, inventories and other factors that influence the borrowing base and, to the extent

any outstanding borrowing exceeds the borrowing base, any such excess is due and payable immediately.

As of December 31, 2014, we had $8.0 million of borrowings outstanding under the Amended Credit

Agreement, all of which was borrowed in the United States and bore interest at a rate of 2.58 percent as of