Memorex 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

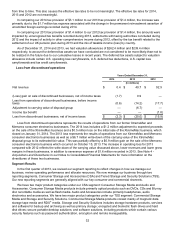

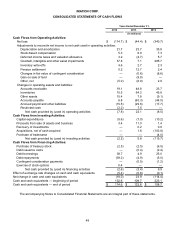

We had $64 million of cash outside the U.S. at December 31, 2014. As of December 31, 2014, the Company

has changed its position on the permanent reinvestment assertion of its unremitted foreign earnings. A deferred tax

liability has been recorded as of December 31, 2014 for the impact of future repatriation of the unremitted foreign

earnings in the amount of $15.7 million. Of this liability, $14.1 million would be fully offset by net operating losses,

and the remaining $1.6 million liability is related to foreign tax withholding and reduced 2014 results. We also have

significant net operating loss carryforwards offset by a full valuation allowance in the U.S.

Our liquidity needs for 2015 include the following: restructuring payments of approximately $2 million to $5

million, up to $18.9 million repayment on our credit facility, capital expenditures of approximately $5 million to $8

million, operating lease payments of approximately $5 million, pension funding of approximately $1 million to $2

million, any amounts associated with organic investment opportunities and any amounts associated with the

repurchase of common stock under the authorization discussed above.

We expect that our cash positions in the U.S. and outside the U.S., together with cash flow from operations and

availability of borrowings under our Amended Credit Agreement, our credit agreement in Japan, and other stand-

alone letters of credit will provide liquidity sufficient to meet our needs for our operations and our obligations in the

countries in which we operate. We continue to extract working capital from our legacy businesses and remain

focused on cost reductions. In addition, we are working to monetize our corporate campus and our intellectual

properties. We expect that the proceeds from above activities together with our cash and availability of borrowings

under our credit facilities, will provide liquidity sufficient to invest in our Storage and Security Solutions business and

meet our obligations in the countries in which we operate.

Off-Balance Sheet Arrangements

Other than the operating lease commitments discussed in Note 15 - Litigation, Commitments and Contingencies

in our Notes to Consolidated Financial Statements, we are not using off-balance sheet arrangements, including

special purpose entities.

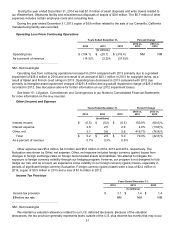

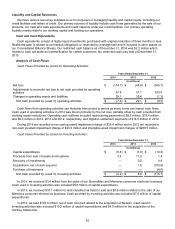

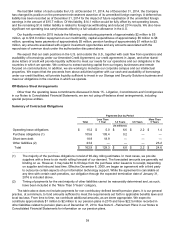

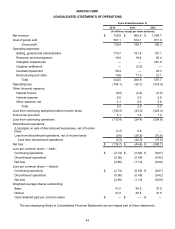

Summary of Contractual Obligations

Payments Due by Period

Total Less Than

1 Year 1-3 Years 3-5 Years More Than

5 Years

(In millions)

Operating lease obligations $ 15.2 $ 5.0 $ 6.6 $ 2.2 $ 1.4

Purchase obligations (1) 105.6 105.4 0.2 — —

Short-term debt 18.9 18.9 — — —

Other liabilities (2) 23.2 — — — 23.2

Total $ 162.9 $ 129.3 $ 6.8 $ 2.2 $ 24.6

_______________________________________

(1) The majority of the purchase obligations consist of 90-day rolling estimates. In most cases, we provide

suppliers with a three to six month rolling forecast of our demand. The forecasted amounts are generally not

binding on us. However, it may take 60 to 90 days from the purchase order issuance to receipt, depending

on supplier and inbound lead time. Effective December 8, 2009, we began an agreement with a third party

to outsource certain aspects of our information technology support. While the agreement is cancelable at

any time with certain cash penalties, our obligation through the expected termination date of January 31,

2016 is included above.

(2) Timing of payments for the vast majority of other liabilities cannot be reasonably determined and, as such,

have been included in the “More Than 5 Years” category.

The table above does not include payments for non-contributory defined benefit pension plans. It is our general

practice, at a minimum, to fund amounts sufficient to meet the requirements set forth in applicable benefits laws and

local tax laws. From time to time, we contribute additional amounts, as we deem appropriate. We expect to

contribute approximately $1 million to $2 million to our pension plans in 2015 and have $22.5 million recorded in

other liabilities related to pension plans as of December 31, 2014. See Note 9 - Retirement Plans in our Notes to

Consolidated Financial Statements for information on our pension plans.