Memorex 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

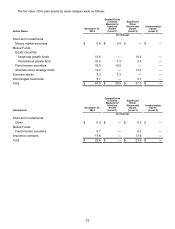

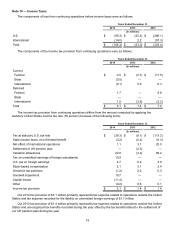

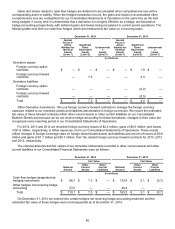

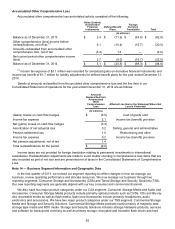

Gains and losses related to cash flow hedges are deferred in accumulated other comprehensive loss with a

corresponding asset or liability. When the hedged transaction occurs, the gains and losses in accumulated other

comprehensive loss are reclassified into our Consolidated Statements of Operations in the same line as the item

being hedged. If at any time it is determined that a derivative is not highly effective as a hedge, we discontinue

hedge accounting prospectively, with deferred gains and losses being recognized in current period operations. The

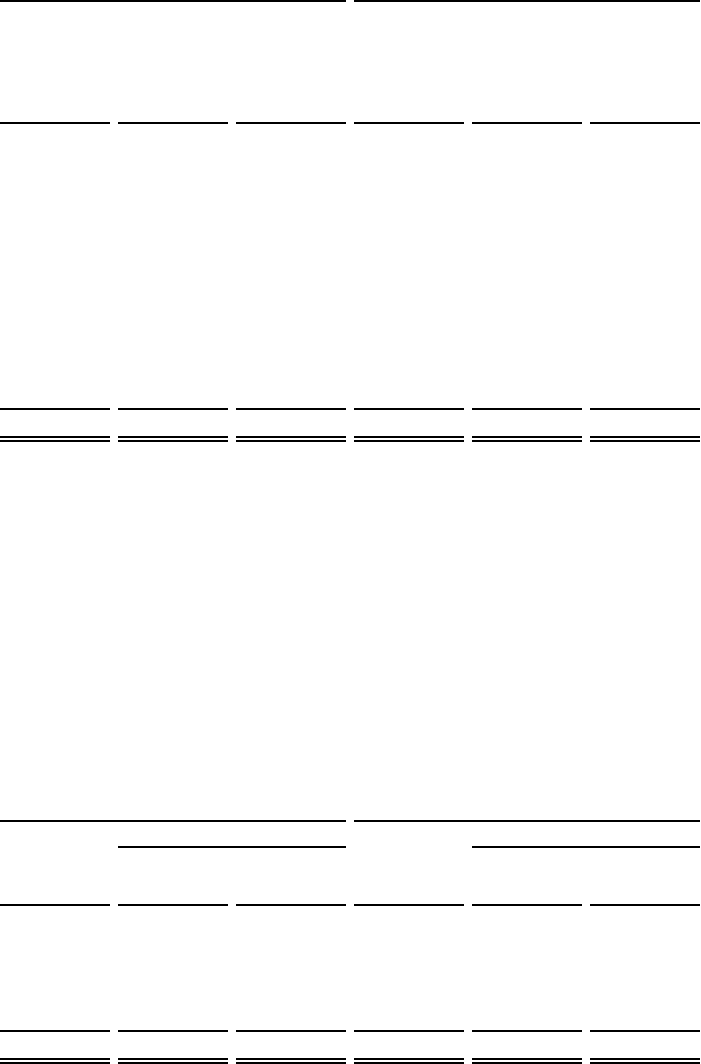

following table sets forth our cash flow hedges which are measured at fair value on a recurring basis.

December 31, 2014 December 31, 2013

Quoted

Prices in

Active

Markets for

Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Unobservabl

e

Inputs

(Level 3)

Quoted

Prices in

Active

Markets for

Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Unobservabl

e

Inputs

(Level 3)

(In millions)

Derivative assets

Foreign currency option

contracts $ — $ — $ — $ — $ 1.8 $ —

Foreign currency forward

contracts — 7.3 — — 3.3 —

Derivative liabilities

Foreign currency option

contracts — — — — (0.2) —

Foreign currency forward

contracts — — — — (0.5) —

Total $ — $ 7.3 $ — $ — $ 4.4 $ —

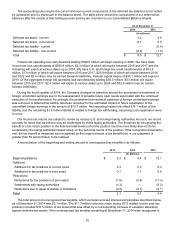

Other Derivative Instruments. We use foreign currency forward contracts to manage the foreign currency

exposure related to our monetary assets and liabilities denominated in foreign currencies. We record the estimated

fair value of these forward contracts within other current assets or other current liabilities on our Consolidated

Balance Sheets and because we do not receive hedge accounting for these derivatives, changes in their value are

recognized every reporting period in our Consolidated Statements of Operations.

For 2014, 2013 and 2012 we recorded foreign currency losses of $2.2 million, gains of $0.5 million, and losses

of $1.6 million, respectively, in Other expenses, net in our Consolidated Statements of Operations. These results

reflect changes in foreign exchange rates on foreign denominated assets and liabilities and are net of losses of $0.8

million and gains of $1.7 million and $0.7 million, from the related foreign currency forward contracts for 2014, 2013

and 2012, respectively.

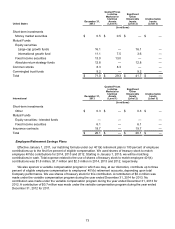

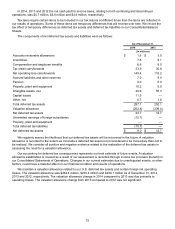

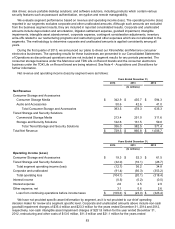

The notional amounts and fair values of our derivative instruments recorded in other current assets and other

current liabilities in our Consolidated Financial Statements were as follows:

December 31, 2014 December 31, 2013

Fair Value Fair Value

Notional

Amount

Other

Current

Assets

Other

Current

Liabilities Notional

Amount

Other

Current

Assets

Other

Current

Liabilities

(In millions)

Cash flow hedges designated as

hedging instruments $ 86.7 $ 7.3 $ — $ 133.8 $ 5.1 $ (0.7)

Other hedges not receiving hedge

accounting 23.4 — — 29.4 — —

Total $ 110.1 $ 7.3 $ — $ 163.2 $ 5.1 $ (0.7)

On December 31, 2014 we entered into certain hedges not receiving hedge accounting treatment and the

estimated fair value of these hedges were inconsequential as of December 31, 2014.