Memorex 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

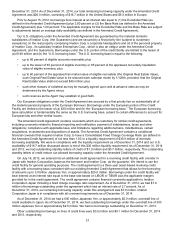

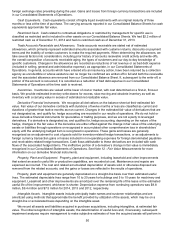

Since the October 2010 ECJ ruling, we evaluate quarterly on a country-by-country basis whether (i) levies

should be accrued on current period commercial and/or consumer channel sales; and, (ii) accrued, but unpaid,

copyright levies on prior period consumer channel sales should be reversed. Our evaluation is made on a

jurisdiction-by-jurisdiction basis and considers ongoing and cumulative developments related to levy litigation and

law making activities within each jurisdiction as well as throughout the EU. We did not reverse any amounts into

cost of goods sold for prior year obligations in 2014 or 2012. However, we continued to accrue, but not pay, a

liability for levies arising from consumer channel sales, in all applicable jurisdictions except Italy and France due to

recent court rulings. As of December 31, 2014 and 2013, we had accrued liabilities of $9.3 million and $10.0 million,

respectively, associated with levies related to consumer channel sales for which we are withholding payment. See

Note 15 - Commitments and Contingencies in our Notes to Consolidated Financial Statements for discussion of

reversals of copyright levies.

Litigation. We record a liability when a loss from litigation is known or considered probable and the amount can

be reasonably estimated. Our current estimated range of liability related to pending litigation is based on claims for

which we can estimate the amount or range of loss. Based upon information presently available, we believe that

accruals for these claims are adequate. Due to uncertainties related to both the amount and range of loss on the

remaining pending litigation, we are unable to make a reasonable estimate of the liability that could result from an

unfavorable outcome. While these matters could materially affect our financial condition, results of operations and

cash flows in future periods depending on the final resolution, it is our opinion that after final disposition, any

monetary liability to us beyond that provided in our Consolidated Balance Sheet as of December 31, 2014, would

not be material to our financial condition, results of operations and cash flows. As additional information becomes

available, the potential liability related to pending litigation will be assessed and estimates will be revised as

necessary.

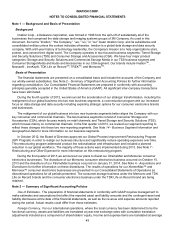

Recently Issued Accounting Standards

See Note 2 — Summary of Significant Accounting Policies in our Notes to Consolidated Financial Statements

for disclosure related to recently issued accounting standards.

Cautionary Statements Regarding Forward-Looking Statements

We may from time to time make written or oral forward-looking statements with respect to our future goals,

including statements contained in this Form 10-K, in our other filings with the SEC and in our reports to

shareholders.

Certain information which does not relate to historical financial information may be deemed to constitute

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words or

phrases "is targeting," "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "project,"

"believe," or similar expressions identify "forward looking statements." Such statements are subject to certain risks

and uncertainties that could cause our actual results in the future to differ materially from our historical results and

those presently anticipated or projected. We wish to caution investors not to place undue reliance on any such

forward-looking statements. Any forward-looking statements speak only as of the date on which such statements

are made, and we undertake no obligation to update such statements to reflect events or circumstances arising

after such date. Risk factors include our ability to successfully implement our strategy; our ability to grow our

business in new products with profitable margins and the rate of revenue decline for certain existing products; our

ability to meet future revenue growth, gross margin and earnings targets; the ability to quickly develop, source,

introduce and deliver differentiated and innovative products; our potential dependence on third parties for new

product introductions or technologies in order to introduce our own new products; our ability to successfully

implement restructuring plans; foreign currency fluctuations; the ready availability and price of energy and key raw

materials or critical components including the effects of natural disasters and our ability to pass along raw materials

price increases to our customers; continuing uncertainty in global and regional economic conditions; our ability to

identify, value, integrate and realize the expected benefits from any acquisition which has occurred or may occur in

connection with our strategy; the possibility that our goodwill and intangible assets or any goodwill or intangible

assets that we acquire may become impaired; the ability of our security products to withstand cyber-attacks; loss of

a major customer, partner, or reseller; changes in European law or practice related to the imposition or collectability

of optical levies; the seasonality and volatility of the markets in which we operate; significant changes in discount

rates and other assumptions used in the valuation of our pension plans; changes in tax laws, regulations and results

of inspections by various tax authorities; our ability to successfully defend our intellectual property rights and the

ability or willingness of our suppliers to provide adequate protection against third party intellectual property or

product liability claims; the outcome of any pending or future litigation and patent disputes; ability to access