Memorex 2014 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2014 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

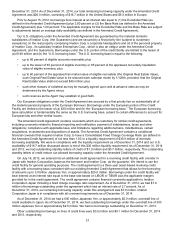

rate of 16.5 percent. The discount rate used in 2014 increased by 2 percent from prior year. The discount rate

reflects the relative risk of achieving cash flows as well as any other specific risks or factors related to the Storage

Solutions reporting unit. We calculated the impact of a potential change in our assumptions to determine the impact

on the results or the impairment test. The impairment test is sensitive to assumptions used in the calculation and

even minor changes to various components of our projected cash flows could potentially result in an indication of

impairment.

While our current projections support no additional impairment of this reporting unit in fourth quarter 2014, it is

reasonably possible that an impairment could be incurred in the future given that our 2014 results fell below

expectations and the sensitivities to various assumptions. We will continue to closely monitor our results and

expected cash flows in the future to assess whether an additional goodwill impairment in our Storage Solutions

reporting unit may be necessary.

2013 Goodwill Analysis

During the fourth quarter of 2013, we performed our annual impairment testing of goodwill for our Mobile

Security and Storage Solutions reporting units. These impairment tests resulted in no impairment of goodwill as the

estimated fair value of each reporting unit exceeded the carrying value in Step 1 of the impairment tests by 25.7

percent and 34.2 percent, for the Storage Solutions and Mobile Security reporting units, respectively. There were no

triggering events that occurred during 2013 that warranted an interim goodwill impairment test to be performed.

Mobile Security Reporting Unit - For the 2013 impairment test for the Mobile Security reporting unit, the

estimated fair value of the reporting unit exceeded the carrying value in Step 1 of the impairment test by 34.2

percent. We used forecasted cash flows over a ten year period, a terminal growth rate of 3.0 percent and a discount

rate of 15.5 percent. The discount rate reflects the relative risk of achieving cash flows as well as any other specific

risks or factors related to the Mobile Security reporting unit.

Storage Solutions Reporting Unit - For the 2013 impairment test for the Storage Solutions reporting unit, the

estimated fair value of the reporting unit exceeded the carrying value in Step 1 of the impairment test by 25.7

percent. We used forecasted cash flows over a ten year period, a terminal growth rate of 3.0 percent and a discount

rate of 13.5 percent. The discount rate reflected the relative risk of achieving cash flows as well as any other

specific risks or factors related to the Storage Solutions reporting unit.

2012 Goodwill Analysis

We acquired the assets of MXI Security from Memory Experts International Inc., and the secure data storage

hardware business of IronKey during 2011 which resulted in goodwill of $21.9 million and $9.4 million, respectively.

These businesses made up our Mobile Security reporting unit as of December 31, 2012 with a carrying value of

$31.3 million of goodwill prior to our 2012 impairment testing described below.

During the second and third quarters of 2012, we adjusted our internal financial forecast for our Mobile Security

reporting unit (referred to as our Americas-Mobile Security reporting unit in 2012) due to changes in timing of

expected cash flows and lower expected short-term revenues and gross margins. As we considered these factors to

be an event that warranted an interim test as to whether the goodwill was impaired, we performed an impairment

test as of each of these periods. These impairment tests resulted in no impairment of goodwill as the estimated fair

value of the reporting units exceeded the carrying value in Step 1 of the impairment tests by 43.3 percent and 17.7

percent, during the second and third quarters of 2012, respectively. During the fourth quarter of 2012, our internal

financial forecast for our Mobile Security reporting unit was again adjusted with further declines in our revenue and

gross margin projections resulting from lower expectations in the high-security market segment. In accordance with

our policy, we performed our annual assessment of goodwill in the Mobile Security reporting unit during the fourth

quarter of 2012 and, as a result of this assessment, it was determined that the fair value of our Mobile Security

reporting unit was impaired. We recorded an impairment charge of $23.3 million in our Consolidated Statements of

Operations.

The significant assumptions used included a discount rate of 16.0 percent to reflect the relevant risks of the

higher growth assumed for the Mobile Security reporting unit, revenue growth rates, which were forecasted to be

significant, and a terminal growth rate of 2.5 percent.

See Note 2 - Summary of Significant Accounting Policies and Note 6 - Intangible Assets and Goodwill in our

Notes to Consolidated Financial Statements as well as Critical Accounting Policies and Estimates for further

background and information on goodwill impairments.