Loreal 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246

|

|

75REGISTRATION DOCUMENT − L’ORÉAL 2011

Comments on the2011 nancialyear

3

The Group's business activities in 2011

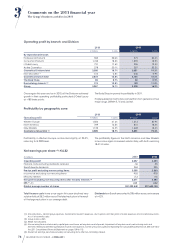

Income tax excluding non-recurring items amounted to

978 million euros, representing a rate of 27.4%, slightly below the

2010 rate.

Net profit excluding non-recurring items after non-controlling

interests amounted to 2,583 million euros, up by 8.9%.

Net earnings per share, at €4.32, increased by 7.8%.

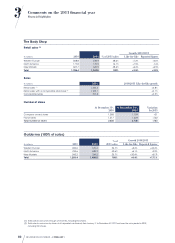

Net profit after minority interest: €2,438 million

€ millions

2010 2011 Evolution

Net profit excluding non-recurring items after minority interest 2,371 2,583

Non-recurring items net of tax -131 -145

Net profit after minority interest 2,240 2,438 +9%

Diluted earnings per share (€) 3.79 4.08

After allowing for non-recurring items, representing in2011 a

charge, net of tax, of 145 million euros, net profit amounted to

2,438 million euros, an increase of 9%.

Cash flow Statement, Balance sheet and Debt

Gross cash flow amounted to 3,226 million euros.

The working capital requirement increased by 322 million euros,

after two years of decline in absolute value. This represents a

return to a situation more in line with the Group’s activity.

Capital expenditure, at 866 million euros, amounted to 4.3% of

sales.

After dividend payment and acquisitions (Q-MED and

Clarisonic

),

the Group recorded at December31st, 2011, a net cash surplus

of 504million euros.

The balance sheet structure is very solid, as at end-2011

shareholders’ equity represented 65.7% of total assets. The

reinforcement of shareholders’ equity compared with end-2010

is mainly the result of profit allocated to reserves and the net

increase in value of the Sanofi shares, valued at market price.

Proposed dividend at the Annual General

Meeting of April17th, 2012

The Board of Directors has decided to propose that the Annual

General Meeting of shareholders of April17th, 2012 should

approve a dividend of 2euros per share, an increase of +11%

compared with the dividend paid in2011. This dividend will be

paid on May3rd, 2012 (ex-dividend date April27th, 2012 at 0:00

a.m., Paris time).