Loreal 2011 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246

|

|

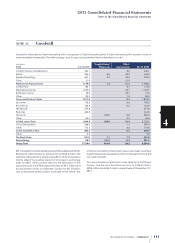

112 REGISTRATION DOCUMENT − L’ORÉAL 2011

42011 Consolidated Financial Statements

Notes to the consolidated nancial statements

€ millions

2010 12.31.2009

Acquisitions/

Disposals

Other

movements 12.31.2010

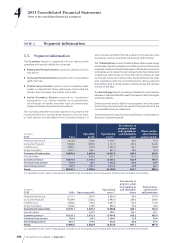

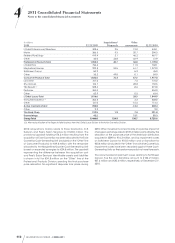

L’Oréal Professionnel/Kérastase 328.6 2.5 12.0 343.1

Matrix 266.3 9.3 20.7 296.3

Redken/PureOlogy 419.4 2.1 46.2 467.7

Other 40.0 34.8 -42.9 31.9

Professional Products Total 1,054.3 48.7 36.0 1,139.0

L’Oréal Paris 756.6 11.5 768.1

Maybelline/Garnier 992.8 24.5 61.7 1,079.0

Softsheen Carson 50.9 -5.9 45.0

Other 35.2 49.8 -0.1 84.9

Consumer Products Total 1,835.5 74.3 67.2 1,977.0

Lancôme 767.6 7.6 775.2

Shu Uemura 123.7 28.8 152.5

YSL Beauté(1) 528.4 -8.6 519.8

Perfumes 334.0 334.0

Other 62.9 0.5 63.4

L’Oréal Luxury Total 1,816.6 28.3 1,844.9

Vichy/Dermablend(1) 264.8 3.2 268.0

Other 131.0 -16.6 114.4

Active Cosmetics Total 395.8 -13.4 382.4

Other 9.2 9.2

The Body Shop 312.5 1.9 7.4 321.8

Dermatology 42.2 13.1 55.3

Group Total 5,466.0 124.9 138.7 5,729.6

(1) After reclassification of the Roger & Gallet business from the L’Oréal Luxury Division to the Active Cosmetics Division.

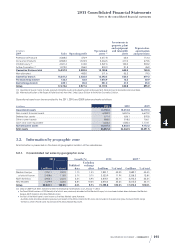

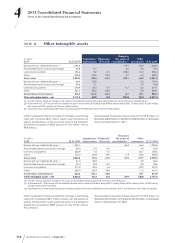

2010 acquisitions mainly relate to Essie Cosmetics, C.B.

Sullivan and Peel’s Salon Services for €123.0million. The

provisional goodwill totalling €74.3million resulting from the

acquisition of Essie Cosmetics has been allocated to the Essie

Cosmetics Cash-Generating Unit (included on the “Other” line

of Consumer Products) for €49.8million, with the remainder

allocated to the Maybelline/Garnier Cash-Generating Unit

based on expected synergies for €24.5million. The goodwill

representing the difference between the acquisition cost

and Peel’s Salon Services’ identifiable assets and liabilities

is shown in full for €34.8million on the “Other” line of the

Professional Products Division, pending the final purchase

price allocation. Nosignificant disposals took place during

2010. Other movements consist mainly of a positive impact of

changes in exchange rates for €187.4million, partly offset by the

allocation of the purchase price of the American distributors

acquired in2009 for €16.3million, and by impairment losses

on Softsheen Carson for €10.0million and on Sanoflore for

€20.4million (included in the “Other” line of Active Cosmetics).

Impairment losses have been recorded against these Cash-

Generating Units as their performance did not meet forecasts.

The accumulated impairment losses relating to Softsheen

Carson, Yue Sai and Sanoflore amount to €103.2million,

€27.6million and €30.4million, respectively, at December31st,

2010.