Loreal 2011 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

212 REGISTRATION DOCUMENT − L’ORÉAL 2011

7Stock market information andsharecapital

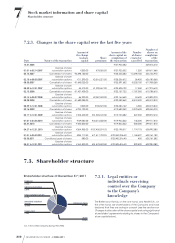

Shareholder structure

7.3.3. Employee share ownership

The employees of the Company and its affiliates held

4,404,950shares as at December31st, 2011, that is 0.73% of the

share capital, through the Company S avings P lan (PEE).

At that date, this stake in the capital is held by 9,649employees

participating in the Group Company S avings P lan.

7.3.4. Disclosures to

theCompany oflegal

thresholds crossed

During 2011, the Company was not informed of any crossing of

the legal thresholds with regard to the holding of its shares or

voting rights.

7.3.5. Shareholders’ agreements

relating to shares in the

Company’s share capital

The Company is not aware of any shareholders’ agreements

relating to shares in its share capital other than the agreement

described below.

A memorandum of agreement was signed on February3rd, 2004

between Mrs.Liliane Bettencourt and her family, and Nestlé,

providing for the merger of Gesparal into L’Oréal. It contains the

following clauses:

7.3.5.1. Clauses relating to the management

ofthe L’Oréal shares held

Clause limiting the shareholding

The parties agreed not to increase their shareholdings or their

voting rights held in L’Oréal, either directly or indirectly, in any

manner whatsoever, for a minimum period of three years as from

April29th, 2004, and in any case not until six months have elapsed

after the death of Mrs.Bettencourt.

Lock-up clause

The parties agreed not to transfer any or all of their L’Oréal

shares either directly or indirectly, for a period of five years as

from April29th, 2004.

Exceptions to the undertaking to limit the

shareholding and the lock-up clause

a) The undertaking to limit the shareholding does not apply if

the increase in the shareholding results from a reduction in

the number of L’Oréal shares or voting rights, the acquisition

by the Company of its own shares, or the suspension or

removal of the voting rights of a shareholder.

b) The undertaking to limit the shareholding and the lock-up

clause will no longer apply in the event of a takeover bid

for L’Oréal shares, as from the date of publication of the

clearance decision (

avis de recevabilité

) and up until the

day after the publication of the notice of results (

avis de

résultat).

c) In the event of an increase in the share capital of L’Oréal, the

parties may, provided that the other party has voted in favour

of the capital increase, acquire shares or subscribe for new

shares, in order to maintain their holding at the percentage

existing prior to the said transaction.

d) The parties are free to carry out transfers of L’Oréal shares,

in the case of individuals, in favour of an ascendant,

descendant or spouse in the form of a gift, and in the case

of individuals or legal entities, in favour of any company in

which the individual or legal entity carrying out the transfer

holds over 90% of the share capital or voting rights.

Pre-emption clause

The parties have reciprocally granted each other a pre-emption

right concerning the L’Oréal shares they hold since the date of

the merger, and those they will hold after such date.

This pre-emption right will come into force on expiry of the lock-

up clause for a period of five years; as an exception, it will come

into force before the expiry of the lock-up period in the event of

a takeover bid for L’Oréal shares for a period beginning on the

day of the clearance decision and ending the day after the

publication of the notice of results.

“No concert party” provision

The parties have agreed for a period of ten years from the

effective date of the merger not to conclude an agreement with

any third party and not to form a concert party relating to the

shares making up the share capital of L’Oréal.

Breach of such undertaking entitles the other party to exercise

its pre-emption right with regard to the shareholding of the party

having committed such breach, for a price per share equal to

the average of the share prices for the last thirty trading sessions

prior to notification of exercise of the pre-emption right.

7.3.5.2. Board of Directors

The memorandum of agreement did not provide for any change

to the composition of the Board of Directors as compared to

its composition at the date of signing, but did stipulate an

undertaking by the parties to vote in favour of the appointment

as Directors of three members proposed by the other party.

The Bettencourt family and Nestlé also agreed to vote in favour of

the appointment of two Vice-Chairmen of the Board of Directors,

one proposed by the Bettencourt family, and the other by Nestlé.

The parties provided for the creation on the Board of Directors of

L’Oréal of a committee

called the

Strategy and Implementation

Committee which has six members, and is chaired by the