Loreal 2011 Annual Report Download - page 216

Download and view the complete annual report

Please find page 216 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

214 REGISTRATION DOCUMENT − L’ORÉAL 2011

7Stock market information andsharecapital

Shareholder structure

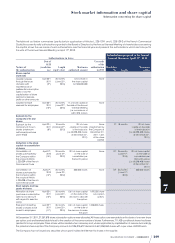

7.3.6.2. Transactions carried out by L’Oréal

with respect to its shares in2011

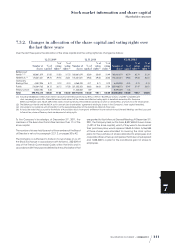

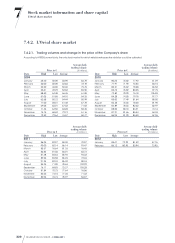

Percentage of share capital held

bythe Company directly and indirectly

atDecember31st, 2011: 1.43%

Including:

♦those intended to cover existing share

purchase option plans 0.86%

♦those intended to cover conditional shares 0.17%

♦those intended for cancellation 0.00%

Number of shares cancelled during the last

24months: 500,000

Number of shares held in the portfolio

at12.31.2011: 8,597,659

Net book value of the portfolio at 12.31.2011: €644.4million

Market portfolio value at 12.31.2011: €693.8million

Total gross transactions

Purchases Sales/Transfers(1)

Number of shares None 2,739,023

Average transaction

price Not

applicable

Average exercise price €76.22

Amounts None €208.8million

(1) Exercise of stock options for the purchase of shares granted to

employees and corporate officers of Group companies.

There is no open purchase or sale position at December31st, 2011.

7.3.6.3. Renewal by the Annual General

Meeting of the authorisation

given tothe Board to trade in

theCompany’s shares

By voting a new resolution, the Annual General Meeting would be

able to provide the Board of Directors with the means to enable

it to continue its share buyback policy.

This authorisation would be given for a maximum period of

18months as from the date of the Annual General Meeting and

the purchase price per share could not exceed €130.

The Company would be able to buy its own shares for the

following purposes:

♦their cancellation;

♦their transfer within the scope of employee share ownership

programmes and their allocation to free grants of shares and/

or share purchase options for the benefit of employees and

corporate officers of the Group;

♦stabilisation of the share price;

♦retaining them and subsequently using them as payment in

connection with external growth operations.

The authorisation would concern up to 10% of the share capital

for a maximum amount of €7,838.8million, it being specified

that the Company may never at any time hold over 10% of its

own share capital.

These shares could be acquired by any means, on one or more

occasions, on the stock market or over the counter, including

through purchases of blocks of shares.

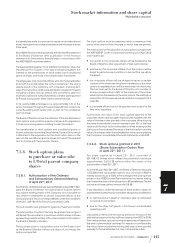

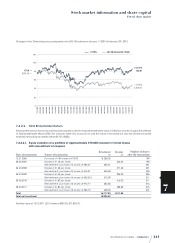

7.3.7. Presentation of the stock

option plans for the

purchase or subscription

of shares and plan for

the Conditional Grant

ofShares to Employees

Policy

For several years, L’Oréal has set up stock option plans in favour of

its employees and corporate officers in an international context.

It pursues a dual objective:

♦motivating and associating those who make big contributions

to future development in the Group’s results;

♦increasing solidarity and helping to instil a Group spirit among

its managers by seeking to foster their loyalty over time.

In2009, L’Oréal enlarged its policy by introducing a mechanism

for the conditional grant of shares to employees .

The objective is:

♦to provide a long-term incentive offering greater motivation

to all those who only received stock options occasionally or

in limited numbers;

♦to reach out to a broader population of potential beneficiaries,

particularly internationally, in a context of increased

competition with regard to talents.

In2010, this policy remained unchanged, and was applied to

an even larger number of beneficiaries.

In2011, L’Oréal decided to make plans for the conditional grant

of shares to employees the primary tool for its long-term incentive

policy by extending the grants of such shares to the Group’s main

senior managers who were previously motivated only through

stock options .

Except for the Chairman and Chief Executive Officer who

received stock options only, the main senior managers of L’Oréal,

including the members of the Executive Committee, received a

mix of stock options and conditional grants of shares in order to

encourage their entrepreneurial spirit and reward their medium

and long-term performance.

Other eligible employees are stimulated by conditional grants

of shares only.

The decision with regard to each individual grant is, in every case,

contingent on the quality of the performance rendered at the

time of implementation of the plan.

According to the eligibility criteria linked to the position held by

the beneficiary and the size of the entity or the country in which