Loreal 2011 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

215REGISTRATION DOCUMENT − L’ORÉAL 2011

Stock market information andsharecapital

7

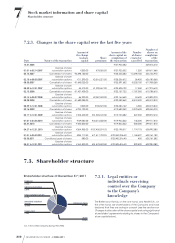

Shareholder structure

the beneficiary works, in a concern for equity on an international

scale, these grants are made every year, every two years or every

three years.

Since2009, the plans are proposed by the General Management

to the Board of Directors after publication of the financial

statements for the previous financial year, in accordance with

the AFEP-MEDEF recommendation.

The General Management and the Board of Directors stress the

importance that is given in this way to bringing together the

interests of the beneficiaries of stock options and conditional

grants of shares and those of the shareholders themselves.

The employees and corporate officers who are the beneficiaries

share with the shareholders the same confidence in the strong

steady growth of the Company with a medium and long-term

vision. This is why stock options are granted for a period of 10years

including a 5-year lock-up period, and conditional grants of

shares for a period of 4years followed by a 2-year waiting period

for France during which these shares cannot be sold.

In all, nearly 2,800employees (

i.e.

approximately 14% of the

senior managers throughout the world) benefit from at least one

currently existing stock option plan or plan for the conditional

grant of shares.

The Board of Directors draws the attention of the beneficiaries of

stock options and conditional grants of shares to the regulations

in force concerning persons holding “inside ” information.

The beneficiaries of stock options and conditional grants of

shares undertake to read the Stock Market Code of Ethics which

is attached to the regulations for the stock option plans or the

plans for the conditional grant of shares from which they benefit

and to comply with the provisions thereof.

7.3.8. Stock option plans

topurchase or subscribe

to L’Oréal p arent company

shares

7.3.8.1. Authorisation of the Ordinary

andExtraordinary General Meeting

of April22nd, 2011

The Ordinary and Extraordinary General Meeting of April22nd, 2011

gave the Board of Directors the authorisation to grant options

to purchase existing shares of the Company or to subscribe for

new shares to employees or certain corporate officers of the

Company and its French or foreign affiliates under the conditions

of ArticleL.225-180 of the French Commercial Code.

This authorisation was granted for a period of twenty-six months.

The total number of options that may be granted may not grant

entitlement to subscribe for or purchase a total number of shares

representing more than 0.6% of the share capital on the date of

the Board of Directors’ decision.

The purchase price or subscription price for the shares is set

by the Board of Directors, without any discount, on the day the

options are granted.

The stock options must be exercised within a maximum time

period of ten years as from the date on which they are granted.

The mechanism for the allocation of stock options complies with

the AFEP-MEDEF Code of Corporate Governance of April2010

and in particular:

♦any grants to the corporate officers will be decided by the

Board of Directors after assessment of their performance;

♦exercise by the corporate officers of all the options will be

linked to performance conditions to be met that are set by

the Board;

♦the corporate officers will be obliged to retain a certain

number of the shares resulting from the exercise of the stock

options in registered form until the termination of their duties.

This has been set by the Board of Directors at a number of

shares corresponding to 50% of the balance of the shares

resulting from the exercise of the stock options. The methods of

calculation of this balance are described in paragraph2.3.3

page 56 ;

♦a corporate officer may not be granted stock options at the

time of his departure.

Furthermore, the value of the stock options granted to the

corporate officers during a given financial year together with the

value of the free shares granted to the corporate officers during

the same financial year may not represent over 10% of the total

value of all the stock options allocated and free shares granted

during such financial year. The value of the stock options and the

value of the shares mean the estimated fair value used to prepare

the Company’s consolidated financial statements under IFRS.

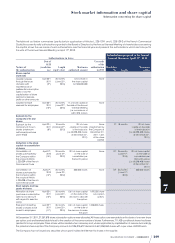

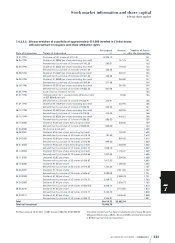

7.3.8.2. Stock options granted in2011

(ShareSubscription Option Plan

ofApril22nd, 2011)

The share capital as of April 22nd, 2011 consisted of

601,788,112shares, which offered the possibility to distribute

approximately 3,610,728options within the scope of the

authorisation of April22nd, 2011.

At its meeting on April22nd, 2011, the Board of Directors allocated

1,470,000share subscription options at a unit price of €83 .19,

namely a price equal to 100% of the average of the closing share

prices on the NYSE-Euronext Paris market for the twenty trading

days before the date of their allocation to 89beneficiaries. The fair

unit value of these options amounts to €18.58.

It was decided to make the exercise of these options subject to

achievement of performance conditions taking into consideration:

♦for half the amount, growth in cosmetics sales as compared

to a panel of competitors;

♦and for the other half growth in the Group’s consolidated

operating profit;

calculated at the end of the lock-up period on the basis of the

arithmetical mean for the four full financial years from 2012 to 2015.

The number of stock options that may be exercised will depend on

the level of performance achieved. For reasons of confidentiality,

the various levels of performance required were communicated

precisely to the beneficiaries but may not be made public.