Loreal 2011 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246

|

|

167REGISTRATION DOCUMENT − L’ORÉAL 2011

2011 parent company Financial Statements

5

Notes to the parent company nancial statements

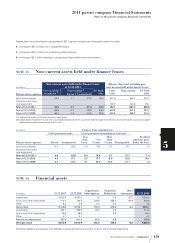

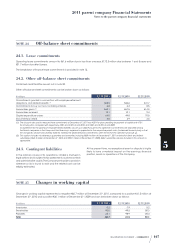

NOTE24 Off-balance sheet commitments

24.1. Lease commitments

Operating lease commitments amount to €61.6million due in less than one year, €172.3million due between 1 and 5years and

€31.7million due after 5years.

The breakdown of finance lease commitments is provided in note13.

24.2. Other off-balance sheet commitments

Confirmed credit facilities are set out in note20.

Other off-balance sheet commitments can be broken down as follows:

€ millions

12.31.2011 12.31.2010 12.31.2009

Commitments granted in connection with employee retirement

obligations and related benefits(1) 508.5 536.6 441.7

Commitments to buy out non-controlling interests 6.8 6.4 8.5

Guarantees given(2) 662.1 657.5 614.3

Guarantees received 10.1 10.1 9.4

Capital expenditure orders 64.0 44.8 70.5

Documentary credits 4.8 3.9 3.5

(1) The discount rate used to measure these commitments at December31st, 2011 was 4.50% for plans providing for payment of capital and 4.75%

forannuity plans, compared with respectively, 4.25% and 4.50% at end-2010, and 5.00% and 5.25% at end-2009.

An agreement for the pooling of employee-related liabilities was set up in2004. Pursuant to this agreement, commitments are allocated among

theFrench companies in the Group and their financing is organised in proportion to their respective payroll costs (customised for each plan) so that

thecompanies are joint and severally liable for meeting the aforementioned commitments within the limit of the collective funds built up.

(2) This caption includes miscellaneous guarantees and warranties, including €659.4million at December31st, 2011 on behalf of direct and indirect

subsidiaries (€641.5million at December31st, 2010 and €593.1million at December31st, 2009). Seller’s warranties are also included in this amount as

appropriate.

NOTE25 Changes in working capital

Changes in working capital represented a negative €60.7million at December31st, 2011, compared to a positive €41.5million at

December31st, 2010 and a positive €30.1 million at December31st, 2009, and can be broken down as follows:

€ millions

12.31.2011 12.31.2010 12.31.2009

Inventories 0.2 -7.9 5.2

Receivables -93.0 -49.5 50.3

Payables 32.1 98.9 -25.4

Total -60.7 41.5 30.1

24.3. Contingent liabilities

In the ordinary course of its operations, L’Oréal is involved in

legal actions and is subject to tax assessments, customs controls

and administrative audits. The Company sets aside a provision

wherever a risk is found to exist and the related cost can be

reliably estimated.

At the present time, no exceptional event or dispute is highly

likely to have a material impact on the earnings, financial

position, assets or operations of the Company.