Loreal 2011 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122 REGISTRATION DOCUMENT − L’ORÉAL 2011

42011 Consolidated Financial Statements

Notes to the consolidated nancial statements

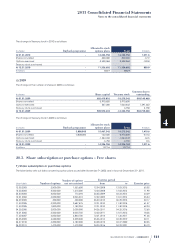

All plans have a 5-year exercise period and no performance-

related conditions, except the April22nd, 2011 plan (for all

participants) and the April27th, 2010 and March25th, 2009

plans (for members of the Management Committee). The

performance conditions associated with these plans concern:

♦April22nd, 2011 plan:

− for 50% of options granted, the increase in comparable

Cosmetic revenues for the 2012, 2013, 2014 and 2015 fiscal

years in relation to the growth in revenues for a panel of

competitors;

− for 50% of options granted, the increase over the same

period in Group consolidated operating profit.

The calculation will be based on the arithmetic average of the

performance in2012, 2013, 2014 and 2015 fiscal years and will

use a predefined allocation scale based on the performance

percentage reached.

♦April27th, 2010 and March25th, 2009 plans:

− for 50% of options granted, the increase in comparable

Cosmetic revenues for the 2011, 2012, 2013 and 2014

fiscal years for the 2010 plan and for the 2010, 2011, 2012

and2013 fiscal years for the 2009 plan compared to the

growth of the cosmetics market;

− for 50% of shares granted, the percentage, over the same

period, resulting from the ratio between the contribution

before advertising and promotion expenses,

i.e.

the

sum of operating profit and advertising and promotion

expenses, and published Cosmetic revenues.

The calculation will be based on the arithmetic average of

performance in the 2011, 2012, 2013 and 2014 fiscal years for

the 2010 plan and in the 2010, 2011, 2012 and2013 fiscal years

for the 2009 plan, and will use a predefined allocation scale

based on the performance percentage achieved.

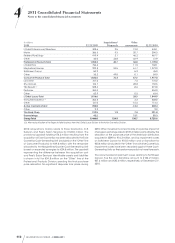

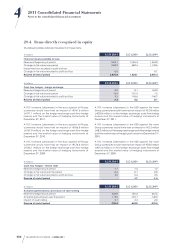

The fair value of options is determined using the Black&Scholes method based on the following assumptions:

Purchase options Subscription options

December

2003

November

2005

December

2003

March

2004

December

2004

June

2005

November

2005

April

2006

December

2006

November

2007

March

2009

April

2010

April

2011

Risk-free rate

of return 4.22% 3.16% 3.92% 3.39% 3.17% 2.63% 3.16% 3.80% 3.62% 4.01% 3.15% 2.83% 3.42%

Expected life

span 8years 6years 6years 7years 6years 6years 6years 6years 7years 7years 7years 7years 8years

Expected

volatility 21.50% 21.00% 21.50% 23.67% 18.70% 17.00% 21.00% 20.50% 22.52% 23.00% 31.95% 23.53% 22.60%

Expected

dividends 1.00% 1.35% 1.00% 1.20% 1.34% 1.38% 1.35% 1.35% 1.35% 1.24% 2.83% 1.86% 2.10%

Share price €63.45 €61.30 €63.45 €60.60 €54.60 €59.40 €61.30 €74.10 €74.60 €94.93 €50.94 €80.50 €85.68

Exercise

price €71.90 €62.94 €63.02 €64.69 €55.54 €60.17 €61.37 €72.60 €78.06 €91.66 €50.11 €80.03 €83.19

Fair value €15.24 €12.30 €15.66 €14.67 €10.15 €9.45 €12.88 €17.48 €17.19 €25.88 €12.16 €17.17 €18.58

Expected volatility is equal to the implied volatility of the options

listed on MONEP at the grant dates. As from2007, in order to

mitigate the effects of atypical phenomena, the volatility

used corresponds to the average between implied volatility

at the grant date and historic volatility over the expected life

span of the option. The expected life span has been adjusted

to take account of behavioural assumptions relating to the

beneficiaries.