Loreal 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101REGISTRATION DOCUMENT − L’ORÉAL 2011

2011 Consolidated Financial Statements

4

Notes to the consolidated nancial statements

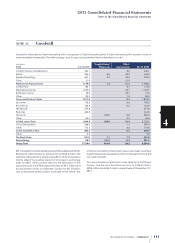

A price of SEK79.00 in cash was offered for each share, with the

exception of shares owned by Q-Med founder Bengt Agerup,

who sold his 47.5% stake at a price of SEK58.94 per share. An

earn-out clause stipulates that the total price can under no

circumstances exceed SEK74.96 per share.

On March15th, 2011, Galderma declared the offer wholly

unconditional and acquired 95,361,096 shares, representing

95.95% of the existing issued share capital of Q-Med. Galderma

decided to request compulsory acquisition of the remaining

shares in Q-Med shares, which was obtained on November15th,

2011.

Q-Med is proportionally consolidated as from March1st, 2011.

On December15th, 2011, L’Oréal announced the completed

acquisition of Pacific Bioscience Laboratories Inc., the market

leader in the rapidly growing area of sonic skin care devices.

The move gives L’Oréal access to patented sonic skin care

technology enabling the Company to acquire strategic

positions in the booming skin care devices category.

Clarisonic® is sold mainly throughout the US and is also

present in the UK, Australia, Mexico, Canada and the Far

East. It is sold through a distribution network which includes

dermatologists and cosmetic surgeons, spas, prestige retail,

e-tail, television shopping and clarisonic.com. In full-year 2010,

Clarisonic® delivered net sales of $105million. It has been fully

consolidated since December15th, 2011.

The cost of these new acquisitions was €813.5million. The total

amount of goodwill and other intangible assets resulting from

the acquisitions was provisionally estimated at €415.6million

and €320.8million, respectively.

These acquisitions represent around €193million in sales and

€33million in operating profit in2011.

2.2. 2010

On April21st, 2010, L’Oréal USA signed an agreement to acquire

the assets of Essie Cosmetics, the ultimate nail colour authority in

the US, sold mainly in American salons and spas. The acquisition

was completed on June25th, 2010 and the c ompany has been

fully consolidated since June30th, 2010. Essie’s net sales were

$25million in2009.

On June1st, 2010, L’Oréal USA acquired 100% of the capital of

C.B. Sullivan, a New Hampshire-based company. C.B. Sullivan

supplies hair salons in six states across the north-eastern United

States (Vermont, New Hampshire, Maine, Connecticut, Rhode

Island and Massachusetts), with a network of representatives

and professional-only outlets. The c ompany’s net sales in fiscal

year 2009 were approximately $50million. The acquisition was

fully consolidated as of June1st, 2010.

On December10th, 2010, L’Oréal USA acquired the professional

distribution business of Peel’s Salon Services, a Nebraska-

based company. Peel’s Salon Services supplies hair salons in

12 states across the mid-US, with a network of representatives

and professional-only outlets. The c ompany’s net sales

are approximately $100million. This acquisition was fully

consolidated as of December11th, 2010.

The cost of these new acquisitions amounts to approximately

€204.1million. The total amount of goodwill and other intangible

assets resulting from the acquisitions was estimated after

the final purchase price allocation at €119.9million and

€68.6million, respectively.

These acquisitions represent around $170million in full-year

sales and $7.2million in full-year operating profit for 2010. They

would have contributed $130million in additional net sales for

the Group over the 12months of 2010.

2.3. 2009

On April9th, 2009, L’Oréal USA signed an agreement for the

acquisition of Idaho Barber and Beauty Supply (IBB), a distributor

of professional products to hair salons in several states in the

North West of the United States, particularly Idaho, Montana

and Washington. Idaho Barber and Beauty Supply are fully

consolidated from June1st, 2009.

On December31st, 2009, L’OréalUSA acquired Maly’s Midwest

and Marshall Salon Services, distributors of professional

products to hair salons across 8 states in the US Midwest region.

Maly’s Midwest and Marshall Salon Services have been fully

consolidated since December31st, 2009.

These acquisitions represent around $150million in full-year

sales and $8million in full-year operating profit for 2009. They

would have contributed $93.5million in additional net sales for

the Group over the 12months of 2009.

The cost of these acquisitions amounts to approximately

€60.8million. The total amount of goodwill and other intangible

assets resulting from these acquisitions after the final purchase

price allocation is €26.9million and €20.4million, respectively.