Loreal 2011 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9REGISTRATION DOCUMENT − L’ORÉAL 2011

Presentation oftheGroup

1

International and cosmetics market

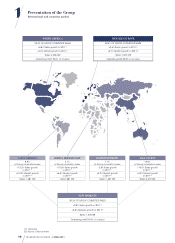

1.4.2. Rapid development outside

Western Europe

Beginning in the 1970s, the Latin America Zone developed with

a multi-divisional organisation that the Group has reproduced

in the other major regions of the world.

Present in Japan for nearly 50years, the L’Oréal Group has

developed its presence in that country by choosing the brands

to be given priority for this extremely specific market:

Kérastase

in hair salons,

Lancôme

in Luxury products and

Maybelline

and

L’Oréal Paris

in mass-market products.

The 1990s witnessed the opening up of N ew M arkets with the fall

of the Berlin wall which gave our brands access to the markets

in Eastern European countries.

L’Oréal was among the first foreign groups to obtain an

authorisation from the Indian government in1994 for the

creation of a wholly-owned subsidiary.

In1997, the Group created a large multi-divisional zone in Asia

and opened new subsidiaries, particularly in China where

L’Oréal holds 100% of the capital of its entity.

Africa and the Middle East where the Group had a weak

presence is a new frontier for development in the N ew M arkets:

the number of subsidiaries in that region has increased from 5

to 9 over the last three years.

The mid 2000s was the turning point: the strong acceleration

of the development of N ew M arkets is leading to a shift of the

point of gravity in the economic world.

In all, the percentage of cometics sales generated by the Group

in the New Markets was 15.5% in1995, 27.1% in2006 and 38.3%

in2011. This progress is expected to continue.

1.4.3. A commitment to shared

and sustainable growth

Anxious to protect the future and to lay the foundations for

lasting growth, the Group is striving to develop its presence in

the New Markets by applying the fundamental rules of a good

corporate citizen:

♦the products offered to consumers meet the highest quality

standards;

♦the Group’s commitments in social matters are the same in

all its subsidiaries;

♦all production centres comply with the same rules regarding

a decrease in discharges and a reduction in environmental

footprint. Social audits are carried out at suppliers of plants;

♦each subsidiary participates, as far as its resources permit,

in the large corporate sponsorship programmes of the

L’OréalFoundation such as For Women In Science and

Hairdressers against AIDS.

This approach is in line with the Group’s ambition as the world

leader in cosmetic products: helping to make the world more

beautiful.

1.4.4. Immense development

potential

Besides the major countries known as the BRIMC countries

(Brazil, Russia, India, Mexico and China), L’Oréal has notably

identified among the “growth markets” the following countries:

Poland, Ukraine, Argentina, Colombia, Indonesia, Thailand,

Vietnam, Philippines, Turkey, Egypt, Saudi Arabia, Pakistan,

Kazakhstan, South Africa and Nigeria.

In each of these countries, the consumption of cosmetics

products per inhabitant is 10 to 20times lower than in mature

countries. Several dozen million inhabitants have access every

year to levels of revenues which make them part of the “middle

classes” and allow them to consume modern cosmetics

products.

The marketing teams, in particular in large countries, pay heed

to these new consumers. The laboratories on all continents study

their specificities. The Group’s innovation policy is based on the

accessibility and adaptation of products to the beauty habits

and rituals of all men and women in their infinite diversity. These

form the basis for the universalisation of beauty.