Loreal 2011 Annual Report Download - page 225

Download and view the complete annual report

Please find page 225 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

223REGISTRATION DOCUMENT − L’ORÉAL 2011

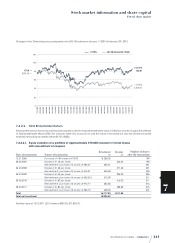

Stock market information andsharecapital

7

L’Oréal share market

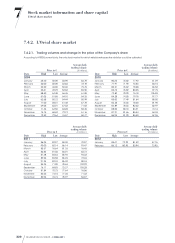

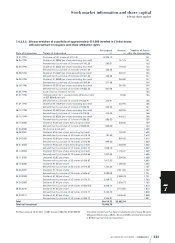

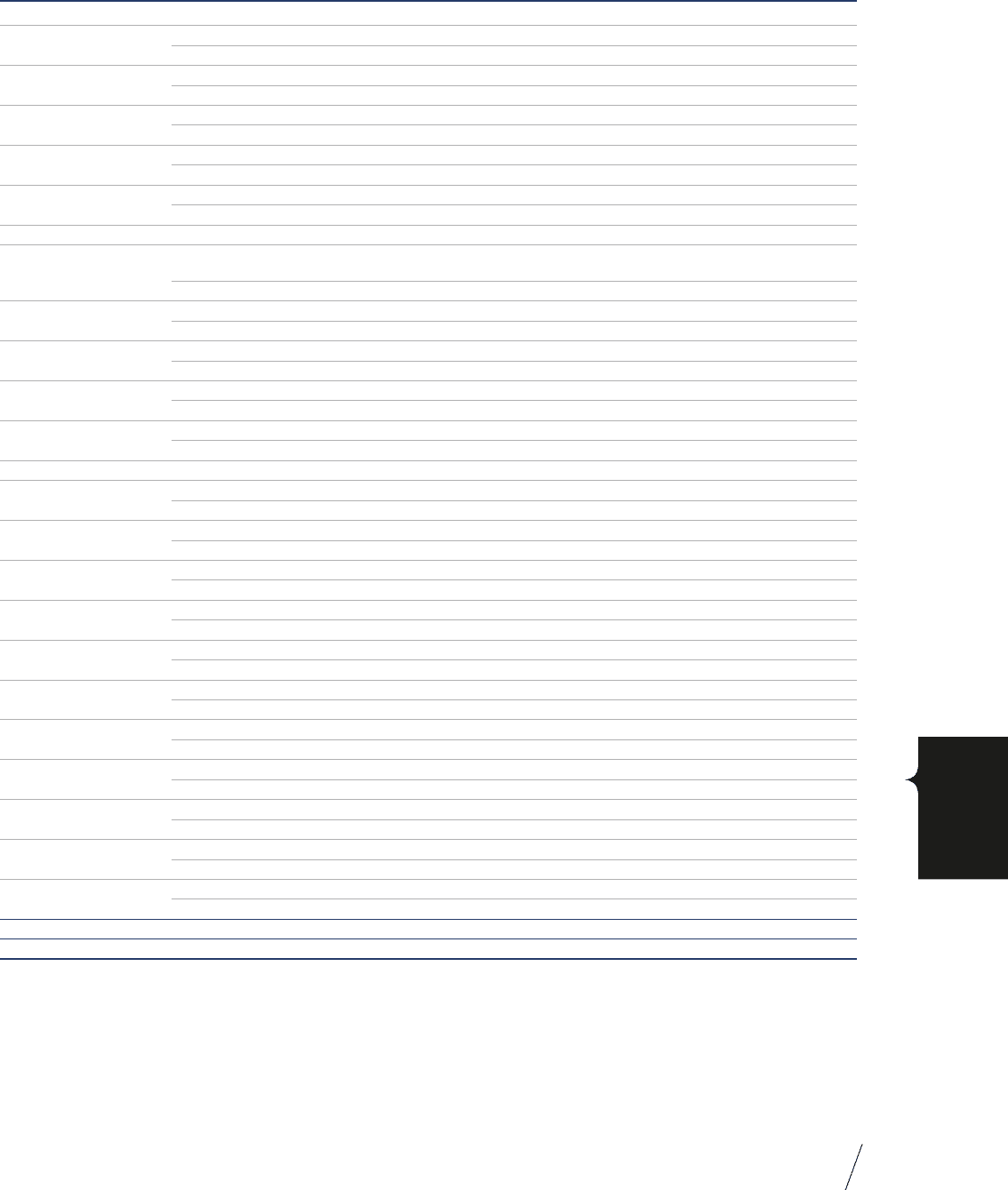

7.4.2.2.3. 20-year evolution of a portfolio of approximately €15,000 invested in L’Oréal shares

withreinvestment of coupons and share attribution rights

Date of transaction Nature of transaction Investment

(€)

Income

(€)

Number of shares

after the transaction

12.31.1991 Purchase of 131 shares at €114.49 14,998.19 131

06.26.1992 Dividend: €1.28057 per share, excluding tax credit 167.75 131

Reinvestment: purchase of 2shares at €140.25 280.51 133

06.25.1993 Dividend: €1.46351per share, excluding tax credit 194.65 133

Reinvestment: purchase of 2shares at €167.69 335.38 135

06.28.1994 Dividend: €1.64645per share, excluding tax credit 222.27 135

Reinvestment: purchase of 2shares at €167.69 335,38 137

06.28.1995 Dividend: €1.85988per share, excluding tax credit 254.80 137

Reinvestment: purchase of 2shares at €185.84 371.68 139

06.28.1996 Dividend: €2.02757per share, excluding tax credit 281.83 139

Reinvestment: purchase of 2shares at €260.54 521.08 141

07.01.1996 Issue of bonus shares (1 for 10) 155

07.31.1996 Compensation for 1 unused share attribution right

at€22.85668 per right 22.86 155

Reinvestment: purchase of 1 share at €236.91 236.91 156

07.01.1997 Dividend: €2.13429per share, excluding tax credit 332.95 156

Reinvestment: purchase of 1 share at €393.93 393.93 157

06.12.1998 Dividend: €2.43918per share, excluding tax credit 382.95 157

Reinvestment: purchase of 1 share at €473.05 473.05 158

06.15.1999 Dividend: €2.82031per share, excluding tax credit 445.61 158

Reinvestment: purchase of 1 share at €586.50 586.50 159

06.15.2000 Dividend: €3.40per share, excluding tax credit 540.60 159

Reinvestment: purchase of 1 share at €825.00 825.00 160

07.03.2000 Ten-for-one share split 1,600

06.08.2001 Dividend: €0.44per share, excluding tax credit 704.00 1,600

Reinvestment: purchase of 10shares at €78.15 781.50 1,610

06.04.2002 Dividend: €0.54per share, excluding tax credit 869.40 1,610

Reinvestment: purchase of 12shares at €74.95 899.40 1,622

05.27.2003 Dividend: €0.64per share, excluding tax credit 1,038.08 1,622

Reinvestment: purchase of 17shares at €61.10 1,038.70 1,639

05.14.2004 Dividend: €0.73per share, excluding tax credit 1,196.47 1,639

Reinvestment: purchase of 19shares at €63.65 1,209.35 1,658

05.11.2005 Dividend: €0.82per share 1,359.56 1,658

Reinvestment: purchase of 25shares at €56.50 1,412.50 1,683

05.10.2006 Dividend: €1.00per share 1,683.00 1,683

Reinvestment: purchase of 24shares at €72.65 1,743.60 1,707

05.03.2007 Dividend: €1.18per share 2,014.26 1,707

Reinvestment: purchase of 24shares at €86.67 2,080.08 1,731

04.30.2008 Dividend: €1.38 per share 2,388.78 1,731

Reinvestment: purchase of 32shares at €76.21 2,438.72 1,763

04.24.2009 Dividend: €1.44per share 2,538.72 1,763

Reinvestment: purchase of 49shares at €52.015 2,548.74 1,812

05.05.2010 Dividend: €1.50per share 2,718.00 1,812

Reinvestment: purchase of 36shares at €76.77 2,763.72 1,848

05.04.2011 Dividend: €1.80per share 3,326.40 1,848

Reinvestment: purchase of 39shares at €85.79 3,345.81 1,887

Total 39,619.72 22,682.94

Total net investment 16,936.78

Portfolio value at 12.31.2011 (1,887shares at €80.70): €152,280.90. The initial capital has thus been multiplied by 10.15 over 20years

(20-year inflation rate =38.8% - Source: INSEE) and the final capital

is 8.99 times the total net investment.