Loreal 2011 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2011 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

213REGISTRATION DOCUMENT − L’ORÉAL 2011

Stock market information andsharecapital

7

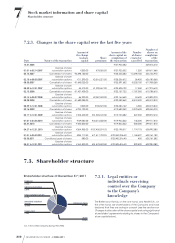

Shareholder structure

Chairman of the Board of Directors of L’Oréal and composed of

two members proposed by the Bettencourt family, two members

proposed by Nestlé and one other independent director. The

committee meets six times a year.

7.3.5.3. Term

Unless otherwise stipulated, the memorandum of agreement

will remain in force for five years from April29th, 2004, and in all

cases until a period of six months has elapsed after the death

of Mrs.Bettencourt.

7.3.5.4. Concerted action between

theparties

The parties declared that they would act in concert for a period

of five years from April29th, 2004 onwards.

On April9th, 2009, the Bettencourt family and Nestlé published

the following press release:

“On February3rd, 2004, the Bettencourt family and Nestlé signed

an agreement organising their relationship and the management

of their stakes within the L’Oréal Company.

The agreement is public and remains unchanged. It foresees

the non-transferability of their respective stakes in the capital

of L’Oréal until April29th, 2009, the other clauses (inparticular,

limitation on the shareholding, pre-emption, escrow, prohibition

on constituting a concert party with any third party, composition

of the Board of Directors and of the Strategy and Implementation

Committee) continue to be effective until the expiry date

mentioned in the 2004 deed.

The Bettencourt family and Nestlé will continue on acting in

concert with regard to the L’Oréal Company beyond April29th,

2009.”

7.3.6. Buyback by the Company

of its own shares

7.3.6.1. Information concerning share

buybacks during the 2011 financial

year

In2011, the Company did not buy back any of its own shares. It

did not therefore make any use of the authorisation voted by the

Annual General Meetings of April27th, 2010 and April22nd, 2011.

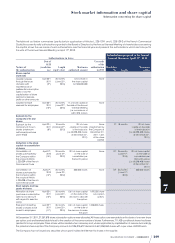

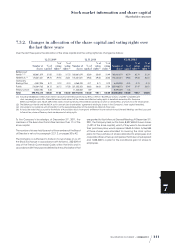

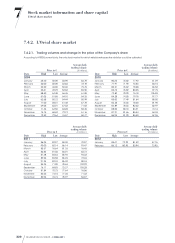

The table set out below summarises the transactions carried out within this framework, and the use made of the shares bought back:

Date of authorisation of the Annual

General Meeting

April27th, 2010

(13thresolution)

April22nd, 2011

(8thresolution)

Expiry date of the authorisation October27th, 2011 October 22nd, 2012

Maximum amount of authorised

buybacks 10% of capital on the date

of theshare buybacks

(

i.e.

at 12.31.2010 60,099,258shares),

for a maximum amount of €7,812.9million

10% of capital on the date

of theshare buybacks

(

i.e.

at 12.31.2011 60,298,408shares),

for a maximum amount of €7,838.8million

Maximum purchase price per share €130 €130

Authorised purposes Cancellation

Share purchase options

Free grants of shares

Liquidity and market stabilisation

External growth

Cancellation

Share purchase options

Free grants of shares

Liquidity and market stabilisation

External growth

Board of Directors’ meeting

that decided on the buybacks

(maximumamount) None None

Purpose of buybacks Not applicable Not applicable

Period of buybacks made Not applicable Not applicable

Number of shares purchased None None

Average purchase price per share None None

Use of shares purchased Not applicable Not applicable