ICICI Bank 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion & Analysis

92 Annual Report 2014-2015

In February 2015, RBI issued final guidelines on implementation of the Counter Cyclical Capital Buffer (CCCB) which

proposes higher capital requirements for banks ranging from 0% to 2.5% of risk-weighted assets, during periods of

high economic growth. The capital requirement would be determined based on certain triggers such as deviation of

the credit-to-GDP ratio from its long-term average and other indicators. While the framework is effective, banks would

be required to comply with the CCCB requirement only when activated. RBI has stated that circumstances currently do

not warrant activation of CCCB;

In March 2015, RBI issued amendments to prudential guidelines on capital adequacy and liquidity standards to align

them with internationally agreed standards. In this regard, the risk weight of 1111% applicable earlier for certain

exposures was revised to 1250%. These guidelines are effective from April 1, 2015;

In March 2015, RBI issued guidelines regarding sale of non-performing assets (NPAs) to securitisation and reconstruction

companies. RBI permitted banks to reverse the excess provision arising out of sale of NPAs at a value higher than the

net book value to the profit and loss account;

In March 2015, RBI released a discussion paper on the large exposures framework and enhancing credit supply through

market mechanism. The framework proposes a limit of 25.0% of the eligible capital base in respect of exposures to

each counterparty, which will include a group of connected counterparties. The group will be identified on the basis

of economic interdependence and the eligible capital base is defined as the Tier 1 capital of the bank as against the

current norm of capital funds;

In March 2015, the Parliament approved amendments to legislation governing the insurance sector, which, inter alia,

raised the foreign shareholding limit in insurance companies from 26% to 49%, while requiring the companies to be

Indian owned and controlled;

In March 2015, the Insurance Regulatory and Development Authority of India released draft regulations regarding

registration of corporate agents. As per the draft guidelines, registered corporate agents, including banks, will have to

sell insurance products of at least two insurers with a maximum cap of three insurers. Business sourced for a single

insurer as a proportion of the total insurance business sourced by the agent would have to be reduced in a phased

manner to 50% over four years. The above requirement would be applied separately for life, non-life and health

insurance. Only a single corporate agent registration would be allowed for a business group as a whole. Further,

corporate agents would not be allowed to sell group products offered by the insurers; and

In April 2015, RBI issued revised guidelines on priority sector lending, based on the report of the internal working

group set up to revisit priority sector lending. As per the guidelines, the overall target for priority sector lending

would continue to be 40% of adjusted net bank credit; sub-targets for direct and indirect lending to agriculture

were combined; and sub-targets of 8.0% for lending to small & marginal farmers and 7.5% lending target to micro-

enterprises were introduced. These sub-targets are to be achieved in a phased manner by March 2017. Sectors

qualifying for priority sector lending have been broadened to include medium enterprises, social infrastructure

and renewable energy. Priority sector lending achievement would be evaluated on a quarterly average basis from

fiscal 2017.

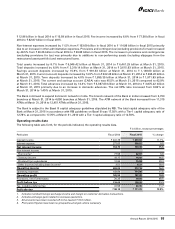

STANDALONE FINANCIALS AS PER INDIAN GAAP

Summary

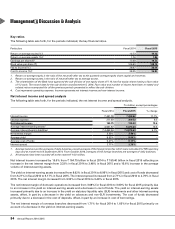

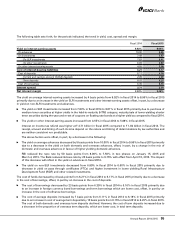

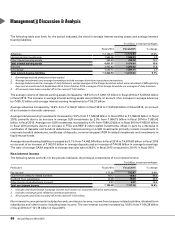

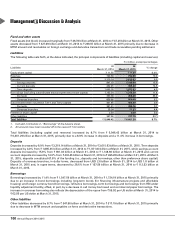

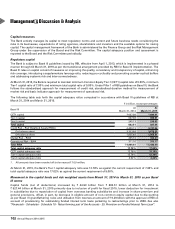

Profit after tax increased by 13.9% from ` 98.10 billion in fiscal 2014 to ` 111.75 billion in fiscal 2015. The increase in profit

after tax was mainly due to a 15.6% increase in net interest income and a 16.8% increase in non-interest income offset,

in part, by a 11.5% increase in non-interest expenses and a 48.5% increase in provisions and contingencies (excluding

provisions for tax).

Net interest income increased by 15.6% from ` 164.75 billion in fiscal 2014 to ` 190.40 billion in fiscal 2015, reflecting an

increase of 15 basis points in net interest margin and an increase of 10.6% in average interest-earning assets.

Non-interest income increased by 16.8% from ` 104.28 billion in fiscal 2014 to ` 121.76 billion in fiscal 2015. The

increase in non-interest income was primarily due to a gain of ` 16.93 billion from treasury-related activities in fiscal

2015 compared to a gain of ` 10.17 billion in fiscal 2014 and a 20.3% increase in dividend income from subsidiaries from