ICICI Bank 2015 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2015 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

162 Annual Report 2014-2015

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

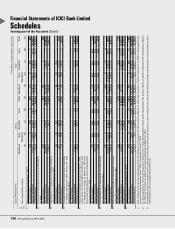

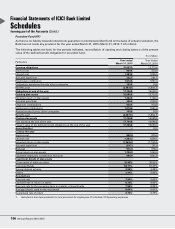

33. Fixed Assets

The following table sets forth, for the periods indicated, the movement in software acquired by the Bank, as included

in fixed assets.

` in million

Particulars At

March 31, 2015

At

March 31, 2014

At cost at March 31 of preceding year 9,433.7 8,508.0

Additions during the year 1,827.9 925.7

Deductions during the year (0.9) –

Depreciation to date (8,554.8) (7,298.8)

Net block 2,705.9 2,134.9

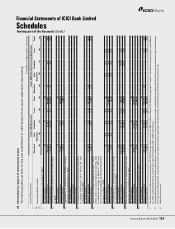

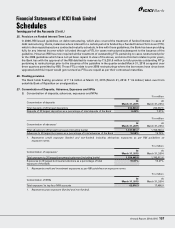

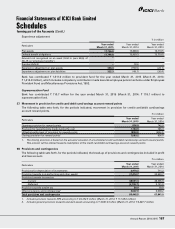

34. Description of contingent liabilities

The following table describes the nature of contingent liabilities of the Bank.

Sr. no. Contingent liability Brief Description

1. Claims against the Bank, not

acknowledged as debts

This item represents demands made in certain tax and legal matters against the Bank in the

normal course of business and customer claims arising in fraud cases. In accordance with

the Bank’s accounting policy and AS - 29, the Bank has reviewed and classified these items

as possible obligations based on legal opinion/judicial precedents/assessment by the Bank.

2. Liability for partly paid

investments

This item represents amounts remaining unpaid towards liability for partly paid investments.

These payment obligations of the Bank do not have any profit/loss impact.

3. Liability on account of

outstanding forward

exchange contracts

The Bank enters into foreign exchange contracts in the normal course of its business, to

exchange currencies at a pre-fixed price at a future date. This item represents the notional

principal amount of such contracts, which are derivative instruments. With respect to the

transactions entered into with its customers, the Bank generally enters into off-setting

transactions in the inter-bank market. This results in generation of a higher number of

outstanding transactions, and hence a large value of gross notional principal of the portfolio,

while the net market risk is lower.

4. Guarantees given on

behalf of constituents,

acceptances, endorsements

and other obligations

This item represents the guarantees and documentary credits issued by the Bank

in favour of third parties on behalf of its customers, as part of its trade finance

banking activities with a view to augment the customers’ credit standing. Through these

instruments, the Bank undertakes to make payments for its customers’ obligations, either

directly or in case the customer fails to fulfill their financial or performance obligations.

5. Currency swaps, interest

rate swaps, currency

options and interest rate

futures

This item represents the notional principal amount of various derivative instruments which

the Bank undertakes in its normal course of business. The Bank offers these products to its

customers to enable them to transfer, modify or reduce their foreign exchange and interest

rate risks. The Bank also undertakes these contracts to manage its own interest rate and

foreign exchange positions. With respect to the transactions entered into with its customers,

the Bank generally enters into off-setting transactions in the inter-bank market. This results in

generation of a higher number of outstanding transactions, and hence a large value of gross

notional principal of the portfolio, while the net market risk is lower.

6. Other items for which the

Bank is contingently liable

Other items for which the Bank is contingently liable primarily include the amount of

Government securities bought/sold and remaining to be settled on the date of financial

statements. This also includes the value of sell down options and other facilities pertaining

to securitisation, the notional principal amounts of credit derivatives, amount applied in

public offers under Application Supported by Blocked Amounts (ASBA), bill re-discounting,

amount transferred to the RBI under the Depositor Education and Awareness Fund (DEAF),

commitment towards contribution to venture fund and the amount that the Bank is obligated

to pay under capital contracts. Capital contracts are job orders of a capital nature which have

been committed.