ICICI Bank 2015 Annual Report Download - page 228

Download and view the complete annual report

Please find page 228 of the 2015 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236

|

|

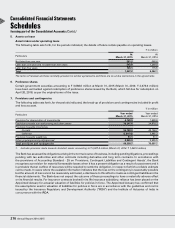

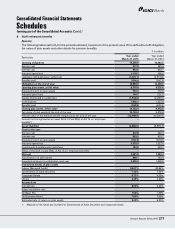

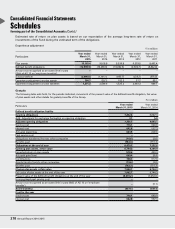

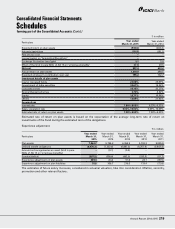

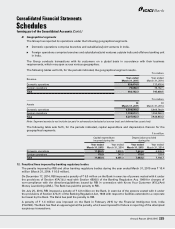

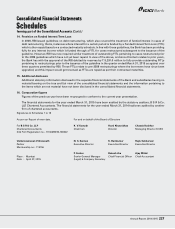

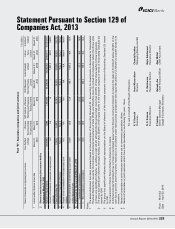

Schedules

forming part of the Consolidated Accounts (Contd.)

226 Annual Report 2014-2015

Consolidated Financial Statements

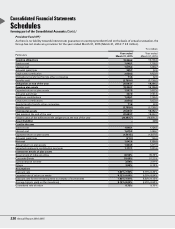

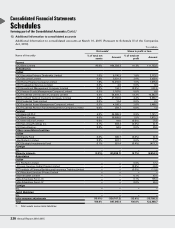

13. Additional information to consolidated accounts

Additional information to consolidated accounts at March 31, 2015 (Pursuant to Schedule III of the Companies

Act, 2013)

` in million

Name of the entity

Net assets1Share in profit or loss

% of total net

assets Amount % of total net

profit Amount

Parent

ICICI Bank Limited 95.0% 804,293.3 91.3% 111,753.5

Subsidiaries

Indian

ICICI Securities Primary Dealership Limited 1.0% 8,106.3 1.8% 2,173.7

ICICI Securities Limited 0.4% 3,521.3 2.0% 2,439.6

ICICI Home Finance Company Limited 1.8% 14,916.6 1.6% 1,975.8

ICICI Trusteeship Services Limited 0.0% 4.8 0.0% 0.3

ICICI Investment Management Company Limited 0.0% 134.1 (0.0%) (20.3)

ICICI Venture Funds Management Company Limited 0.3% 2,187.6 0.0% 8.6

ICICI Prudential Life Insurance Company Limited 6.4% 54,404.7 13.3% 16,342.9

ICICI Lombard General Insurance Company Limited 3.8% 31,792.8 4.4% 5,356.1

ICICI Prudential Trust Limited 0.0% 12.4 0.0% 2.2

ICICI Prudential Asset Management Company Limited 0.5% 4,390.3 2.0% 2,468.2

ICICI Prudential Pension Funds Management Company Limited 0.0% 258.7 0.0% 1.0

Foreign

ICICI Bank UK PLC 4.0% 34,089.3 0.9% 1,121.1

ICICI Bank Canada 4.6% 38,698.5 1.5% 1,815.3

ICICI International Limited 0.0% 93.0 (0.0%) (7.9)

ICICI Securities Holdings Inc. 0.1% 603.3 (0.0%) (0.7)

ICICI Securities Inc. 0.0% 94.5 0.0% 20.6

Other consolidated entities

Indian

ICICI Equity Fund 0.0% 390.7 (0.0%) (5.7)

I-Ven Biotech Limited 0.0% 267.1 0.0% 11.7

ICICI Strategic Investments Fund 0.1% 551.4 (0.4%) (477.7)

Foreign

NIL – – – –

Minority interests (3.0%) (25,058.1) (5.7%) (6,954.3)

Associates

Indian

Fino PayTech Limited – – 0.0% 17.2

I-Process Services (India) Private Limited – – (0.0%) (2.0)

NIIT Institute of Finance Banking and Insurance Training Limited – – (0.0%) (11.5)

ICICI Merchant Services Private Limited – – – –

India Infradebt Limited – – 0.1% 67.5

India Advantage Fund - III – – 0.1% 135.4

India Advantage Fund - IV – – 0.0% 26.4

Foreign

NIL – – – –

Joint Ventures

NIL – – – –

Inter-company adjustments (15.0%) (126,707.2) (12.9%) (15,788.3)

Total 100.0% 847,045.4 100.0% 122,468.7

1. Total assets minus total liabilities.