ICICI Bank 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236

|

|

35Annual Report 2014-2015

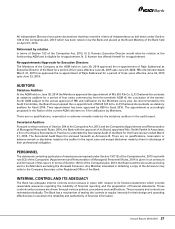

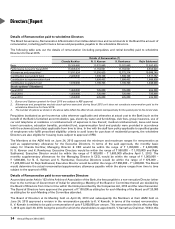

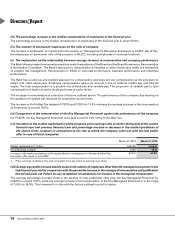

range, the Board will approve the remuneration payable to K. V. Kamath from time to time subject to approval of RBI. The

Board at its Meeting held on October 25, 2013 approved a remuneration of ` 3,000,000 per annum effective May 1, 2014.

RBI vide its letter dated March 25, 2014 while approving the re-appointment of the Chairman for the period May 1, 2014 upto

April 30, 2017 has also approved the above remuneration of ` 3,000,000 per annum. K. V. Kamath was paid a remuneration of

` 3,000,000 for the period May 1, 2014 to April 30, 2015.

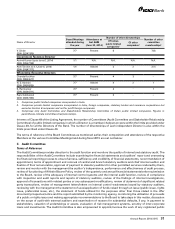

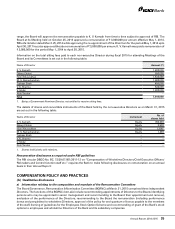

Information on the total sitting fees paid to each non-executive Director during fiscal 2015 for attending Meetings of the

Board and its Committees is set out in the following table:

Name of Director Amount (`)

K. V. Kamath 1,600,000

Dileep Choksi 900,000

Homi Khusrokhan 1,540,000

M. S. Ramachandran 1,380,000

Tushaar Shah 400,000

V. K. Sharma 540,000

V. Sridar 1,280,000

Alok Tandon1–

Total 7,640,000

1. Being a Government Nominee Director, not entitled to receive sitting fees.

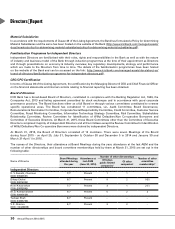

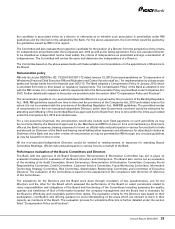

The details of shares and convertible instruments of the Bank held by the non-executive Directors as on March 31, 2015

are set out in the following table:

Name of Director Instrument No. of

shares held

K. V. Kamath Equity 950,000

Dileep Choksi Equity 2,500

Homi Khusrokhan Equity 3,5001

M. S. Ramachandran Equity 1,300

Tushaar Shah – –

V. K. Sharma – –

V. Sridar – –

Alok Tandon – –

1. Shares held jointly with relatives.

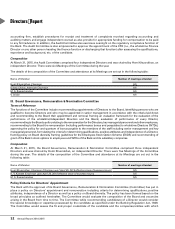

Remuneration disclosures as required under RBI guidelines

The RBI circular DBOD No. BC. 72/29.67.001/2011-12 on “Compensation of Wholetime Directors/Chief Executive Officers/

Risk takers and Control function staff etc.” requires the Bank to make following disclosures on remuneration on an annual

basis in their Annual Report:

COMPENSATION POLICY AND PRACTICES

(A) Qualitative disclosures

a) Information relating to the composition and mandate of the Remuneration Committee

The Board Governance, Remuneration & Nomination Committee (BGRNC) at March 31, 2015 comprised three independent

Directors. The functions of the BGRNC inter alia include recommending appointments of Directors to the Board, identifying

persons who may be appointed in senior management and recommending to the Board their appointment and removal,

evaluation of the performance of the Directors, recommending to the Board the remuneration (including performance

bonus and perquisites) to wholetime Directors, approval of the policy for and quantum of bonus payable to the members

of the staff, framing of guidelines for the Employees Stock Option Scheme and recommending of grant of the Bank’s stock

options to employees and wholetime Directors of the Bank and its subsidiary companies.