ICICI Bank 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127Annual Report 2014-2015

forming part of the Accounts (Contd.)

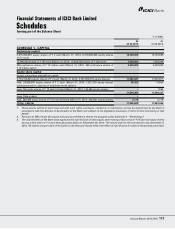

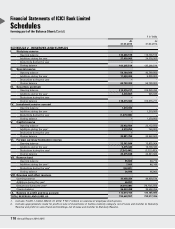

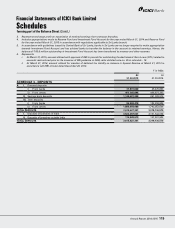

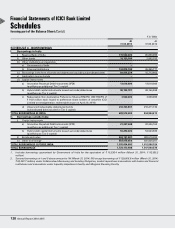

Schedules

Financial Statements of ICICI Bank Limited

k) The Bank deals in bullion business on a consignment basis. The difference between price recovered from

customers and cost of bullion is accounted for at the time of sales to the customers. The Bank also deals in bullion

on a borrowing and lending basis and the interest paid/received is accounted on accrual basis.

2. Investments

Investments are accounted for in accordance with the extant RBI guidelines on investment classification and valuation

as given below.

1. All investments are classified into ‘Held to Maturity’, ‘Available for Sale’ and ‘Held for Trading’. Reclassifications, if

any, in any category are accounted for as per RBI guidelines. Under each classification, the investments are further

categorised as (a) government securities, (b) other approved securities, (c) shares, (d) bonds and debentures, (e)

subsidiaries and joint ventures and (f) others.

2. ‘Held to Maturity’ securities are carried at their acquisition cost or at amortised cost, if acquired at a premium over

the face value. Any premium over the face value of fixed rate and floating rate securities acquired is amortised over

the remaining period to maturity on a constant yield basis and straight line basis respectively.

3. ‘Available for Sale’ and ‘Held for Trading’ securities are valued periodically as per RBI guidelines. Any premium over

the face value of fixed rate and floating rate investments in government securities, classified as ‘Available for Sale’,

is amortised over the remaining period to maturity on constant yield basis and straight line basis respectively.

Quoted investments are valued based on the trades/quotes on the recognised stock exchanges, subsidiary general

ledger account transactions, price list of RBI or prices declared by Primary Dealers Association of India jointly with

Fixed Income Money Market and Derivatives Association (FIMMDA), periodically.

The market/fair value of unquoted government securities which are in the nature of Statutory Liquidity Ratio (SLR)

securities included in the ‘Available for Sale’ and ‘Held for Trading’ categories is as per the rates published by

FIMMDA. The valuation of other unquoted fixed income securities wherever linked to the Yield-to-Maturity (YTM)

rates, is computed with a mark-up (reflecting associated credit risk) over the YTM rates for government securities

published by FIMMDA.

Unquoted equity shares are valued at the break-up value, if the latest balance sheet is available, or at ` 1, as per

RBI guidelines.

Securities are valued scrip-wise and depreciation/appreciation is aggregated for each category. Net appreciation

in each category, if any, being unrealised, is ignored, while net depreciation is provided for. Non-performing

investments are identified based on the RBI guidelines.

4. Treasury bills, commercial papers and certificate of deposits being discounted instruments, are valued at carrying

cost.

5. Costs including brokerage and commission pertaining to investments, paid at the time of acquisition, are charged

to the profit and loss account. Cost of investments is computed based on the First-In-First-Out (FIFO) method.

6. Equity investments in subsidiaries/joint ventures are categorised as ‘Held to Maturity’ in accordance with RBI

guidelines. The Bank assesses these investments for any permanent diminution in value and appropriate provisions

are made.

7. Profit/loss on sale of investments in the ‘Held to Maturity’ category is recognised in the profit and loss account and

profit is thereafter appropriated (net of applicable taxes and statutory reserve requirements) to Capital Reserve.

Profit/loss on sale of investments in ‘Available for Sale’ and ‘Held for Trading’ categories is recognised in the profit

and loss account.

8. Market repurchase and reverse repurchase transactions are accounted for as borrowing and lending transactions

respectively in accordance with the extant RBI guidelines. The transactions with RBI under Liquidity Adjustment

Facility (LAF) are accounted for as borrowing and lending transactions.

9. Broken period interest (the amount of interest from the previous interest payment date till the date of purchase/

sale of instruments) on debt instruments is treated as a revenue item.