ICICI Bank 2015 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2015 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

143Annual Report 2014-2015

forming part of the Accounts (Contd.)

Schedules

Financial Statements of ICICI Bank Limited

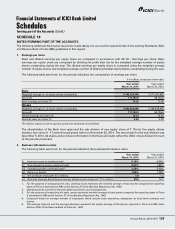

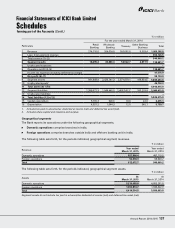

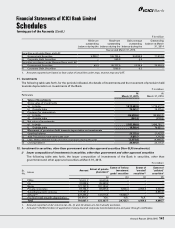

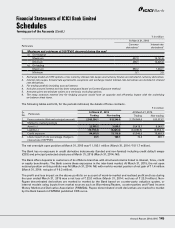

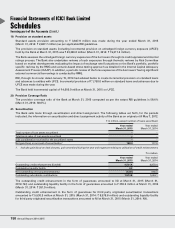

13. Sales and transfers of securities to/from Held to Maturity (HTM) category

During the year ended March 31, 2015 the value of sales and transfers of securities to/from HTM category (excluding

one-time transfer of securities to/from HTM category with the approval of Board of Directors permitted to be

undertaken by banks at the beginning of the accounting year, sale to RBI under pre-announced Open Market Operation

auctions and repurchase of Government securities by Government of India) had exceeded 5% of the book value of

the investments held in HTM category at the beginning of the year. The market value of investments held in the HTM

category was ` 1,271,386.6 million at March 31, 2015 which includes investments in subsidiaries/joint ventures and

RIDF deposits carried at cost.

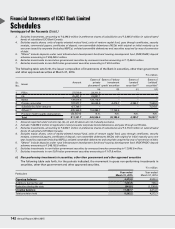

14. CBLO transactions

Collateralised Borrowing and Lending Obligation (CBLO) is a discounted money market instrument, established by The

Clearing Corporation of India Limited (CCIL) and approved by RBI, which involves secured borrowings and lending

transactions. At March 31, 2015, the Bank had outstanding borrowings amounting to Nil (March 31, 2014: ` 11,496.9

million) and outstanding lending amounting to Nil (March 31, 2014: Nil) in the form of CBLO. The amortised book value

of securities given as collateral by the Bank to CCIL for availing the CBLO facility was ` 84,853.6 million at March 31,

2015 (March 31, 2014: ` 86,251.8 million).

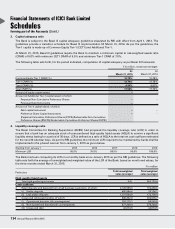

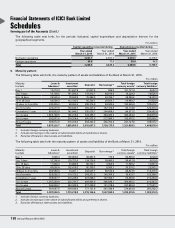

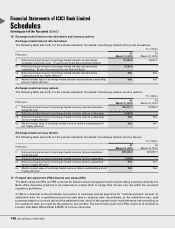

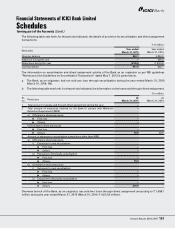

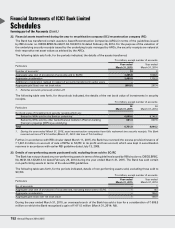

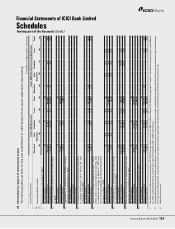

15. Derivatives

The Bank is a major participant in the financial derivatives market. The Bank deals in derivatives for balance sheet

management, proprietary trading and market making purposes whereby the Bank offers derivative products to its

customers, enabling them to hedge their risks.

Dealing in derivatives is carried out by identified groups in the treasury of the Bank based on the purpose of the

transaction. Derivative transactions are entered into by the treasury front office. Treasury Control and Service Group

(TCSG) conducts an independent check of the transactions entered into by the front office and also undertakes activities

such as confirmation, settlement, accounting, risk monitoring and reporting and ensures compliance with various

internal and regulatory guidelines.

The market making and the proprietary trading activities in derivatives are governed by the Investment policy and

Derivative policy of the Bank, which lays down the position limits, stop loss limits as well as other risk limits. The Risk

Management Group (RMG) lays down the methodology for computation and monitoring of risk. The Risk Committee

of the Board (RCB) reviews the Bank’s risk management policy in relation to various risks including credit and recovery

policy, investment policy, derivative policy, Asset Liability Management (ALM) policy and operational risk management

policy. The RCB comprises independent directors and the Managing Director and CEO.

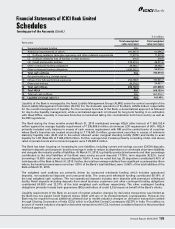

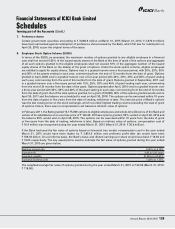

The Bank measures and monitors risk of its derivatives portfolio using such risk metrics as Value at Risk (VAR), stop

loss limits and relevant greeks for options. Risk reporting on derivatives forms an integral part of the management

information system.

The use of derivatives for hedging purposes is governed by the hedge policy approved by Asset Liability Management

Committee (ALCO). Subject to prevailing RBI guidelines, the Bank deals in derivatives for hedging fixed rate, floating rate

or foreign currency assets/liabilities. Transactions for hedging and market making purposes are recorded separately.

For hedge transactions, the Bank identifies the hedged item (asset or liability) at the inception of the hedge itself. The

effectiveness is assessed at the time of inception of the hedge and periodically thereafter.

Hedge derivative transactions are accounted for pursuant to the principles of hedge accounting based on guidelines

issued by RBI. Derivatives for market making purpose are marked to market and the resulting gain/loss is recorded

in the profit and loss account. The premium on option contracts is accounted for as per Foreign Exchange Dealers

Association of India (FEDAI) guidelines.

Over the counter (OTC) derivative transactions are covered under International Swaps and Derivatives Association

(ISDA) master agreements with the respective counter parties. The exposure on account of derivative transactions is

computed as per RBI guidelines.