ICICI Bank 2015 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2015 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

146 Annual Report 2014-2015

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

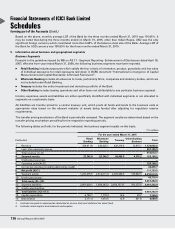

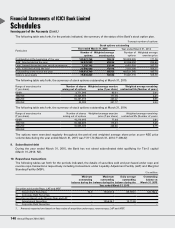

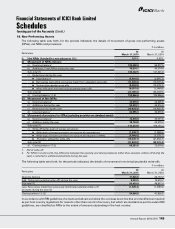

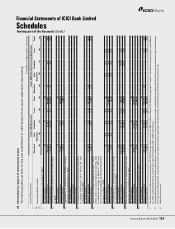

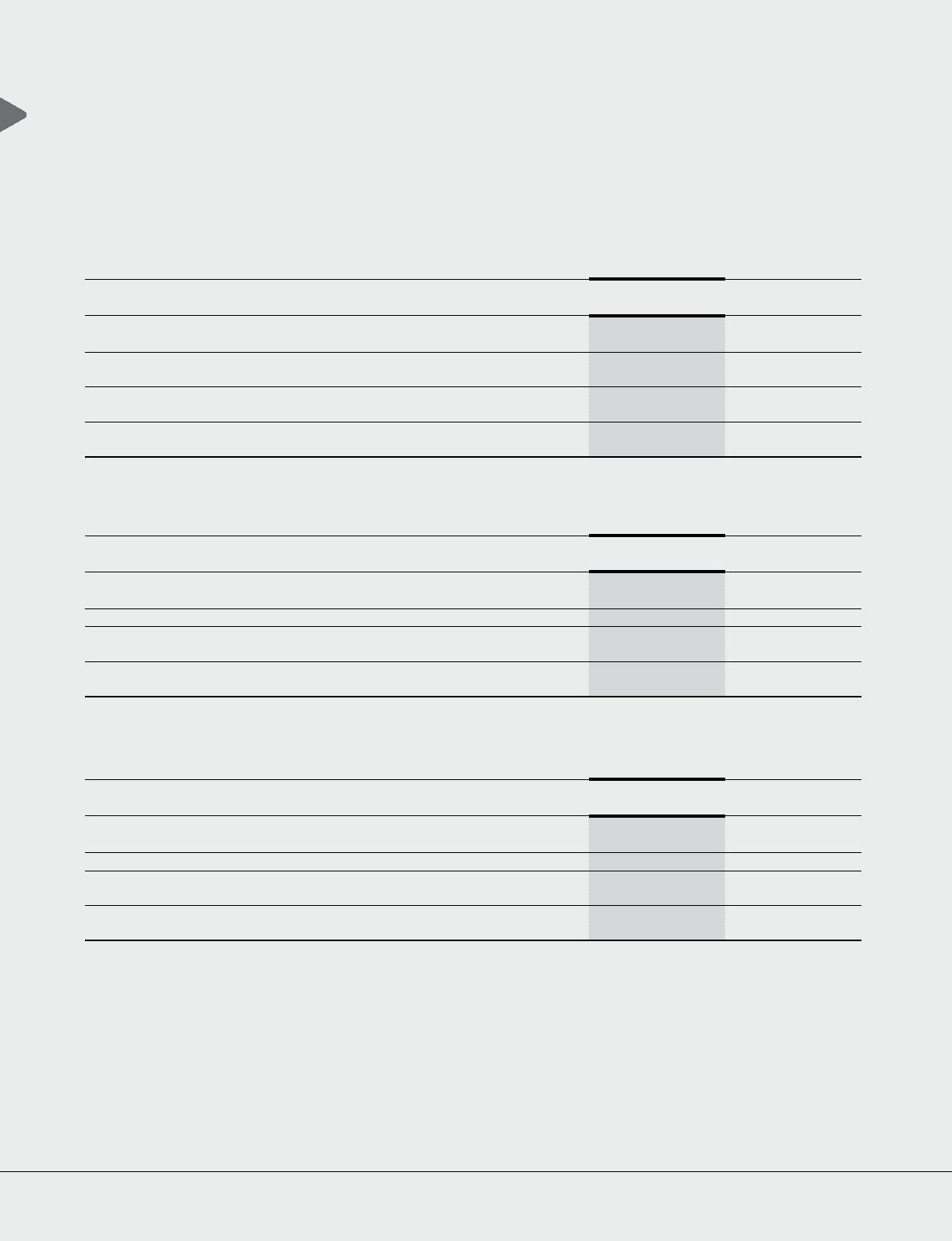

16. Exchange traded interest rate derivatives and currency options

Exchange traded interest rate derivatives

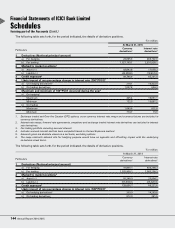

The following table sets forth, for the periods indicated, the details of exchange traded interest rate derivatives.

` in million

Particulars At

March 31, 2015

At

March 31, 2014

i) Notional principal amount of exchange traded interest rate derivatives

undertaken during the year - 10 year Government Security Notional Bond

76,383.2 10,057.6

ii) Notional principal amount of exchange traded interest rate derivatives

outstanding - 10 year Government Security Notional Bond

9,125.0 –

iii) Notional principal amount of exchange traded interest rate derivatives

outstanding and not "highly effective"

N.A. N.A.

iv) Mark-to-market value of exchange traded interest rate derivatives outstanding

and not "highly effective"

N.A. N.A.

Exchange traded currency options

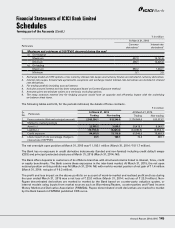

The following table sets forth, for the periods indicated, the details of exchange traded currency options.

` in million

Particulars At

March 31, 2015

At

March 31, 2014

i) Notional principal amount of exchange traded currency options undertaken

during the year

148,171.1 37,806.3

ii) Notional principal amount of exchange traded currency options outstanding 4,645.4 –

iii) Notional principal amount of exchange traded currency options outstanding

and not “highly effective”

N.A. N.A.

iv) Mark-to-market value of exchange traded currency options outstanding and

not “highly effective”

N.A. N.A.

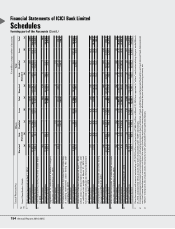

Exchange traded currency futures

The following table sets forth, for the periods indicated, the details of exchange traded currency futures.

` in million

Particulars At

March 31, 2015

At

March 31, 2014

i) Notional principal amount of exchange traded currency futures undertaken

during the year

625,328.4 425,257.3

ii) Notional principal amount of exchange traded currency futures outstanding 1,324.8 –

iii) Notional principal amount of exchange traded currency futures outstanding

and not “highly effective”

N.A. N.A.

iv) Mark-to-market value of exchange traded currency futures outstanding and not

“highly effective”

N.A. N.A.

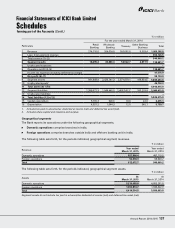

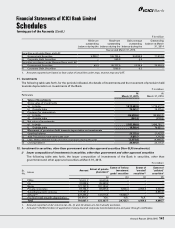

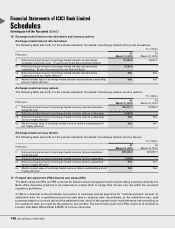

17. Forward rate agreement (FRA)/Interest rate swaps (IRS)

The Bank enters into FRA and IRS contracts for balance sheet management and market making purposes whereby the

Bank offers derivative products to its customers to enable them to hedge their interest rate risk within the prevalent

regulatory guidelines.

A FRA is a financial contract between two parties to exchange interest payments for ‘notional principal’ amount on

settlement date, for a specified period from start date to maturity date. Accordingly, on the settlement date, cash

payments based on contract rate and the settlement rate, which is the agreed bench-mark/reference rate prevailing on

the settlement date, are made by the parties to one another. The benchmark used in the FRA contracts of the Bank is

London Inter-Bank Offered Rate (LIBOR) of various currencies.