ICICI Bank 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business Overview

86 Annual Report 2014-2015

The Bank’s efforts were recognised and appreciated by the Indian Banks’ Association (IBA) at the IBA Banking Technology

Awards 2015. ICICI Bank was adjudged the winner in six and the first runner-up in one category out of a total of eight

categories for private sector banks. The Bank won the overall award of the ‘Best Technology Bank of the Year’.

KEY SUBSIDIARIES

ICICI Prudential Life Insurance Company (ICICI Life)

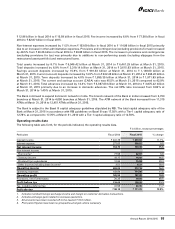

lClCl Life enhanced its leadership among private players in terms of new business premium on a retail weighted basis,

achieving a market share of over 11% in fiscal 2015. lClCl Life’s total premium for fiscal 2015 was ` 153.07 billion and new

business annualised premium equivalent premium was ` 47.44 billion. The profit after tax was ` 16.34 billion in fiscal 2015

compared to ` 15.67 billion in fiscal 2014. The in-force sum assured by lClCI Life, including the group insurance business,

increased by 14.3% from ` 2,682.80 billion at March 31, 2014 to ` 3,065.31 billion at March 31, 2015. During the year, ICICI

Life crossed the milestone of ` 1 trillion in assets under management (AUM). The embedded value on Indian Embedded

Value (IEV) basis at March 31, 2015 was ` 137.21 billion.

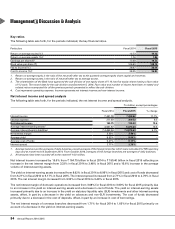

lClCl Lombard General lnsurance Company (lClCl General)

lClCl General’s Gross Written Premium (GWP) was ` 69.14 billion in fiscal 2015. The company maintained its market

leadership in the private sector with an overall share of 8.6% (excluding monoline companies). The company witnessed an

increase in policy volumes by 24% from 11.2 million in FY2014 to 13.9 million in FY2015. ICICI General’s profit before tax

increased from ` 5.20 billion in FY2014 to ` 6.91 billion in FY2015. However, the increase in profit after tax was lower from

` 5.11 billion in FY2014 to ` 5.36 billion in FY2015, due to lower tax charge in FY2014 as a result of tax benefit on losses

carried forward from earlier years.

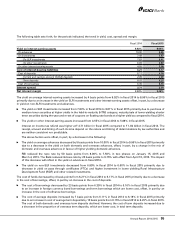

ICICI Prudential Asset Management Company (AMC)

ICICI AMC had quarterly average assets under management of ` 1,485.60 billion for the quarter ended March 2015. The

company increased its overall market share to 12.9% at March 31, 2015, with equity market share increasing from 11.1%

at March 31, 2014 to 13.5% at March 31, 2015. The company won several awards for its fund performance including the

‘Asia Asset Management Annual Best of the Best Awards 2014’ for India’s Best Fund House, the Outlook Money 2014 - Best

Fund House Award and Money Today - FPCIL 2014 Best Debt Fund House Award. The profit after tax increased from ` 1.83

billion in fiscal 2014 to ` 2.47 billion in fiscal 2015.

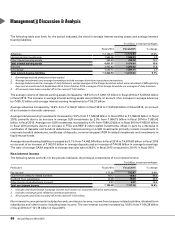

ICICI Venture Funds Management Company (ICICI Venture)

ICICI Venture has established itself as one of India’s most diversified alternative asset managers with a presence across

private equity, real estate, infrastructure and special situations. During fiscal 2015, the special situations fund (AION) to

which ICICI Venture is an advisor under a strategic alliance with a leading global company (Apollo Global Management,

US) concluded its final closing at USD 825 million. AION is one of the largest India focused alternative funds ever raised

from the global investor community. ICICI Venture’s momentum of new investments and exits since 2009 was sustained

during fiscal 2015 as well. ICICI Venture has concluded 45 exits worth about USD 1 billion since 2009 which is among the

highest in the Indian market for this period. ICICI Venture achieved a profit after tax of ` 0.01 billion in fiscal 2015 compared

to ` 0.33 billion in fiscal 2014.

ICICI Securities (I-Sec)

In fiscal 2015, ICICI Securities continued to expand its client base across various business segments, assisting its customers

in meeting their financial goals by providing them with research, advisory and execution services. The company’s client

base comprises corporates, institutional investors and over 3.3 million retail customers. The company’s was able to

leverage its strong franchise to capitalise on the positive momentum in capital markets and achieve a consolidated profit

after tax ` 2.94 billion in fiscal 2015 compared to ` 0.91 billion in fiscal 2014.

ICICI Securities Primary Dealership (I-Sec PD)

I-Sec PD maintained its leadership in auction bidding and underwriting as well as in the secondary market in Government

securities. The Company also increased its outreach to the FII segment, generating significant amount of activity in both

Government securities and corporate bonds. The Company is one of the fund managers managing the corpus belonging to

Employees Provident Fund Organisation, India’s largest retirement fund. The Company managed multiple corporate debt