ICICI Bank 2015 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2015 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134 Annual Report 2014-2015

Schedules

forming part of the Accounts (Contd.)

Financial Statements of ICICI Bank Limited

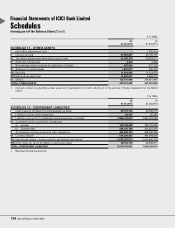

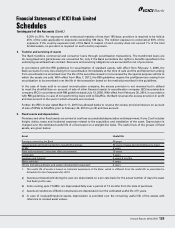

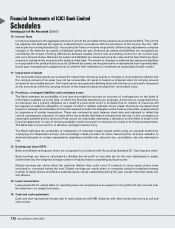

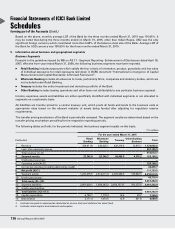

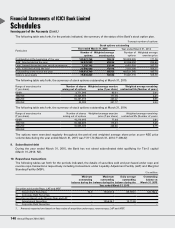

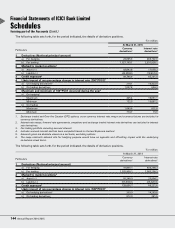

3. Capital adequacy ratio

The Bank is subject to the Basel III capital adequacy guidelines stipulated by RBI with effect from April 1, 2013. The

guidelines provide a transition schedule for Basel III implementation till March 31, 2019. As per the guidelines, the

Tier-1 capital is made up of Common Equity Tier-1 (CET1) and Additional Tier-1.

At March 31, 2015, Basel III guidelines require the Bank to maintain a minimum capital to risk-weighted assets ratio

(CRAR) of 9.0% with minimum CET1 CRAR of 5.5% and minimum Tier-1 CRAR of 7.0%.

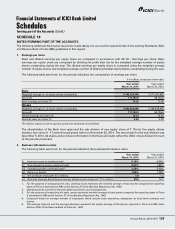

The following table sets forth, for the period indicated, computation of capital adequacy as per Basel III framework.

` in million, except percentages

At

March 31, 2015

At

March 31, 2014

Common Equity Tier 1 CRAR (%) 12.78% 12.78%

Tier-1 CRAR (%) 12.78% 12.78%

Tier-2 CRAR (%) 4.24% 4.92%

Total CRAR (%) 17.02% 17.70%

Amount of equity capital raised ––

Amount of Additional Tier-1 capital raised; of which

Perpetual Non-Cumulative Preference Shares ––

Perpetual Debt Instruments ––

Amount of Tier-2 capital raised; of which

Debt capital instrument ––

Preference Share Capital Instruments ––

[Perpetual Cumulative Preference Shares (PCPS)/Redeemable Non-Cumulative

Preference Shares (RNCPS)/Redeemable Cumulative Preference Shares (RCPS)]

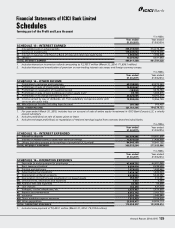

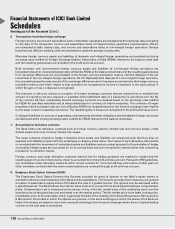

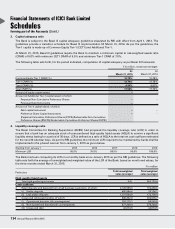

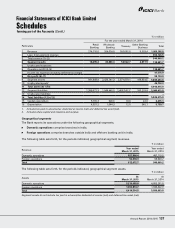

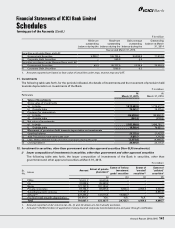

4. Liquidity coverage ratio

The Basel Committee for Banking Supervision (BCBS) had proposed the liquidity coverage ratio (LCR) in order to

ensure that a bank has an adequate stock of unencumbered high quality liquid assets (HQLA) to survive a significant

liquidity stress lasting for a period of 30 days. LCR is defined as a ratio of HQLA to the total net cash outflows estimated

for the next 30 calendar days. As per the RBI guidelines the minimum LCR required to be maintained by banks shall be

implemented in the phased manner from January 1, 2015 as given below.

Starting from January 1 2015 2016 2017 2018 2019

Minimum LCR 60.0% 70.0% 80.0% 90.0% 100.0%

The Bank has been computing its LCR on a monthly basis since January 2015 as per the RBI guidelines. The following

table sets forth the average of unweighted and weighted value of the LCR of the Bank, based on month end values, for

the three months ended March 31, 2015.

` in million

Particulars Total unweighted

value (average)

Total weighted

value (average)

High quality liquid assets

1 Total high quality liquid assets N.A. 569,153.4

Cash outflows

2 Retail deposits and deposits from small business customers, of which: 2,126,588.6 192,404.6

(i) Stable deposits 405,084.6 20,254.2

(ii) Less stable deposits 1,721,504.0 172,150.4

3 Unsecured wholesale funding, of which: 840,202.0 392,978.7

(i) Operational deposits (all counterparties) 320,279.2 80,069.8

(ii) Non-operational deposits (all counterparties) 477,248.4 270,234.5

(iii) Unsecured debt 42,674.5 42,674.5