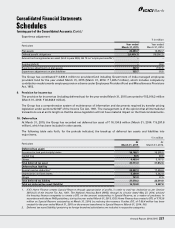

ICICI Bank 2015 Annual Report Download - page 216

Download and view the complete annual report

Please find page 216 of the 2015 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Schedules

forming part of the Consolidated Accounts (Contd.)

214 Annual Report 2014-2015

Consolidated Financial Statements

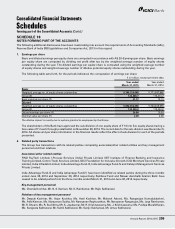

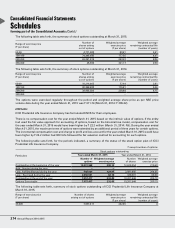

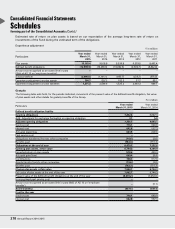

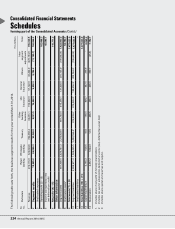

The following table sets forth, the summary of stock options outstanding at March 31, 2015.

Range of exercise price

(` per share)

Number of

shares arising

out of options

Weighted average

exercise price

(` per share)

Weighted average

remaining contractual life

(number of years)

60-99 4,771,000 80.81 2.41

100-199 74,346,685 177.35 4.41

200-299 69,291,015 243.22 8.06

300-399 25,000 321.17 9.59

The following table sets forth, the summary of stock options outstanding at March 31, 2014.

Range of exercise price

(` per share)

Number of

shares arising

out of options

Weighted average

exercise price

(` per share)

Weighted average

remaining contractual life

(number of years)

60-99 10,216,665 77.64 2.81

100-199 90,398,800 175.81 5.26

200-299 39,906,300 228.84 8.15

300-399 – – –

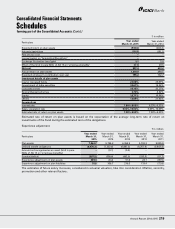

The options were exercised regularly throughout the period and weighted average share price as per NSE price

volume data during the year ended March 31, 2015 was ` 311.74 (March 31, 2014: ` 209.32).

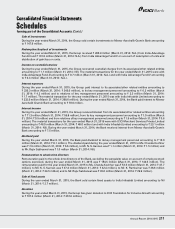

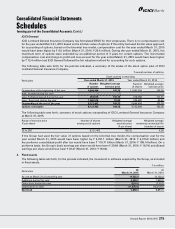

ICICI Life:

ICICI Prudential Life Insurance Company has formulated ESOS for their employees.

There is no compensation cost for the year ended March 31, 2015 based on the intrinsic value of options. If the entity

had used the fair value approach for accounting of options, based on the binomial tree model, compensation cost for

the year ended March 31, 2015 would have been higher by ` 22.2 million (March 31, 2014: Nil). During the year ended

March 31, 2015, the maximum terms of options were extended by an additional period of three years for certain options.

The incremental compensation cost and charge to profit and loss account for the year ended March 31, 2015 would have

been higher by ` 22.2 million had ICICI Life followed the fair valuation method for accounting for such options.

The following table sets forth, for the periods indicated, a summary of the status of the stock option plan of ICICI

Prudential Life Insurance Company.

` except number of options

Particulars

Stock options outstanding

Year ended March 31, 2015 Year ended March 31, 2014

Number of

options

Weighted average

exercise price

Number

of shares

Weighted average

exercise price

Outstanding at the beginning of the year 10,201,948 200.10 12,620,354 210.60

Add: Granted during the year – – – –

Less: Forfeited/lapsed during the year 588,000 324.93 2,087,905 264.45

Less : Exercised during the year 2,556,531 82.10 330,501 69.30

Outstanding at the end of the year 7,057,417 232.45 10,201,948 200.10

Options Exercisable 7,057,417 232.45 10,201,948 200.10

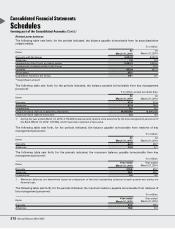

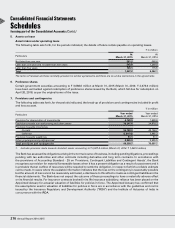

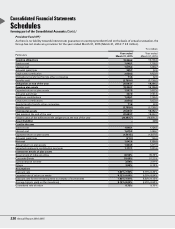

The following table sets forth, summary of stock options outstanding of ICICI Prudential Life Insurance Company at

March 31, 2015.

Range of exercise price

(` per share)

Number of shares

arising out of options

Weighted average

exercise price

(` per share)

Weighted average

remaining contractual life

(number of years)

30-400 7,057,417 232.45 4