ICICI Bank 2015 Annual Report Download - page 223

Download and view the complete annual report

Please find page 223 of the 2015 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

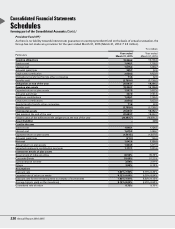

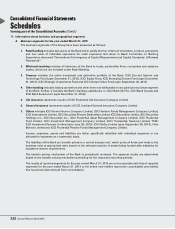

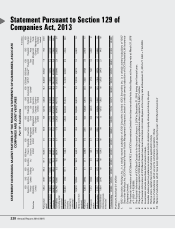

forming part of the Consolidated Accounts (Contd.)

Schedules

221Annual Report 2014-2015

Consolidated Financial Statements

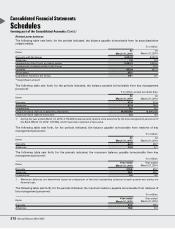

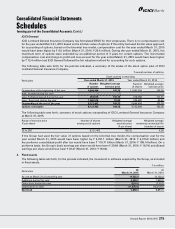

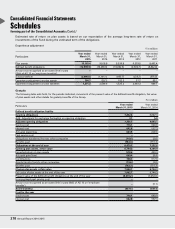

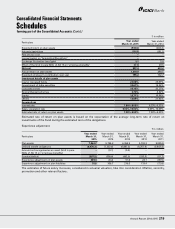

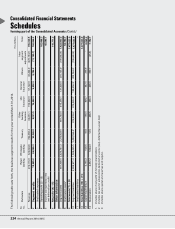

Experience adjustment

` in million

Particulars Year ended

March 31, 2015

Year ended

March 31, 2014

Plan assets 20,683.7 18,352.7

Defined benefit obligations (20,683.7) (18,356.2)

Amount not recognised as an asset (limit in para 59(b) AS 15 on ‘employee benefits’) ––

Surplus/(deficit) –(3.5)

Experience adjustment on plan assets 347.0 (136.3)

Experience adjustment on plan liabilities 325.7 (9.9)

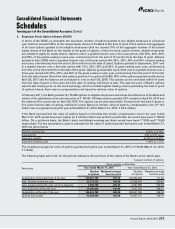

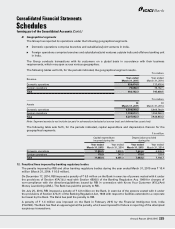

The Group has contributed ` 2,030.3 million to provident fund including Government of India managed employees

provident fund for the year ended March 31, 2015 (March 31, 2014: ` 1,925.7 million), which includes compulsory

contribution made towards employee pension scheme under Employees Provident Fund and Miscellaneous Provisions

Act, 1952.

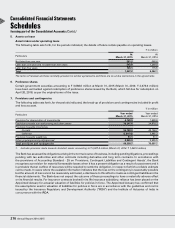

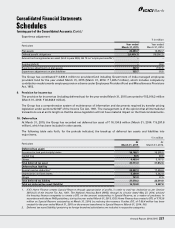

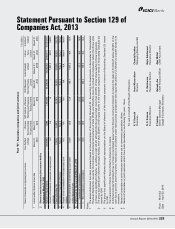

9. Provision for income tax

The provision for income tax (including deferred tax) for the year ended March 31, 2015 amounted to ` 53,916.2 million

(March 31, 2014: ` 46,044.0 million).

The Group has a comprehensive system of maintenance of information and documents required by transfer pricing

legislation under sections 92-92F of the Income Tax Act, 1961. The management is of the opinion that all international

transactions are at arm’s length so that the above legislation will not have material impact on the financial statements.

10. Deferred tax

At March 31, 2015, the Group has recorded net deferred tax asset of ` 16,134.8 million (March 31, 2014: ` 9,297.8

million), which has been included in other assets.

The following table sets forth, for the periods indicated, the break-up of deferred tax assets and liabilities into

major items.

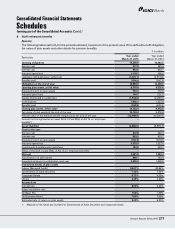

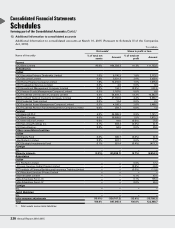

` in million

Particulars At

March 31, 2015

At

March 31, 2014

Deferred tax asset

Provision for bad and doubtful debts 39,199.1 28,595.5

Capital loss 50.5 49.6

Others 4,463.4 3,167.5

Total deferred tax asset 43,713.0 31,812.6

Deferred tax liability

Special reserve deduction122,057.3 17,234.9

Depreciation on fixed assets 5,359.9 5,242.4

Others 161.0 37.5

Total deferred tax liability 27,578.2 22,514.8

Total net deferred tax asset/(liability) 16,134.8 9,297.8

1. ICICI Home Finance creates Special Reserve through appropriation of profits, in order to avail tax deduction as per Section

36(1)(viii) of the Income Tax Act, 1961. The National Housing Bank (NHB), through its circular dated May 27, 2014, advised

the housing finance companies to create a DTL on the amount outstanding in Special Reserve, as a matter of prudence. In

accordance with these NHB guidelines, during the year ended March 31, 2015, ICICI Home Finance has created a DTL of

`

703.9

million on Special Reserve outstanding at March 31, 2014, by reducing the reserves. Further, DTL of

`

80.4 million has been

created for the year ended March 31, 2015 on the amount transferred to Special Reserve (March 31, 2014: Nil).

2. Deferred tax asset/(liability) pertaining to foreign branches/subsidiaries are included in respective categories.