ICICI Bank 2015 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2015 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

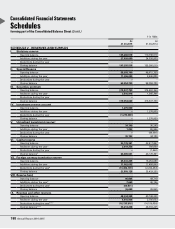

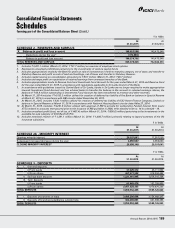

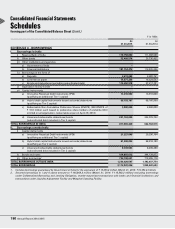

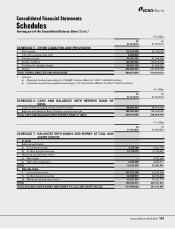

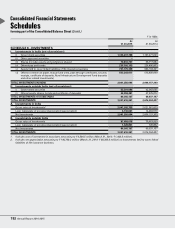

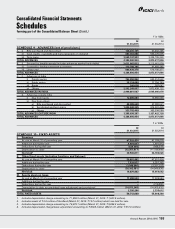

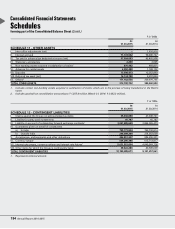

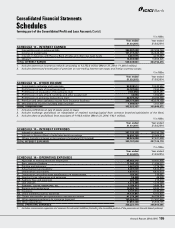

Schedules

forming part of the Consolidated Accounts (Contd.)

198 Annual Report 2014-2015

Consolidated Financial Statements

6. During the three months ended December 31, 2014, ICICI Kinfra Limited ceased to be a consolidating entity and accordingly, has not

been consolidated.

7. During the three months ended March 31, 2015, ICICI Bank Eurasia Limited Liability Company ceased to be a subsidiary and

accordingly, has not been consolidated.

Comm Trade Services Limited has not been consolidated under AS 21 and Falcon Tyres Limited under AS 23, since the

investments are temporary in nature. 3i Infotech Limited (3i Infotech), in which the Group holds 25.17% equity shares, has

not been accounted as per equity method under AS 23 at March 31, 2015 based on the Group’s continued intention to

reduce the stake in 3i Infotech below 20.00% in the near future and the severe long-term restrictions on 3i Infotech under

restructuring arrangement that impair the ability of 3i Infotech to transfer funds to its investors.

SIGNIFICANT ACCOUNTING POLICIES

1. Transactions involving foreign exchange

The consolidated financial statements of the Group are reported in Indian rupees (`), the national currency of India.

Foreign currency income and expenditure items are translated as follows:

For domestic operations, at the exchange rates prevailing on the date of the transaction with the resultant gain or

loss accounted for in the profit and loss account.

For integral foreign operations, at daily closing rates with the resultant gain or loss accounted for in the profit

and loss account. An integral foreign operation is a subsidiary, associate, joint venture or branch of the reporting

enterprise, the activities of which are based or conducted in a country other than the country of the reporting

enterprise but are an integral part of the reporting enterprise.

For non-integral foreign operations, at the quarterly average closing rates with the resultant gains or losses

accounted for as foreign currency translation reserve.

Monetary foreign currency assets and liabilities of domestic and integral foreign operations are translated at closing

exchange rates notified by Foreign Exchange Dealers’ Association of India (FEDAI) relevant to the balance sheet date

and the resulting gains/losses are included in the profit and loss account.

Both monetary and non-monetary foreign currency assets and liabilities of non-integral foreign operations are

translated relevant to closing exchange rates notified by FEDAI relevant to the balance sheet date and the resulting

gains/losses from exchange differences are accumulated in the foreign currency translation reserve until the disposal

of the net investment in the non-integral foreign operations. On the disposal/partial disposal of a non-integral foreign

operation, the cumulative/proportionate amount of the exchange differences which has been accumulated in the

foreign currency translation reserve and which relates to that operation are recognised as income or expenses in the

same period in which the gain or loss on disposal is recognised.

The premium or discount arising on inception of forward exchange contracts in domestic operations that are entered

to establish the amount of reporting currency required or available at the settlement date of a transaction is amortised

over the life of the contract. All other outstanding forward exchange contracts are revalued based on the exchange rates

notified by FEDAI for specified maturities and at interpolated rates for contracts of interim maturities. The contracts of

longer maturities where exchange rates are not notified by FEDAI are revalued, based on the forward exchange rates

implied by the swap curves in respective currencies. The resultant gains or losses are recognised in the profit and loss

account.

Contingent liabilities on account of guarantees, endorsements and other obligations denominated in foreign currency

are disclosed at the closing exchange rates notified by FEDAI relevant to the balance sheet date.

2. Revenue recognition

Interest income is recognised in the profit and loss account as it accrues except in the case of non-performing

assets (NPAs) where it is recognised upon realisation, as per the income recognition and asset classification norms

of RBI/NHB/other applicable guidelines.

Income from finance leases is calculated by applying the interest rate implicit in the lease to the net investment

outstanding on the lease over the primary lease period. Finance leases entered into prior to April 1, 2001 have