ICICI Bank 2015 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2015 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

133Annual Report 2014-2015

forming part of the Accounts (Contd.)

Schedules

Financial Statements of ICICI Bank Limited

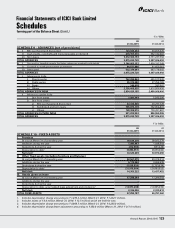

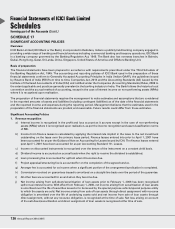

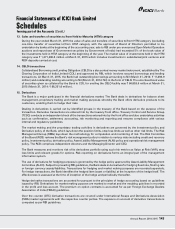

SCHEDULE 18

NOTES FORMING PART OF THE ACCOUNTS

The following additional disclosures have been made taking into account the requirements of Accounting Standards (ASs)

and Reserve Bank of India (RBI) guidelines in this regard.

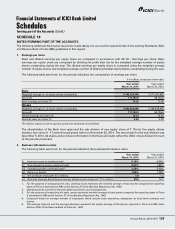

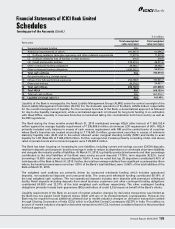

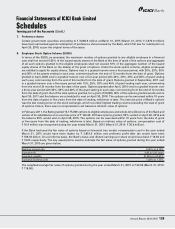

1. Earnings per share

Basic and diluted earnings per equity share are computed in accordance with AS 20 – Earnings per share. Basic

earnings per equity share are computed by dividing net profit after tax by the weighted average number of equity

shares outstanding during the year. The diluted earnings per equity share is computed using the weighted average

number of equity shares and weighted average number of dilutive potential equity shares outstanding during the year.

The following table sets forth, for the periods indicated, the computation of earnings per share.

` in million, except per share data

Year ended

March 31, 2015

Year ended

March 31, 2014

Basic

Weighted average no. of equity shares outstanding 5,785,726,485 5,771,587,885

Net profit 111,753.5 98,104.8

Basic earnings per share (`)19.32 17.00

Diluted

Weighted average no. of equity shares outstanding 5,842,092,456 5,794,468,950

Net profit 111,753.5 98,104.8

Diluted earnings per share (`)19.13 16.93

Nominal value per share (`)2.00 2.00

The dilutive impact is due to options granted to employees by the Bank.

The shareholders of the Bank have approved the sub-division of one equity share of ` 10 into five equity shares

having a face value of ` 2 each through postal ballot on November 20, 2014. The record date for the sub-division was

December 5, 2014. All shares and per share information in the financial results reflect the effect of sub-division for each

of the periods presented.

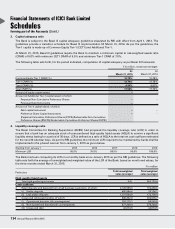

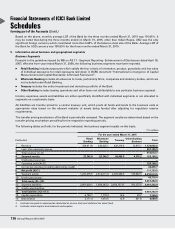

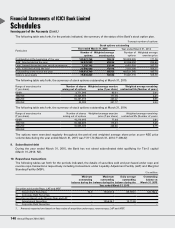

2. Business/information ratios

The following table sets forth, for the periods indicated, the business/information ratios.

Year ended

March 31, 2015

Year ended

March 31, 2014

(i) Interest income to working funds18.19% 8.00%

(ii) Non-interest income to working funds12.03% 1.89%

(iii) Operating profit to working funds1,2 3.29% 3.00%

(iv) Return on assets31.86% 1.78%

(v) Net profit per employee4 (` in million) 1.6 1.4

(vi) Business (average deposits plus average advances) per employee4,5 (` in million) 83.2 74.7

1. For the purpose of computing the ratio, working funds represent the monthly average of total assets computed for reporting

dates of Form X submitted to RBI under Section 27 of the Banking Regulation Act, 1949.

2. Operating profit is profit for the year before provisions and contingencies.

3. For the purpose of computing the ratio, assets represent monthly average of total assets computed for reporting dates of Form

X submitted to RBI under Section 27 of the Banking Regulation Act, 1949.

4. Computed based on average number of employees which include sales executives, employees on fixed term contracts and

interns.

5. The average deposits and the average advances represent the simple average of the figures reported in Form A to RBI under

Section 42(2) of the Reserve Bank of India Act, 1934.