ICICI Bank 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIGITALLY

EMPOWERING

THE NATION

21st Annual Report

and Accounts 2014-2015

Table of contents

-

Page 1

DIGITALLY EMPOWERING THE NATION 21st Annual Report and Accounts 2014-2015 -

Page 2

...the nation by providing digital banking services Promoting Inclusive Growth Awards Directors' Report Auditor's Certificate on Corporate Governance Business Overview Management's Discussion & Analysis Key Financial Indicators: Last Ten Years REGISTERED OFFICE Landmark Race Course Circle Vadodara 390... -

Page 3

... always been a priority for the ICICI Group. The Bank offers multiple digitally-enabled services making banking more accessible to rural citizens. In line with the Government's 'Digital India' mission, ICICI Bank has set up a model 'Digital Village' at Akodara, Gujarat. Annual Report 2014-2015 1 -

Page 4

ICICI Bank at a Glance ` 6,461 billion Assets ` 111.75 billion Profit After Tax 45.5% CASA ratio 36.8% Cost to Income Ratio Over 52 million 4,050 Branches Customers -

Page 5

...subsidiaries include India's leading private sector insurance companies and among India's largest securities brokerage, asset management and private equity companies. The Bank's presence spans 17 countries, including India. Around 50% of transactions were carried out on Internet and mobile Over 20... -

Page 6

... FY2013 432.45 FY2014 495.20 FY2015 39.31% FY2011 37.98% FY2012 FY2013 FY2014 FY2015 Current Accounts (` in billion) Savings Accounts (` in billion) Term Deposits (` in billion) Total (` in billion) Retail Domestic corporate SMEAG Overseas Total (` in billion) 4 Annual Report 2014-2015 -

Page 7

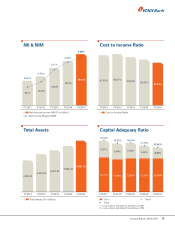

...49% 38.25% 36.83% FY2011 FY2012 FY2013 FY2014 FY2015 FY2011 FY2012 FY2013 FY2014 FY2015 Net Interest Income (NII) (` in billion) Net Income Margin (NIM) Cost to Income Ratio Total Assets Capital Adequacy Ratio 19.54% 18.52% 18.74% 17.70% 6.37% 5.94% 17.02% 5.84% 4.92% 4.24% 6,461... -

Page 8

...implementation of direct benefit transfer of the LPG subsidy through bank accounts. The focus on devolution of power and resources to states is another key step. The long-term impact of these reforms will reap rich dividends for the country and its ability to achieve and sustain high rates of growth... -

Page 9

...emergence of new technology-based businesses, driven by entrepreneurs who are capitalising on the opportunities of this new digital, mobile world. 2015 marks a major milestone for the ICICI Group, as it has completed 60 years since its founding in 1955. The ICICI Group has always partnered India in... -

Page 10

...profit after tax grew to ` 122.47 billion, and the consolidated return on equity was 15.0%. We continued to maintain a very strong capital position with a consolidated total capital adequacy ratio of 17.20% and Tier I capital adequacy ratio of 12.88%, well above regulatory requirements. Fiscal 2015... -

Page 11

...introduce payment services on Twitter. We have also invested in our corporate Internet and mobile banking platforms to improve the customer experience and to provide value-added solutions to the government sector. We continued to expand our distribution network during the year. We added 297 branches... -

Page 12

...Directors of the Bank Committee of Executive Directors Chanda Kochhar, Chairperson N. S. Kannan K. Ramkumar Rajiv Sabharwal Saurabh Singh G. Srinivas T. K. Srirang Rahul Vohra Maninder Juneja Shilpa Kumar Anita Pai Kumar Ashish Sanjay Chougule Head-Group Internal Audit 10 Annual Report 2014-2015 -

Page 13

...cards for highways & metro rail and self-service kiosks for varied banking services. We will continue to introduce and adapt new technology solutions to offer the best experience to our customers and help realise the dream of a 'Digital India'." Rajiv Sabharwal Executive Director Annual Report 2014... -

Page 14

... not customers of ICICI Bank, can instantly download the e-wallet, fund it from any bank account in the country and start transacting immediately. 'Pockets' is the only e-wallet that enables users to transact on any website or mobile application in India. It allows users to instantly send money to... -

Page 15

1st bank in India and 2nd globally to introduce transfer of funds on Twitter ICICI Bank is the first bank in India to offer its customers the facility to transfer funds on Twitter. Using 'icicibankpay', customers can pay a friend, recharge their prepaid mobile phones, check their account balance ... -

Page 16

... to the demands of the Indian urban consumer. ICICI Bank is the first bank in the country to launch contactless debit and credit cards. The 'Coral Contactless Credit Card' and 'Expressions Wave Debit Card' enable customers to make payments at stores by just waving the 14 Annual Report 2014-2015 -

Page 17

..., Internet Banking, Video Banking and Phone Banking facilities. Customers can deposit cash and cheques, transfer funds, view and print account statements, pay bills, create fixed deposits, initiate a video chat with a customer service officer and do much more. These Touch Banking branches have... -

Page 18

... in India. They need a quick, secure and hassle-free method to remit money. ICICI Bank has leveraged technology to offer a range of innovative solutions for its NRI customers. 1st bank in India to offer the facility of online paperless account opening for NRIs in the US 16 Annual Report 2014-2015 -

Page 19

... two working days to open an ICICI Bank account. Extending its popular Money2India service for online remittances, ICICI Bank launched a new remittance channel called Call2Remit. This service allows the user to contact a 24X7 customer care executive and remit money over the Annual Report 2014-2015... -

Page 20

...without having to provide additional documents. ICICI Bank's rural customers also use this biometric authentication to access banking services at microATMs using the Aadhaar Enabled Payment System (AEPS). This allows them to withdraw cash, transfer funds and check for account balance in a secure and... -

Page 21

... tendering process. ICICI Bank continues to play its role as a partner in nation building and aims to empower every citizen with best-inclass banking solutions. Over 2 million Jan-Dhan accounts as of January 31, 2015 3.7 million AEPS transactions till March 31, 2015 Annual Report 2014-2015 19 -

Page 22

...31, 2015, including over 10,000 in fiscal 2015 Women comprise 31% of the trainees 100% of the trained youth have secured job placement The new centres at Durg and Indore have been set up in partnership with the Governments of Chhattisgarh and Madhya Pradesh, respectively 20 Annual Report 2014-2015 -

Page 23

...course material for First Year of Basic School Training Certificate 35 nodal level Academic Resource Centres developed in Jaipur, Baran and Churu districts 102 school management committees have been made operational Chhattisgarh Developed a two-year Diploma in Education (D.Ed.) course under the Open... -

Page 24

...August 2014 and opened over 2.0 million accounts, which was the largest among private sector banks. It also is a leading service provider for Electronic Benefit Transfer (EBT) services and has initiated EBT payment facilities in 74 districts across 12 states. As part of its urban financial inclusion... -

Page 25

...an annual event organised by ICICI Bank in partnership with GiveIndia, a platform that allows anyone to donate to NGOs working for many different welfare causes. The objective of Daan Utsav is to help the Bank's employees and customers donate to meaningful projects. The campaign was conducted across... -

Page 26

... of Company Secretaries of India) National Awards for Corporate Governance. Awarded the 'Best Risk Management Service Provider, India' at The Asset Triple A Transaction Banking Awards 2014. Second in the category of 'Banks & Financial Institutions' in the '2015 Brand Trust Report India Study... -

Page 27

... and key financial metrics of the Bank, the Bank's capital position and requirements and the regulations pertaining to the same. Your Bank has a consistent dividend payment history. Given the financial performance for fiscal 2015 and in line with the Bank's dividend policy, your Directors are... -

Page 28

... Office and Corporate Office. As required by Accounting Standard-21 issued by the Institute of Chartered Accountants of India, the Bank's consolidated financial statements included in this Annual Report incorporate the accounts of its subsidiaries and other consolidating entities. A summary of key... -

Page 29

... write to the Company Secretary at the Registered Office of the Bank. INTERNAL CONTROL AND ITS ADEQUACY The Bank has adequate internal controls and processes in place with respect to its financial statements which provide reasonable assurance regarding the reliability of financial reporting and the... -

Page 30

... compliance with inspection and audit reports of Reserve Bank of India, other regulators and statutory auditors. The Asset Liability Management Committee is responsible for managing liquidity and interest rate risk and reviewing the asset-liability position of the Bank. 28 Annual Report 2014-2015 -

Page 31

... an opportunity for any employee/ Director of the Bank to raise any issue concerning breaches of law, accounting policies or any act resulting in financial or reputation loss and misuse of office or suspected or actual fraud. The Policy provides for a mechanism to report such concerns to the Audit... -

Page 32

.../CFO Certification In terms of Clause 49 of the Listing Agreement, the certification by the Managing Director & CEO and Chief Financial Officer on the financial statements and internal controls relating to financial reporting has been obtained. Board of Directors ICICI Bank has a broad-based Board... -

Page 33

... defaults, if any, in payment to stakeholders, valuation of undertakings or assets, evaluation of risk management systems, scrutiny of inter-corporate loans and investments. The Audit Committee is also empowered to appoint/oversee the work of any registered public Annual Report 2014-2015 31 -

Page 34

... April 25, 2014 effective close of business hours) K. V. Kamath (Chairman upto April 25, 2014 effective close of business hours) M. S. Ramachandran Number of meetings attended 5/5 5/5 5/5 Policy/Criteria for Directors' Appointment The Bank with the approval of its Board Governance, Remuneration... -

Page 35

... working of its Audit Committee, Board Governance, Remuneration & Nomination Committee, Corporate Social Responsibility Committee, Credit Committee, Customer Service Committee, Fraud Monitoring Committee, Information Technology Strategy Committee, Risk Committee, Stakeholders Relationship Committee... -

Page 36

... benefits, provident fund, superannuation fund and gratuity were provided in accordance with the scheme(s) and rule(s) applicable from time to time. In line with the staff loan policy applicable to specified grades of employees who fulfill prescribed eligibility criteria to avail loans for purchase... -

Page 37

...000 per annum. K. V. Kamath was paid a remuneration of ` 3,000,000 for the period May 1, 2014 to April 30, 2015. Information on the total sitting fees paid to each non-executive Director during fiscal 2015 for attending Meetings of the Board and its Committees is set out in the following table: Name... -

Page 38

Directors' Report b) Information relating to design and structure of remuneration processes and the key features and objectives of remuneration policy The Bank has under the guidance of the Board and the BGRNC, followed compensation practices intended to drive meritocracy within the framework of ... -

Page 39

... Financial Officer, Chief Executive Officer, Company Secretary or Manager, if any, in the financial year The percentage increase in remuneration of each wholetime Director, Chief Financial Officer, Chief Executive Officer and Company Secretary ranges between 12.0% and 15.0%. Annual Report 2014-2015... -

Page 40

... the company, price earnings ratio as at the closing date of the current financial year and previous financial year and percentage increase or decrease in the market quotations of the shares of the company in comparison to the rate at which the company came out with the last public offer in case of... -

Page 41

... Rajiv Sabharwal Chief Financial Officer Company Secretary 0.037% 0.025% 0.025% 0.023% 0.016% 0.014% (x) The key parameters for any variable component of remuneration availed by the directors The Bank's compensation policy and practices are in line with the guidelines issued by RBI in January... -

Page 42

...website of the Bank http://www.icicibank.com/managed-assets/docs/about-us/ ICICI-Bank-CSR-Policy.pdf. The Annual Report on CSR activities is annexed herewith as Annexure E. V. Credit Committee Terms of Reference The functions of the Committee include review of developments in key industrial sectors... -

Page 43

... activities of Asset Liability Management Committee. The Committee also reviews the risk profile template and key risk indicators pertaining to various risks. In addition, the Committee has oversight on risks of subsidiaries covered under the Group Risk Management Framework. Annual Report 2014-2015... -

Page 44

... the Company Secretary of the Bank and Compliance Officer for the purpose of listing agreement with stock exchanges. 112 shareholder complaints received in fiscal 2015 were processed. At March 31, 2015, no complaints were pending. Sub-division of equity shares The Board of Directors at its meeting... -

Page 45

...to equity or equity linked issues and subscription to equity shares or equity linked products or preference shares. The Committee also exercises powers in relation to borrowings and treasury operations as approved by the Board, empowers officials of the Bank and its group companies through execution... -

Page 46

... the Bank by RBI, any of the stock exchanges or SEBI for any non-compliance on any matter relating to capital markets during the last three years. 3. In terms of the Whistle Blower Policy of the Bank, no employee of the Bank has been denied access to the Audit Committee. 44 Annual Report 2014-2015 -

Page 47

... The financial results, official news releases, analyst call transcripts and presentations are also available on the Bank's website. The Management's Discussion & Analysis forms part of the Annual Report. General Shareholder Information General Body Meeting Twenty First AGM Day, Date & Time Monday... -

Page 48

...ICICI Bank has paid annual listing fees on its capital for the relevant periods to BSE and NSE where its equity shares are listed and NYSE where its ADSs are listed. Market Price Information The reported high and low closing prices and volume of equity shares of ICICI Bank traded during fiscal 2015... -

Page 49

...price & volumes have been adjusted. Additionally, proportionate American Depository Shares (ADS) were issued to maintain the ratio of one ADS to two equity shares. The performance of the ICICI Bank equity share relative to the BSE Sensitive Index (Sensex), BSE Bank Index (Bankex) and NYSE Financial... -

Page 50

... is conducted on a quarterly basis by a firm of Chartered Accountants, for the purpose of, inter alia, reconciliation of the total admitted equity share capital with the depositories and in the physical form with the total issued/paid up equity share capital of ICICI Bank. Certificates issued in... -

Page 51

... of ICICI Bank at March 31, 2015 Shareholder Category Deutsche Bank Trust Company Americas (Depositary for ADS holders) FIIs, NRIs, Foreign Banks, Foreign Companies, OCBs and Foreign Nationals Insurance Companies Bodies Corporate (including Government Companies) Banks & Financial Institutions Mutual... -

Page 52

... million equity shares) outstanding, which constituted 29.06% of ICICI Bank's total equity capital at March 31, 2015. Currently, there are no convertible debentures outstanding. Plant Locations - Not applicable Address for Correspondence P . Sanker Senior General Manager (Legal) & Company Secretary... -

Page 53

... to any employee/Director in a year is limited to 0.05% of ICICI Bank's issued equity shares at the time of the grant, and the aggregate of all such options is limited to 10% of ICICI Bank's issued equity shares on the date of the grant (equivalent to 579.86 million shares of face value ` 2 each at... -

Page 54

... wholetime Directors of ICICI Bank being subject to RBI approval). Each option confers on the employee a right to apply for one equity share of face value of ` 2 of ICICI Bank at ` 308.25 which was closing price on the stock exchange which recorded the highest trading volume in ICICI Bank shares on... -

Page 55

... Limited/Central Depository Services (India) Limited. The Companies Act, 2013 and the underlying rules as well as Clause 32 of the Listing Agreement permit the dissemination of financial statements in electronic mode to the shareholders. Your Directors are thankful to the shareholders for actively... -

Page 56

... consolidated entities Indian ICICI Equity Fund I-Ven Biotech Limited ICICI Strategic Investments Fund Foreign NIL Minority interests Associates Indian Fino Pay Tech Limited I-Process Services (India) Private Limited NIIT Institute of Finance Banking and Insurance Training Limited ICICI Merchant... -

Page 57

...minute books, forms and returns filed and other records made available to us and maintained by ICICI Bank Limited for the financial year ended on March 31, 2015 according to the provisions of: i. ii. The Companies Act, 2013 (the Act) and the rules made thereunder; The Securities Contract (Regulation... -

Page 58

... 1 share of face value ` 10/- each were sub-divided into 5 shares of face value ` 2/- each were approved by the shareholders through postal ballot in November 2014 and the shares were sub-divided effective December 5, 2014. The Bank concluded the sale of ICICI Bank Eurasia Limited Liability Company... -

Page 59

... of financial records and Books of Accounts of the Company. Wherever required, we have obtained the Management representation about the Compliance of laws, rules and regulations and happening of events etc. The Compliance of the provisions of Corporate and other applicable laws, rules, regulations... -

Page 60

... 1 year - - At market price At market price Purchase of bank guarantee issued to a customer by ICICI Bank UK PLC Purchase of a loan given to a customer at market comparative rate Funded risk participation in underlying loans given to customers by ICICI Bank UK PLC at market competitive rates 600... -

Page 61

...20 years 613.5 Associate Associate Associate Others Subsidiary 1 year - - - - 2,362.7 1,927.5 859.6 20,120.1 942.1 17. 18. Interest expenses Interest income Life Insurance Corporation of India ICICI Home Finance Company Limited May 22, 2015 K. V. Kamath Chairman Annual Report 2014-2015 59 -

Page 62

Directors' Report ANNEXURE D FORM NO. MGT-9 Extract of Annual Return as on the financial year ended on March 31, 2015 [Pursuant to section 92(3) of the Companies Act, 2013 and rule 12(1) of the Companies (Management and Administration) Rules, 2014] I. REGISTRATION AND OTHER DETAILS CIN Registration... -

Page 63

...1YN ICICI Home Finance Company Limited Registered Office: ICICI Bank Towers Bandra-Kurla Complex Mumbai 400 051 ICICI International Limited, Mauritius Registered Office: IFS Court Twenty Eight, Cybercity Ebene Mauritius ICICI Investment Management Company Limited Registered Office: ICICI Bank Towers... -

Page 64

... Road New Delhi 110 001 ICICI Prudential Pension Funds Management Company Limited Registered Office: ICICI Prulife Towers 1089, Appasaheb Marathe Marg Prabhadevi Mumbai 400 025 India Infradebt Limited Registered Office: ICICI Bank Towers Bandra-Kurla Complex Mumbai 400 051 FlNO PayTech Limited Shree... -

Page 65

... has been mentioned for Indian subsidiaries/Associate Companies. # These companies are not considered as associates in the financial statements, in accordance with the provisions of AS 23 on 'Accounting for Investments in Associates in Consolidated Financial Statements'. Annual Report 2014-2015 63 -

Page 66

Directors' Report IV. SHAREHOLDING PATTERN (Equity Share Capital Break-up as percentage of Total Equity) i. Sl No. A (1) Category-wise Shareholding Category of shareholders No. of Shares held at the beginning of the year (April 1, 2014) Demat Promoters Indian a) Individual/HUF 0 b) Central Govt 0 ... -

Page 67

... five equity shares having a face value of ` 2 each through postal ballot on November 20, 2014. The record date for sub-division was December 5, 2014. The number of shares and per share information for the period prior to December 5, 2014 reflects the effect of sub-division. Annual Report 2014-2015... -

Page 68

Directors' Report (v) Shareholding of Directors and Key Managerial Personnel Sl. Name of the Director No. 1. K. V. Kamath At the beginning of the year June 18, 2014 Sale June 19, 2014 Sale November 3, 2014 Sale November 5, 2014 Sale At the end of the year Dileep Choksi At the beginning of the year ... -

Page 69

... Sale August 5, 2014 Sale August 18, 2014 Sale September 8, 2014 Allotment November 3, 2014 Sale At the end of the year Shareholding at the beginning of the year (reflects effect of sub-division) No of shares 0 210,000 (75,000) (40,280) (94,720) 300,000 (300,000) 0 % of total shares of the company... -

Page 70

... 5, 2014 Sale At the end of the year Note: The cumulative shareholding column reflects the balance as on day end. V. INDEBTEDNESS Indebtedness of the Company including interest outstanding/accrued but not due for payment ` in Crores Secured Loans excluding deposits Unsecured Loans Deposits Total... -

Page 71

... in lieu of salary under section 17(3) of the Income-tax Act, 1961 Stock Option (Perquisite on stock options exercised in fiscal 2015, w.r.t. options granted upto 10 years prior to date of exercise) Sweat Equity Commission (as % of Profit/Others) Others (A)+(B)+(C) Total remuneration paid in fiscal... -

Page 72

... entitled to reimbursement of expenses for attending Board/Committee Meetings. Note 3: Being a Banking Company, the provisions of Banking Regulation Act, 1949 apply to the Bank and any payments to Non-Executive/ Independent Directors other than sitting fees can be paid only with the approval of RBI... -

Page 73

... has developed significant projects in specific areas, and has built capabilities for direct project implementation as opposed to extending financial support to other organisations. The CSR Policy of the Bank sets the framework guiding the Bank's CSR activities. It outlines the governance structure... -

Page 74

...5 UP 38 Uttarakhand 1 West Bengal 5 412.8 260.0 Amount spent through ICICI Foundation for Inclusive Growth. The Foundation was set up in 2008 to focus on activities in the area of CSR. 1,300.0 1,137.7 1,137.7 Direct & through Bank's business correspondent network. 72 Annual Report 2014-2015 -

Page 75

... branches At multiple centres 32.3 28.9 28.9 1. Indian Institute of Management, Ahmedabad towards endowing a chair for research in finance and banking and enhancing the endowment fund created for awarding teaching excellence. 2. Teach to Lead in Mumbai to support their Teach for India fellowship... -

Page 76

...the company. The CSR Committee hereby confirms that the implementation and monitoring of CSR activities is in compliance with CSR objectives and the CSR Policy of the company. Chanda Kochhar Managing Director & CEO May 13, 2015 M. S. Ramachandran CSR Committee Chairman 74 Annual Report 2014-2015 -

Page 77

... of conditions of corporate governance by ICICI Bank Limited ('the Bank') for the year ended 31 March 2015, as stipulated in Clause 49 of the Listing Agreement of the Bank with The Bombay Stock Exchange Limited ('BSE') and The National Stock Exchange of India Limited ('NSE') (together referred to... -

Page 78

... their account balance, view their last three transactions and recharge prepaid mobiles in a completely secure manner. The Bank launched the country's first 'contactless' debit and credit cards, enabling its customers to make electronic payments by just waving the card close to the merchant terminal... -

Page 79

... through customised financial solutions for enabling business in India and key overseas geographies. The group specialises in analyzing business and financial requirements of its clients and providing solutions through various products, such as working capital finance, Annual Report 2014-2015 77 -

Page 80

...works closely with other specialised teams like Commercial Banking, Loan Syndication, Project Finance, Structured Finance and the Markets Group to develop suitable products and devise solutions that fulfill specific needs of clients. The Commercial Banking Group provides support in terms of managing... -

Page 81

... a combination of customer friendly products, cutting-edge technology and customised service offerings that meet the requirements of the widely dispersed NRI diaspora. In fiscal 2015, the Bank introduced a new account opening process which greatly reduced the time taken to open accounts and also... -

Page 82

... treasury operations at ICICI Bank comprises the Proprietary Trading Group, Markets Group and Asset Liability Management Group. The Proprietary Trading Group manages investments within risk limits as approved by the investment policy of the Bank. The Bank is also a leading arranger for debt private... -

Page 83

... Business Intelligence Unit to provide support for analytics, score card development and database management. The credit officers evaluate retail credit proposals on the basis of the product policy vetted by the Credit Risk Management Group and approved by the Committee of Executive Directors. These... -

Page 84

... in case of policy based retail products to approve financial assistance within the exposure limits set by our Board of Directors. Market Risk Market risk is the risk whereby movements in market factors such as foreign exchange rates, interest rates, credit spreads and equity prices reduce the Bank... -

Page 85

... the Board of Directors. The Policy is applicable across the Bank including overseas branches, ensuring a clear accountability and responsibility for management and mitigation of operational risk, developing a common understanding of operational risk and helping the business and operation groups to... -

Page 86

... customers effectively. The Bank has deployed games and simulation based trainings to develop service and transaction processing skills in employees. Since the last few years, the Bank has implemented several real-time performance support tools for employees through the launch of 'Business Companion... -

Page 87

..., credit card and public provident fund account transactions on their mobile phone; Video Banking: It enables the Bank's Wealth and NRI customers to carry out a video chat with a customer-care executive; iTrack: It lets customers know the status of deliverables including cheque book, debit card/ATM... -

Page 88

... Technology Bank of the Year'. KEY SUBSIDIARIES ICICI Prudential Life Insurance Company (ICICI Life) lClCl Life enhanced its leadership among private players in terms of new business premium on a retail weighted basis, achieving a market share of over 11% in fiscal 2015. lClCl Life's total premium... -

Page 89

... fiscal 2015, ICICI Bank Canada repatriated CAD 80 million of equity capital to ICICI Bank. CREDIT RATING ICICI Bank's credit ratings by various agencies at March 31, 2015 are given below: Rating Agency ICRA Limited Credit Analysis & Research Limited (CARE) CRISIL Limited Moody's Investors Service... -

Page 90

... and interest rates came down during the year. The corporate investment cycle continued to remain subdued; the focus remained on working towards cashflow generation from existing projects and addressing profitability and liquidity challenges in the corporate and SME sectors. The government has taken... -

Page 91

... customer, required to invest 75.0% of deposits in government securities of up to one year maturity and are allowed to sell credit products of other banks as business correspondents. Small finance banks can provide all basic banking products with at least 50.0% of their portfolio constituting loans... -

Page 92

...payment penalties on floating rate term loans. Banks were also directed not to levy penal charges for non-maintenance of minimum balance in non-operative accounts; In May 2014, RBI allowed banks to include the outstanding mandated investments in government funds like Rural Infrastructure Development... -

Page 93

...the project loan; In August 2014, RBI issued guidelines allowing banks to fund project cost overruns arising on account of extension of the date of commencement of commercial operations, without treating them as restructured assets. According to the guidelines, such funding would be allowed provided... -

Page 94

... base is defined as the Tier 1 capital of the bank as against the current norm of capital funds; In March 2015, the Parliament approved amendments to legislation governing the insurance sector, which, inter alia, raised the foreign shareholding limit in insurance companies from 26% to 49%, while... -

Page 95

...total capital adequacy ratio of the Bank at March 31, 2015 in accordance with RBI guidelines on Basel III was 17.02% with a Tier-1 capital adequacy ratio of 12.78% as compared to 17.70% at March 31, 2014 with a Tier-1 capital adequacy ratio of 12.78%. Operating results data The following table sets... -

Page 96

...Discussion & Analysis Key ratios The following table sets forth, for the periods indicated, the key financial ratios. Particulars Return on average equity (%)1 Return on average assets (%)2 Earnings per share (`)3 Book value per share (`) Fee to income (%) Cost to income (%)4 1. 2. 3. Fiscal 2014 13... -

Page 97

...Cost of interest-bearing liabilities - Cost of deposits - Current and savings account (CASA) deposits - Term deposits - Cost of borrowings Interest spread Net interest margin The yield on average interest-earning assets increased by 4 basis points from 8.92% in fiscal 2014 to 8.96% in fiscal 2015... -

Page 98

... investments in corporate bonds & debentures, certificates of deposits, commercial paper, RIDF & related investments and investments in liquid mutual funds. Average interest-bearing liabilities increased by 9.1% from ` 4,462.54 billion in fiscal 2014 to ` 4,870.63 billion in fiscal 2015 on account... -

Page 99

...of investments on account of changes in unrealised profit/(loss) in the fixed income, equity and preference share portfolio, units of venture funds and security receipts issued by asset reconstruction companies. Profit from treasury-related activities increased from ` 10.17 billion in fiscal 2014 to... -

Page 100

... Bank on standard, sub-standard and doubtful assets at rates prescribed by RBI. Loss assets and the unsecured portion of doubtful assets are provided for/written off as required by RBI guidelines. For loans and advances of overseas branches, provisions are made as per RBI regulations or host country... -

Page 101

... 2015. The effective tax rate decreased from 29.8% in fiscal 2014 to 29.4% in fiscal 2015. Financial condition Assets The following table sets forth, at the dates indicated, the principal components of assets. ` in billion, except percentages Assets Cash and bank balances Investments - Government... -

Page 102

...current account deposits increased by 14.5% from ` 432.45 billion at March 31, 2014 to ` 495.20 billion at March 31, 2015. At March 31, 2015, deposits constituted 67.8% of the funding (i.e., deposits and borrowings, other than preference share capital). Deposits of overseas branches, in dollar terms... -

Page 103

...results in generation of a higher number of outstanding transactions, and hence a large value of gross notional principal of the portfolio, while the net market risk is lower. As a part of project financing and commercial banking activities, the Bank has issued guarantees to support regular business... -

Page 104

... of rating agencies, shareholders and investors and the available options for raising capital. The capital management framework of the Bank is administered by the Finance Group and the Risk Management Group under the supervision of the Board and the Risk Committee. The capital adequacy position and... -

Page 105

... charge is computed based on 15% of average of previous three financial years' gross income and is revised on an annual basis at June 30. Internal assessment of capital The capital management framework of the Bank includes a comprehensive internal capital adequacy assessment process conducted... -

Page 106

... table sets forth, at the dates indicated, the composition of the Bank's gross (net of write-offs) outstanding retail finance portfolio. ` in billion, except percentages March 31, 2014 Total retail advances Home loans Automobile loans Commercial business Business banking1 Personal loans Credit cards... -

Page 107

... for loans extended in India against incremental FCNR (B)/NRE deposits from the date of July 26, 2013 and outstanding as on March 7, 2014. Priority sector includes lending to agricultural sector, food and agri-based industries, small enterprises/businesses and housing finance up to certain limits... -

Page 108

... preference shares. All amounts have been rounded off to the nearest ` 10.0 million. The following table sets forth, at the dates indicated, information regarding the Bank's non-performing assets (NPAs). ` in billion, except percentages Year ended March 31, 2013 March 31, 2014 March 31, 2015... -

Page 109

... liabilities are transfer priced to a central treasury unit, which pools all funds and lends to the business units at appropriate rates based on the relevant maturity of assets being funded after adjusting for regulatory reserve requirement and directed lending requirements. Annual Report 2014-2015... -

Page 110

...ICICI Prudential Asset Management Company Limited, offset, in part, by decrease in profit of ICICI Bank Canada and ICICI Bank UK PLC. The consolidated return on average equity increased from 14.91% in fiscal 2014 to 14.99% in fiscal 2015. At March 31, 2015, consolidated Tier-1 capital adequacy ratio... -

Page 111

... Management Company Limited increased from ` 1.83 billion in fiscal 2014 to ` 2.47 billion in fiscal 2015 primarily due to increase in fee income on account of increase in average assets under management, change in mix in favor of equity mutual funds and increase in margins on mutual fund operations... -

Page 112

...2012 2013 2014 Total deposits Annual Report 2014-2015 Total advances Equity capital & reserves Total assets Total capital adequacy ratio Net interest income Net interest margin Profit after tax Earnings per share (Basic)3 Earnings per share (Diluted)3 Return on average equity Dividend... -

Page 113

... of ICICI Bank Limited REPORT ON THE STANDALONE FINANCIAL STATEMENTS 1. We have audited the accompanying standalone financial statements of ICICI Bank Limited ('the Bank'), which comprise the Balance Sheet as at 31 March 2015, the Profit and Loss Account, the Cash Flow Statement for the year then... -

Page 114

... dealt with by us in preparing this report. (iv) the Balance Sheet, the Profit and Loss Account and the Cash Flow Statement dealt with by this report are in agreement with the books of account and with the returns received from the foreign branches not visited by us; 112 Annual Report 2014-2015 -

Page 115

... in transferring amounts, required to be transferred, to the Investor Education and Protection Fund by the Bank. For B S R & Co. LLP Chartered Accountants Firm's Registration No: 101248W/W-100022 Venkataramanan Vishwanath Partner Membership No: 113156 Mumbai 27 April 2015 Annual Report 2014-2015... -

Page 116

Financial Statements of ICICI Bank Limited Balance Sheet at March 31, 2015 ` in '000s Schedule At 31.03.2015 At 31.03.2014 CAPITAL AND LIABILITIES Capital Employees stock options outstanding Reserves and surplus Deposits Borrowings Other liabilities and provisions TOTAL CAPITAL AND LIABILITIES 2 3... -

Page 117

Financial Statements of ICICI Bank Limited Profit and Loss Account for the year ended March 31, 2015 ` in '000s Schedule Year ended 31.03.2015 490,911,399 121,761,305 612,672,704 Year ended 31.03.2014 441,781,528 104,278,721 546,060,249 I. INCOME Interest earned Other income TOTAL INCOME 13 14 ... -

Page 118

... Kochhar Managing Director & CEO (C) (D) N. S. Kannan Executive Director P . Sanker Senior General Manager (Legal) & Company Secretary K. Ramkumar Executive Director Rakesh Jha Chief Financial Officer Rajiv Sabharwal Executive Director Ajay Mittal Chief Accountant 116 Annual Report 2014-2015 -

Page 119

...equity shares having a face value of ` 2 each through postal ballot on November 20, 2014. The record date for the sub-division was December 5, 2014. All shares and per share information in the financial results reflect the effect of sub-division for each of the periods presented. Annual Report 2014... -

Page 120

Financial Statements of ICICI Bank Limited Schedules forming part of the Balance Sheet (Contd.) ` in '000s At 31.03.2015 At 31.03.2014 SCHEDULE 2 - RESERVES AND SURPLUS I. Statutory reserve Opening balance Additions during the year Deductions during the year Closing balance 135,266,519 27,939,000 ... -

Page 121

Financial Statements of ICICI Bank Limited Schedules forming part of the Balance Sheet (Contd.) 3. 4. 5. Represents exchange profit on repatriation of retained earnings from overseas branches. Includes appropriations made to Reserve Fund and Investment Fund Account for the year ended March 31, 2014... -

Page 122

Financial Statements of ICICI Bank Limited Schedules forming part of the Balance Sheet (Contd.) ` in '000s At 31.03.2015 At 31.03.2014 SCHEDULE 4 - BORROWINGS I. Borrowings in India i) ii) iii) Reserve Bank of India Other banks Other institutions and agencies a) Government of India b) Financial ... -

Page 123

Financial Statements of ICICI Bank Limited Schedules forming part of the Balance Sheet (Contd.) ` in '000s At 31.03.2015 At 31.03.2014 48,448,212 - 38,695,810 45,130,364 19,317,632 195,963,436 347,555,454 SCHEDULE 5 - OTHER LIABILITIES AND PROVISIONS I. Bills payable II. Inter-office adjustments (... -

Page 124

Financial Statements of ICICI Bank Limited Schedules forming part of the Balance Sheet (Contd.) ` in '000s At 31.03.2015 At 31.03.2014 SCHEDULE 8 - INVESTMENTS I. Investments in India [net of provisions] i) ii) iii) iv) v) vi) Government securities Other approved securities Shares (includes equity... -

Page 125

Financial Statements of ICICI Bank Limited Schedules forming part of the Balance Sheet (Contd.) ` in '000s At 31.03.2015 At 31.03.2014 83,655,926 552,132,982 2,751,237,584 3,387,026,492 2,858,197,549 41,650,261 487,178,682 3,387,026,492 645,... -

Page 126

Financial Statements of ICICI Bank Limited Schedules forming part of the Balance Sheet (Contd.) ` in '000s At 31.03.2015 At 31.03.2014 1,816,918 47,159,107 39,263,411 2,995 671,126 936,223 11,123,670 7,468,610 218,651,805 327,093,866 SCHEDULE 11 - OTHER ASSETS I. Inter-office adjustments (net) II.... -

Page 127

Financial Statements of ICICI Bank Limited Schedules forming part of ofthe theBalance Profit and Loss Account Sheet (Contd.) Year ended 31.03.2015 ` in '000s Year ended 31.03.2014 314,279,281 115,570,556 1,999,808 9,931,883 441,781,528 SCHEDULE 13 - INTEREST EARNED I. Interest/discount on advances... -

Page 128

...in Vadodara, India is a publicly held banking company engaged in providing a wide range of banking and financial services including commercial banking and treasury operations. ICICI Bank is a banking company governed by the Banking Regulation Act, 1949. The Bank also has overseas branches in Bahrain... -

Page 129

... RBI guidelines. 4. 5. 6. Treasury bills, commercial papers and certificate of deposits being discounted instruments, are valued at carrying cost. Costs including brokerage and commission pertaining to investments, paid at the time of acquisition, are charged to the profit and loss account. Cost of... -

Page 130

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) 10. At the end of each reporting period, security receipts issued by the asset reconstruction companies are valued in accordance with the guidelines applicable to such instruments, prescribed by RBI from time... -

Page 131

...the date of purchase. c) Assets at residences of Bank's employees are depreciated over the estimated useful life of 5 years. d) In case of revalued/impaired assets, depreciation is provided over the remaining useful life of the assets with reference to revised asset values. Annual Report 2014-2015... -

Page 132

... currency assets and liabilities of domestic and integral foreign operations are translated at closing exchange rates notified by Foreign Exchange Dealers' Association of India (FEDAI) relevant to the balance sheet date and the resulting gains/losses are included in the profit and loss account. Both... -

Page 133

... ICICI Bank Limited Schedules forming part of the Accounts (Contd.) 9. Employee Benefits Gratuity The Bank pays gratuity, a defined benefit plan, to employees who retire or resign after a minimum prescribed period of continuous service and in case of employees at overseas locations as per the rules... -

Page 134

... income for the current year, and carry forward losses. Deferred tax assets and liabilities are measured using tax rates and tax laws that have been enacted or substantively enacted at the balance sheet date. The impact of changes in deferred tax assets and liabilities is recognised in the profit... -

Page 135

... 31, 2014 8.00% 1.89% 3.00% 1.78% 1.4 74.7 For the purpose of computing the ratio, working funds represent the monthly average of total assets computed for reporting dates of Form X submitted to RBI under Section 27 of the Banking Regulation Act, 1949. Operating profit is profit for the year before... -

Page 136

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) 3. Capital adequacy ratio The Bank is subject to the Basel III capital adequacy guidelines stipulated by RBI with effect from April 1, 2013. The guidelines provide a transition schedule for Basel III ... -

Page 137

...Liquidity of the Bank is managed by the Asset Liability Management Group (ALMG) under the central oversight of the Asset Liability Management Committee (ALCO). For the domestic operations of the Bank, ALMG-India is responsible for the overall management of liquidity. For the overseas branches of the... -

Page 138

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) Based on the above, monthly average LCR of the Bank for the three months ended March 31, 2015 was 101.45%. It may be noted that during the three months ended on March 31, 2015, other than Indian Rupee, USD ... -

Page 139

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) ` in million For the year ended March 31, 2014 Particulars 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 1. 2. Revenue Less: Inter-segment revenue Total revenue (1)-(2) Segment results Unallocated expenses Operating... -

Page 140

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) The following table sets forth, for the periods indicated, capital expenditure and depreciation thereon for the geographical segments. ` in million Capital expenditure incurred during Year ended March 31, ... -

Page 141

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) 7. Preference shares Certain government securities amounting to ` 3,088.6 million at March 31, 2015 (March 31, 2014: ` 2,970.9 million) have been earmarked against redemption of preference shares issued by ... -

Page 142

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) The following table sets forth, for the periods indicated, the summary of the status of the Bank's stock option plan. ` except number of options Stock options outstanding Year ended March 31, 2015 Year ended ... -

Page 143

... Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) ` in million Minimum Maximum Daily average outstanding outstanding outstanding balance during the balance during the balance during the Year ended March 31, 2014 Securities sold under Repo and LAF i) Government... -

Page 144

... Bank Limited Schedules forming part of the Accounts (Contd.) 3. 4. Excludes investments, amounting to ` 4,396.9 million in preference shares of subsidiaries and ` 2,465.0 million in subordinated bonds of subsidiary ICICI Bank Canada. Excludes equity shares, units of equity-oriented mutual fund... -

Page 145

...by banks at the beginning of the accounting year, sale to RBI under pre-announced Open Market Operation auctions and repurchase of Government securities by Government of India) had exceeded 5% of the book value of the investments held in HTM category at the beginning of the year. The market value of... -

Page 146

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) The following table sets forth, for the period indicated, the details of derivative positions. ` in million At March 31, 2015 Particulars Currency derivatives1 23,695.3 1,027,190.7 43,892.8 (43,608.8) 99,796... -

Page 147

... at March 31, 2015 (March 31, 2014: Nil). The Bank offers deposits to customers of its offshore branches with structured returns linked to interest, forex, credit or equity benchmarks. The Bank covers these exposures in the inter-bank market. At March 31, 2015, the net open notional position on this... -

Page 148

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) 16. Exchange traded interest rate derivatives and currency options Exchange traded interest rate derivatives The following table sets forth, for the periods indicated, the details of exchange traded interest ... -

Page 149

...Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) An IRS is a financial contract between two parties exchanging or swapping a stream of interest payments for a 'notional principal' amount on multiple occasions during a specified period. The Bank deals in interest rate... -

Page 150

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) Trading Benchmark SGD SOR CAD CDOR CAD CDOR CHF LIBOR CHF LIBOR CHF LIBOR GBP LIBOR GBP LIBOR USD LIBOR v/s EURIBOR Total Type Floating receivable v/s fixed payable Floating receivable v/s fixed payable Fixed... -

Page 151

... Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) 18. Non-Performing Assets The following table sets forth, for the periods indicated, the details of movement of gross non-performing assets (NPAs), net NPAs and provisions. ` in million Particulars At March 31, 2015... -

Page 152

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) 19. Provision on standard assets Standard assets provision amounting to ` 3,847.9 million was made during the year ended March 31, 2015 (March 31, 2014: ` 2,487.7 million) as per applicable RBI guidelines. ... -

Page 153

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) The following table sets forth, for the periods indicated, the details of provision for securitisation and direct assignment transactions. ` in million Particulars Opening balance Additions during the year ... -

Page 154

... Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) 22. Financial assets transferred during the year to securitisation company (SC)/reconstruction company (RC) The Bank has transferred certain assets to Asset Reconstruction Companies (ARCs) in terms of the guidelines... -

Page 155

... of restructured accounts is due to utilisation of cash credit facility, exchange rate fluctuation, accrued interest, fresh disbursement, non-fund based development, conversion of loans into equity (including application money pending allotment) as part of restructuring scheme, etc. Insignificant... -

Page 156

... of restructured accounts is due to utilisation of cash credit facility, exchange rate fluctuation, accrued interest, fresh disbursement, non-fund based development, conversion of loans into equity (including application money pending allotment) as part of restructuring scheme, etc. "Others... -

Page 157

The following tables set forth, for the year ended March 31, 2014 details of loan assets subjected to restructuring. ` in million, except number of accounts Under CDR Mechanism Under SME Debt Restructuring Mechanism Type of Restructuring Standard Doubtful (c) 9 3,201.2 2,064.6 44 43,892.7 6,505.6 ... -

Page 158

Schedules Financial Statements of ICICI Bank Limited 156 ` in million, except number of accounts Others Total Type of Restructuring Standard Doubtful (c) 283 5,650.6 3,738.0 435 25,321.3 4,818.6 727 23,992.6 2,200.9 - (4.3) (67.8) 54 153.5 4.8 (2) (2.4) (0.4) (52) (134.2) (95.4) - - - 745 62,310... -

Page 159

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) 25. Provision on Funded Interest Term Loan In 2008, RBI issued guidelines on debt restructuring, which also covered the treatment of funded interest in cases of debt restructuring, that is, instances where ... -

Page 160

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) (II) Sector-wise Advances ` in million except percentages At March 31, 2015 Sr. Sector no. Outstanding advances Gross NPAs % of gross NPAs to total advances in that sector 2.97% 3.20% 1.66% 2.07% 3.37% 1.27% ... -

Page 161

... total assets and total revenue of foreign operations as reported in Schedule 18 of the financial statements, note no. 5 on information about business and geographical segments. (IV) Off-balance sheet special purpose vehicles (SPVs) sponsored (which are required to be consolidated as per accounting... -

Page 162

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) (b) The following table sets forth, the names of SPVs/trusts which are not sponsored by the Bank/subsidiaries and are consolidated. Sr. no. A B Name of the SPV Domestic None Overseas None 28. Intra group ... -

Page 163

..., corporate loans for development of special economic zone, loans to borrowers where servicing of loans is from a real estate activity and exposures to mutual funds/venture capital funds/private equity funds investing primarily in the real estate companies. Excludes non-banking assets acquired... -

Page 164

... course of business. The Bank offers these products to its options and interest rate customers to enable them to transfer, modify or reduce their foreign exchange and interest futures rate risks. The Bank also undertakes these contracts to manage its own interest rate and foreign exchange positions... -

Page 165

... (gain)/loss Effect of the limit in para 59(b) of AS-15 on 'employee benefits' Net cost Actual return on plan assets Expected employer's contribution next year Investment details of plan assets Insurer managed funds2 Government of India securities Corporate bonds Others Year ended March 31, 2015 10... -

Page 166

... rate of return on plan assets 1. 2. Year ended March 31, 2015 8.00% 1.50% 7.00% 8.00% Year ended March 31, 2014 9.25% 1.50% 7.00% 8.00% Included in line item payments to and provision for employees of Schedule-16 Operating expenses. Majority of the funds are invested in Government of India... -

Page 167

... loss/(gain) Effect of the limit in para 59(b) of AS15 on 'employee benefits' Net cost Actual return on plan assets Expected employer's contribution next year Investment details of plan assets Insurer managed funds Government of India securities Corporate bonds Special deposit schemes Equity... -

Page 168

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) Provident Fund (PF) As there is no liability towards interest rate guarantee on exempt provident fund on the basis of actuarial valuation, the Bank has not made any provision for the year ended March 31, 2015... -

Page 169

... scheme under Employees Provident Fund and Miscellaneous Provisions Act, 1952. Superannuation Fund Bank has contributed ` 110.7 million for the year ended March 31, 2015 (March 31, 2014: ` 118.1 million) to superannuation fund. 37. Movement in provision for credit card/debit card/savings account... -

Page 170

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) The Bank has assessed its obligations arising in the normal course of business, including pending litigations, proceedings pending with tax authorities and other contracts including derivative and long term ... -

Page 171

... Funds Management Company Limited. Associates/joint ventures/other related entities ICICI Equity Fund1, ICICI Strategic Investments Fund1, FINO PayTech Limited, I-Process Services (India) Private Limited, NIIT Institute of Finance, Banking and Insurance Training Limited, Comm Trade Services Limited... -

Page 172

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) During the year ended March 31, 2015, the Bank's insurance claims (including the claims received by the Bank on behalf of key management personnel) from the insurance subsidiaries amounted to ` 245.0 million ... -

Page 173

... ICICI Bank Canada on account of buyback of equity shares by ICICI Bank Canada. During the year ended March 31, 2015, the Bank received ` 118.0 million (March 31, 2014: NA) from India Advantage Fund-III, ` 74.4 million (March 31, 2014: Nil) from ICICI Equity Fund and ` 21.6 million (March 31, 2014... -

Page 174

...ICICI Securities Primary Dealership Limited amounting to ` 1,590.8 million (March 31, 2014: ` 179.8 million) and with ICICI Bank Canada amounting to ` 1,249.0 million (March 31, 2014: ` 2,859.5 million). Dividend paid During the year ended March 31, 2015, the Bank paid dividend to its key management... -

Page 175

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) Sale of fixed assets During the year ended March 31, 2015, the Bank sold fixed assets to its subsidiaries amounting to ` 0.7 million (March 31, 2014: ` 2.6 million) and to its associates/joint ventures/other ... -

Page 176

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) During the year ended March 31, 2015, an undertaking furnished on behalf of ICICI Bank Eurasia Limited Liability Company for an amount of USD 19.0 million, had expired on account of repayment of its loan. In ... -

Page 177

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) The following table sets forth, the maximum balance payable to/receivable from subsidiaries/joint ventures/associates/ other related entities/key management personnel and relatives of key management personnel... -

Page 178

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) The following table sets forth, the maximum balance payable to/receivable from subsidiaries/joint ventures/associates/ other related entities/key management personnel and relatives of key management personnel... -

Page 179

... recommendation of grant of the Bank's stock options to employees and Whole Time Directors of the Bank and its subsidiary companies. b) Information relating to design and structure of remuneration processes and the key features and objectives of remuneration policy The Bank has under the guidance of... -

Page 180

... provident fund and gratuity fund by the Bank. Variable pay for the year ended March 31, 2015 was awarded in the month of April 2015 and is subject to approval from RBI. In line with the Bank's compensation policy, the stipulated percentage of performance bonus is deferred. 178 Annual Report 2014... -

Page 181

Financial Statements of ICICI Bank Limited Schedules forming part of the Accounts (Contd.) 47. Disclosure of customers complaints The following table sets forth, for the periods indicated, the movement of the outstanding number of complaints. Complaints relating to Bank's customers on Bank's ATMs ... -

Page 182

... N. S. Kannan Executive Director K. Ramkumar Executive Director Rajiv Sabharwal Executive Director Place : Mumbai Date : April 27, 2015 P . Sanker Senior General Manager (Legal) & Company Secretary Rakesh Jha Chief Financial Officer Ajay Mittal Chief Accountant 180 Annual Report 2014-2015 -

Page 183

...Companies (Accounts) Rules, 2014 and provisions of Section 29 of the Banking Regulation Act, 1949 and the RBI's circulars/guidelines/direction): i) ii) in the case of Consolidated Balance Sheet, of the state of affairs of the Group as at 31 March 2015; in the case of the Consolidated Profit and Loss... -

Page 184

... to note 14 to the consolidated financial statements, which provides details with regard to the creation of provision relating to Funded Interest Term Loan through utilization of reserves, as permitted by the Reserve Bank of India vide letter dated 6 January 2015. Our opinion is not modified... -

Page 185

... in transferring amounts, required to be transferred, to the Investor Education and Protection Fund by the Bank. For B S R & Co. LLP Chartered Accountants Firm's Registration No: 101248W/W-100022 Venkataramanan Vishwanath Partner Membership No: 113156 Mumbai 27 April 2015 Annual Report 2014-2015... -

Page 186

... N. S. Kannan Executive Director K. Ramkumar Executive Director Rajiv Sabharwal Executive Director Place : Mumbai Date : April 27, 2015 P . Sanker Senior General Manager (Legal) & Company Secretary Rakesh Jha Chief Financial Officer Ajay Mittal Chief Accountant 184 Annual Report 2014-2015 -

Page 187

... Profit and Loss Account forming for the year part ended of the Consolidated March 31, 2015 Balance Sheet (Contd.) ` in '000s Schedule Year ended 31.03.2015 549,639,961 352,522,357 902,162,318 Year ended 31.03.2014 494,792,476 300,846,072 795,638,548 I. INCOME Interest earned Other income TOTAL... -

Page 188

... Kochhar Managing Director & CEO (C) (D) N. S. Kannan Executive Director P . Sanker Senior General Manager (Legal) & Company Secretary K. Ramkumar Executive Director Rakesh Jha Chief Financial Officer Rajiv Sabharwal Executive Director Ajay Mittal Chief Accountant 186 Annual Report 2014-2015 -

Page 189

...equity shares having a face value of ` 2 each through postal ballot on November 20, 2014. The record date for the sub-division was December 5, 2014. All shares and per share information in the financial results reflect the effect of sub-division for each of the periods presented. Annual Report 2014... -

Page 190

Consolidated Financial Statements Schedules forming part of the Consolidated Balance Sheet (Contd.) ` in '000s At 31.03.2015 At 31.03.2014 SCHEDULE 2 - RESERVES AND SURPLUS I. Statutory reserve Opening balance Additions during the year Deductions during the year Closing balance 135,266,519 27,939,... -

Page 191

... tax liability of ICICI Home Finance Company Limited on balance in Special Reserve at March 31, 2014 in accordance with National Housing Board circular dated May 27, 2014. 10. At March 31, 2015, includes ` 9,291.6 million utilised with approval of RBI to provide for outstanding Funded Interest Term... -

Page 192

Consolidated Financial Statements Schedules forming part of the Consolidated Balance Sheet (Contd.) ` in '000s At 31.03.2015 At 31.03.2014 SCHEDULE 4 - BORROWINGS I. Borrowings in India i) ii) iii) Reserve Bank of India Other banks Other institutions and agencies a) Government of India b) ... -

Page 193

... accounts ii) Money at call and short notice a) With banks b) With other institutions TOTAL II. Outside India In current accounts In other deposit accounts Money at call and short notice i) ii) iii) TOTAL TOTAL BALANCES WITH BANKS AND MONEY AT CALL AND SHORT NOTICE Annual Report 2014-2015... -

Page 194

Consolidated Financial Statements Schedules forming part of the Consolidated Balance Sheet (Contd.) ` in '000s At 31.03.2015 At 31.03.2014 SCHEDULE 8 - INVESTMENTS I. Investments in India (net of provisions) i) ii) iii) iv) v) vi) Government securities Other approved securities Shares (includes ... -

Page 195

....2015 At 31.03.2014 SCHEDULE 9 - ADVANCES [net of provisions] i) Bills purchased and discounted ii) Cash credits, overdrafts and loans repayable on demand iii) Term loans TOTAL ADVANCES B. i) Secured by tangible assets (includes advances against book debts) ii) Covered by bank/government guarantees... -

Page 196

Consolidated Financial Statements Schedules forming part of the Consolidated Balance Sheet (Contd.) ` in '000s At 31.03.2015 At 31.03.2014 1,816,918 58,486,747 45,492,908 2,995 850,871 1,189,102 13,352,863 9,297,824 259,970,765 390,460,993 SCHEDULE 11 - OTHER ASSETS I. Inter-office adjustments (... -

Page 197

Consolidated Financial Statements Schedules forming part of the Consolidated Balance Profit and Loss(Contd.) Account (Contd.) Sheet ` in '000s Year ended 31.03.2015 Year ended 31.03.2014 337,208,794 142,448,360 4,276,997 10,858,325 494,792,476 SCHEDULE 13 - INTEREST EARNED I. Interest/discount on ... -

Page 198

... group providing a wide range of banking and financial services including commercial banking, retail banking, project and corporate finance, working capital finance, insurance, venture capital and private equity, investment banking, broking and treasury products and services. ICICI Bank Limited... -

Page 199

...Asset management company Trustee company Unregistered venture capital fund Unregistered venture capital fund Investment in research and development of biotechnology Support services for financial inclusion Services related to back end operations Education and training in banking and finance Merchant... -

Page 200

...ACCOUNTING POLICIES 1. Transactions involving foreign exchange The consolidated financial statements of the Group are reported in Indian rupees (`), the national currency of India. Foreign currency income and expenditure items are translated as follows: For domestic operations, at the exchange rates... -

Page 201

... customers and cost of bullion is accounted for at the time of sale to the customers. The Bank also deals in bullion on a borrowing and lending basis and the interest paid/received is accounted on accrual basis. Income from securities brokerage activities is recognised as income on the trade date... -

Page 202

...income for the current year, and carry forward losses. Deferred tax assets and liabilities are measured using tax rates and tax laws that have been enacted or substantively enacted at the balance sheet date. The impact of changes in the deferred tax assets and liabilities is recognised in the profit... -

Page 203

Consolidated Financial Statements Schedules forming part of the Consolidated Accounts (Contd.) revalidated on availability of further information. Claims IBNR represent that amount of claims that may have been incurred during the accounting period but have not been reported or claimed. The claims ... -

Page 204

... are invested according to the rules prescribed by the Government of India. Actuarial valuation for the interest rate guarantee on the provident fund balances is determined by an appointed actuary. The actuarial gains or losses arising during the year are recognised in the profit and loss account... -

Page 205

... any, being unrealised, is ignored, while net depreciation is provided for. Non-performing investments are identified based on the RBI guidelines. d) Treasury bills, commercial papers and certificate of deposits being discounted instruments, are valued at carrying cost. Annual Report 2014-2015 203 -

Page 206

Consolidated Financial Statements Schedules forming part of the Consolidated Accounts (Contd.) e) Costs including brokerage and commission pertaining to investments, paid at the time of acquisition, are charged to the profit and loss account. Cost of investments is computed based on the First-In-... -

Page 207

Consolidated Financial Statements Schedules forming part of the Consolidated Accounts (Contd.) v) The Bank's overseas banking subsidiaries account for unrealised gain/loss, net of tax, on investment in 'Available for Sale' category directly in their reserves. Further unrealised gain/loss on ... -

Page 208

...the case of corporate loans and advances, provisions are made for sub-standard and doubtful assets at rates prescribed by RBI. Loss assets and the unsecured portion of doubtful assets are provided/written-off as per the extant RBI guidelines. For loans and advances booked in overseas branches, which... -

Page 209

.... In case of the Bank, items costing up to ` 5,000/- are depreciated fully over a period of 12 months from the date of purchase. In case of revalued/impaired assets, depreciation is provided over the remaining useful life of the assets with reference to revised asset values. Annual Report 2014-2015... -

Page 210

... exercised or converted during the year. Diluted earnings per equity share is computed using the weighted average number of equity shares and dilutive potential equity shares issued by the group outstanding during the year, except where the results are anti-dilutive. 208 Annual Report 2014-2015 -

Page 211

...of Finance Banking and Insurance Training Limited, Comm Trade Services Limited, ICICI Foundation for Inclusive Growth, ICICI Merchant Services Private Limited, India Infradebt Limited, India Advantage Fund-III, India Advantage Fund-IV and Catalyst Management Services Private Limited. India Advantage... -

Page 212

... ICICI Foundation for Inclusive Growth amounting to ` 12.1 million (March 31, 2014: Nil) and with I-Process Services (India) Private Limited amounting to ` 7.1 million (March 31, 2014: ` 6.6 million). Brokerage, fees and other expenses During the year ended March 31, 2015, the Group paid brokerage... -

Page 213

Consolidated Financial Statements Schedules forming part of the Consolidated Accounts (Contd.) Sale of investments During the year ended March 31, 2014, the Group sold certain investments to Mewar Aanchalik Gramin Bank amounting to ` 147.8 million. Redemption/buyback of investments During the year ... -

Page 214

... financial year. The following table sets forth, for the periods indicated, the maximum balance payable to/receivable from relatives of key management personnel: ` in million Items Deposits Advances Year ended March 31, 2015 42.3 18.2 Year ended March 31, 2014 30.1 8.3 212 Annual Report 2014-2015 -

Page 215

... Schedules forming part of the Consolidated Accounts (Contd.) 3. Employee Stock Option Scheme (ESOS) In terms of the ESOS, as amended, the maximum number of options granted to any eligible employee in a financial year shall not exceed 0.05% of the issued equity shares of the Bank at the time... -

Page 216

...ICICI Prudential Life Insurance Company at March 31, 2015. Range of exercise price (` per share) 30-400 Number of shares arising out of options 7,057,417 Weighted average exercise price (` per share) 232.45 Weighted average remaining contractual life (number of years) 4 214 Annual Report 2014-2015 -

Page 217

Consolidated Financial Statements Schedules forming part of the Consolidated Accounts (Contd.) ICICI General: ICICI Lombard General Insurance Company has formulated ESOS for their employees. There is no compensation cost for the year ended March 31, 2015 based on the intrinsic value of options. If ... -

Page 218

... profit and loss account. ` in million Particulars Provision for depreciation of investments Provision towards non-performing and other assets Provision towards income tax - Current - Deferred Provision towards wealth tax Other provisions and contingencies1 Total provisions and contingencies 1. Year... -

Page 219

...)/loss Effect of the limit in para 59(b) of AS 15 on 'employee benefits' Net cost Actual return on plan assets Expected employer's contribution next year Investment details of plan assets Insurer Managed Funds1 Government of India securities Corporate Bonds Others Assumptions Interest rate Salary... -

Page 220

... Statements Schedules forming part of the Consolidated Accounts (Contd.) Estimated rate of return on plan assets is based on our expectation of the average long-term rate of return on investments of the Fund during the estimated term of the obligations. Experience adjustment ` in million Year... -

Page 221

... loss/(gain) Effect of the limit in para 59(b) of AS 15 on 'employee benefits' Net cost Actual return on plan assets Expected employer's contribution next year Investment details of plan assets Insurer managed funds Government of India securities Corporate bonds Special Deposit schemes Equity... -

Page 222

... Financial Statements Schedules forming part of the Consolidated Accounts (Contd.) Provident Fund (PF) As there is no liability towards interest rate guarantee on exempt provident fund on the basis of actuarial valuation, the Group has not made any provision for the year ended March 31, 2015... -

Page 223

...tax liability Total net deferred tax asset/(liability) 1. 2. ICICI Home Finance creates Special Reserve through appropriation of profits, in order to avail tax deduction as per Section 36(1)(viii) of the Income Tax Act, 1961. The National Housing Bank (NHB), through its circular dated May 27, 2014... -

Page 224

... Management Company Limited, ICICI Trusteeship Services Limited, TCW/ ICICI Investment Partners Limited (upto June 30, 2013), ICICI Kinfra Limited (upto September 30, 2014), I-Ven Biotech Limited and ICICI Prudential Pension Funds Management Company Limited. Income, expenses, assets and liabilities... -

Page 225

... expenses 4 Operating profit (2) - (3) 5 Income tax expenses (net)/ (net deferred tax credit) 6 Net profit1 (4) - (5) Other information 7 Segment assets 8 Unallocated assets2 9 Total Assets (7) + (8) Consolidated Financial Statements forming part of the Consolidated Accounts (Contd... -

Page 226

... Report 2014-2015 4 Operating profit (2) - (3) 5 Income tax expenses (net)/ (net deferred tax credit) 6 Net profit1 (4) - (5) Other information 7 Segment assets 8 Unallocated assets2 9 Total assets (7) + (8) 10 Segment liabilities 11 Unallocated liabilities 12 Total liabilities... -

Page 227

Consolidated Financial Statements Schedules forming part of the Consolidated Accounts (Contd.) B. Geographical segments The Group has reported its operations under the following geographical segments. Domestic operations comprise branches and subsidiaries/joint ventures in India. Foreign operations... -

Page 228

...consolidated accounts Additional information to consolidated accounts at March 31, 2015 (Pursuant to Schedule III of the Companies Act, 2013) ` in million Net assets Name of the entity % of total net assets 95.0% 1 Share in profit or loss Amount % of total net profit 91.3% Amount Parent ICICI Bank... -

Page 229

... N. S. Kannan Executive Director K. Ramkumar Executive Director Rajiv Sabharwal Executive Director Place : Mumbai Date : April 27, 2015 P . Sanker Senior General Manager (Legal) & Company Secretary Rakesh Jha Chief Financial Officer Ajay Mittal Chief Accountant Annual Report 2014-2015 227 -

Page 230

...the closing rate at December 31, 2014 of 1 CAD = ` 54.4225. 6. Investments include securities held as stock in trade. 7. Includes dividend paid on preference shares and interim dividend on equity shares paid during the year. 8. Paid-up share capital does not include share application money. 9. Names... -

Page 231

... CEO Annual Report 2014-2015 N. S. Kannan Executive Director K. Ramkumar Executive Director Rakesh Jha Chief Financial Officer Rajiv Sabharwal Executive Director Ajay Mittal Chief Accountant Place : Mumbai Date : April 27, 2015 P . Sanker Senior General Manager (Legal) & Company Secretary 229 -

Page 232

... at March 31, 2015 Scope of Application Capital adequacy Credit risk Securitisation exposures Market risk Operational risk Interest rate risk in the banking book (IRRBB) Liquidity risk Counterparty credit risk Risk management framework of non-banking group companies Disclosure requirements for... -

Page 233

... Terms Schedules forming part of the Consolidated Accounts (Contd.) Working funds Average deposits Average advances Business Average total assets Operating profit Number of employees Earnings per share Interest income to working funds Non-interest income to working funds Operating profit to working... -

Page 234

Consolidated Financial Statements Schedules Notes forming part of the Consolidated Accounts (Contd.) -

Page 235

Shri Narendra Modi, Honourable Prime Minister of India, inaugurating the ICICI Digital Village accompanied by Ms. Chanda Kochhar, MD & CEO, ICICI Bank -

Page 236

... the financial sector in India. Through an array of products and services that blend technology and innovation, ICICI Bank caters to its large, diverse customer base, upholding its promise of Khayaal Aapka. facebook.com/icicibank ICICI BANK LIMITED ICICI Bank Towers Bandra-Kurla Complex Mumbai 400...