Food Lion 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

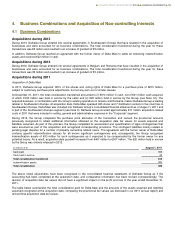

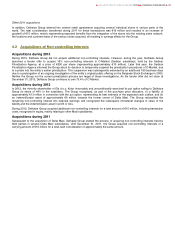

4. Business Combinations and Acquisition of Non-controlling Interests

4.1 Business Combinations

Acquisitions during 2013

During 2013, Delhaize Group entered into several agreements in Southeastern Europe that have resulted in the acquisition of

businesses and were accounted for as business combinations. The total consideration transferred during the year for these

transactions was €9 million and resulted in an increase of goodwill of €3 million.

In addition, Delhaize Group reached an agreement with the former owner of Delta Maxi to settle all remaining indemnification

assets and received €22 million in cash.

Acquisitions during 2012

During 2012, Delhaize Group entered into several agreements in Belgium and Romania that have resulted in the acquisition of

businesses and were accounted for as business combinations. The total consideration transferred during the year for these

transactions was €5 million and resulted in an increase of goodwill of €3 million.

Acquisitions during 2011

Acquisition of Delta Maxi

In 2011, Delhaize Group acquired 100% of the shares and voting rights of Delta Maxi for a purchase price of €615 million,

subject to customary purchase price adjustments, but not any earn-out or similar clauses.

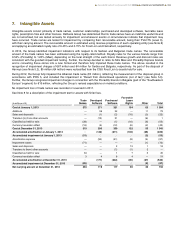

At December 31, 2011, the total consideration transferred amounted to (i) €574 million in cash, net of €21 million cash acquired,

of which €100 million was held in escrow by the seller and (ii) €20 million held in escrow by the Group (see Note 12). The

acquired business, in combination with the Group’s existing operations in Greece and Romania, makes Delhaize Group a leading

retailer in Southeastern Europe. At acquisition date, Delta Maxi operated 485 stores and 7 distribution centers in five countries in

Southeastern Europe. Delta Maxi was included into Delhaize Group’s consolidated financial statements as of August 1, 2011 and

is part of the Southeastern Europe segment (see Note 3). Delhaize Group incurred approximately €11 million acquisition-related

costs in 2011 that were included in selling, general and administrative expenses in the “Corporate” segment.

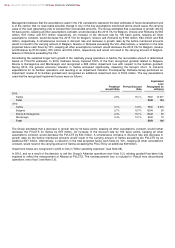

During 2012, the Group completed the purchase price allocation of the transaction and revised the provisional amounts

previously recognized to reflect additional information obtained on the acquisition date fair values for assets acquired and

liabilities assumed. As part of this process, the Group completed its assessment and quantification of legal contingencies that

were assumed as part of the acquisition and recognized corresponding provisions. The contingent liabilities mainly related to

pending legal disputes for a number of property ownership related cases. The agreement with the former owner of Delta Maxi

contains specific indemnification clauses for all known significant contingencies and, consequently, the Group recognized

indemnification assets of €33 million for such contingencies as it expected to be compensated by the former owner for any

potential losses. As a result, acquisition date goodwill increased from €467 million to €507 million. The €20 million held in escrow

by the Group was entirely released in 2012.

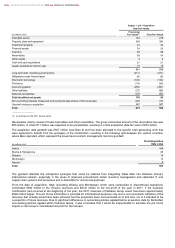

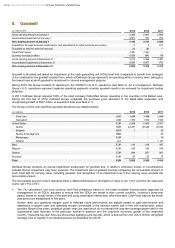

(in millions of €)

August 1, 2011

Cash paid

595

Cash held in escrow

20

Total consideration transferred

615

Indemnification assets

(33)

Total consideration

582

The above noted adjustments have been recognized in the consolidated financial statements of Delhaize Group as if the

accounting had been completed at the acquisition date, and comparative information has been revised correspondingly. The

revision of acquisition date fair values did not have a significant impact on the profit and loss of the year ended December 31,

2011.

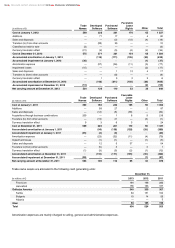

The table below summarizes the total consideration paid for Delta Maxi and the amounts of the assets acquired and liabilities

assumed recognized at the acquisition date, comparing the provisional fair values (as disclosed in our 2011 annual report) and

revised final acquisition date fair values.

DELHAIZE GROUP ANNUAL REPORT 2013 FINANCIAL STATEMENTS

95