Food Lion 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

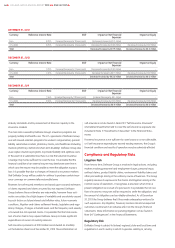

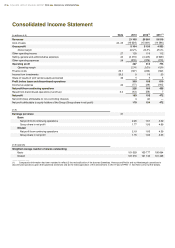

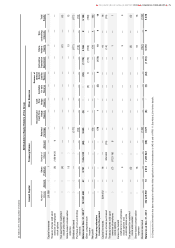

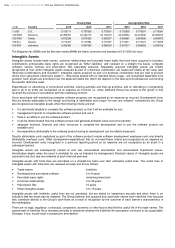

Consolidated Income Statement

e 2013 1) 1)

21 108 20 991 19 519

25 16 004) 15 891) 14 586)

5 104 5 100 4 933

2% 3% 3%

27 129 116 112

24 ) 4 425) 4 098)

28 ) (376) (172)

87 415 775

3% 0% 0%

1 (197) (246) (192)

2 9 16 23

36 4 4 4

03 189 610

22 ) (29) )

26 160 465

3 (43) (58) 7

3 102 472

4 (2)

79 104 472

31

20 61 62

77 03 69

19 60 59

76 03 65

101 029 100 777 100 684

101 570 101 134 101 426

(in millions of €)

Note

2013

2012(1)

2011(1)

Revenues

21 108

20 991

19 519

Cost of sales

24, 25

(16 004)

(15 891)

(14 586)

Gross profit

5 104

5 100

4 933

Gross margin

24.2%

24.3%

25.3%

Other operating income

27

129

116

112

Selling, general and administrative expenses

24

(4 476)

(4 425)

(4 098)

Other operating expenses

28

(270)

(376)

(172)

Operating profit

487

415

775

Operating margin

2.3%

2.0%

4.0%

Finance costs

29.1

(197)

(246)

(192)

Income from investments

29.2

9

16

23

Share of results of joint venture equity accounted

36

4

4

4

Profit before taxes and discontinued operations

303

189

610

Income tax expense

22

(77)

(29)

(145)

Net profit from continuing operations

226

160

465

Result from discontinued operations (net of tax)

5.3

(43)

(58)

7

Net profit

183

102

472

Net profit (loss) attributable to non-controlling interests

4

(2)

—

Net profit attributable to equity holders of the Group (Group share in net profit)

179

104

472

(in €)

Earnings per share

31

Basic

Net profit from continuing operations

2.20

1.61

4.62

Group share in net profit

1.77

1.03

4.69

Diluted

Net profit from continuing operations

2.19

1.60

4.59

Group share in net profit

1.76

1.03

4.65

(in thousands)

Weighted average number of shares outstanding

Basic

101 029

100 777

100 684

Diluted

101 570

101 134

101 426

_______________

(1) Comparative information has been restated to reflect (i) the reclassification of the banners Sweetbay, Harveys and Reid’s and our Montenegrin operations to

discontinued operations given their (planned) divestiture and (ii) the initial application of the amendments to IAS 19 and of IFRS 11. See Note 2.2 for further details.

72

DELHAIZE GROUP ANNUAL REPORT 2013

FINANCIAL STATEMENTS