Food Lion 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance

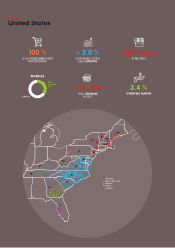

For the full year 2013, Delhaize America gen-

erated revenues of $17.1 billion (€12.9 billion),

an increase of 1.9% over 2012 in local currency

supported by comparable store sales growth of

2.0%. In 2013, the U.S. gross margin decreased

by 15 basis points to 25.9% as a result of price

investments, at both Food Lion and Hannaford.

Selling, general and administrative expenses

as a percentage of revenues increased by

6 basis points to 22.6% mainly as a result of the

reduction of the U.S. bonus accrual in the third

quarter of 2012 which was largely offset by cost

savings. The underlying operating margin

of our U.S. business decreased by 29 basis

points to 3.7% as a result of price investments,

slightly higher SG&A and higher other oper-

ating expenses. Underlying operating profit

decreased by 5.3% to $639 million (€481 mil-

lion). Operating margin was 3.4% mainly as a

result of $53 million (€40 million) restructuring,

fixed asset impairment charges and store

closing expenses.

Food Lion

Food Lion is the largest banner within the

Delhaize Group banner portfolio. The super-

market chain operates 1 124 stores in 11 states,

including 11 Reid’s stores. The DNA of Food Lion

is based on its strong store network, offering

a broad assortment at low prices. In 2013,

the brand respositioning work that kicked off

in 2011 was completed. As a result, the entire

Food Lion network now embodies and reflects

the Simple, Quality and Price elements. Look-

ing at the performance of Food Lion in 2013,

the efforts have clearly resulted in material

revenue uplift. In order to fully benefit from this

trend, Food Lion launched, at the end of last

year, a new round of initiatives, based on the

notions Easy, Fresh and Affordable, that should

result in a continuation of top line growth.

Hannaford

Since it was acquired in 2000 by Delhaize

Group, Hannaford has maintained its strong

position in the Northeast of the U.S., particu-

larly in Maine, New Hampshire, and Vermont.

Known for the quality of its assortment and

a high service level, Hannaford serves its

customers through a network of 183 stores. In

2013 the banner took important measures to

retain its customers´ share of grocery spend-

ing, through improving the value proposition

and increasing customer service levels.

Bottom Dollar Food

Bottom Dollar Food is the fastest growing

banner of Delhaize Group in the U.S. The

discount format operates 62 stores, offering a

limited but convenient assortment of national

and private brand products, fresh meat and

produce. The banner’s differentiator, on which

Bottom Dollar Food prides itself, is offering its

customers the lowest price through its “We

won’t be beat” price guarantee policy. The

store footprint is concentrated in the two most

densely populated markets of the state of

Pennsylvania, Philadelphia and Pittsburgh.

In 2013, 6 new stores were opened.

SWEETBAY,

HARVEYS AND

REID’S

In a highly competitive environment,

Delhaize Group continually needs to

make choices about where and how it

can best deploy its available resources.

That is why, in 2013, Delhaize Group

decided to divest the banners of

Sweetbay, Harveys and Reid’s. The

transaction was announced in the

second quarter of 2013 and is expected

to close in the first half of 2014. In total,

154 stores will be divested for a total

consideration of $267 million in cash,

subject to other customary adjustments.

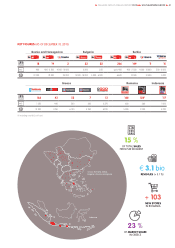

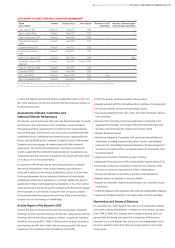

KEY FIGURES (AS OF DECEMBER 31, 2013)

1 124(1) 183 62 72 73

Southeast and

Mid-Atlantic

Northeast New Jersey, Ohio,

Pennsylvania

Georgia, Northern

Florida, South Carolina

Westcoast

of Florida

sq.ft.

25 000 - 45 000 25 000 - 55 000 18 000 - 20 000 25 000 - 45 000 25 000 - 50 000

15 000 - 20 000 25 000 - 46 000 6 000 - 8 000 15 000 - 20 000 28 000 - 42 000

DELHAIZE GROUP ANNUAL REPORT 2013 UNITED STATES

35

(1) Including 11 Reid’s stores.