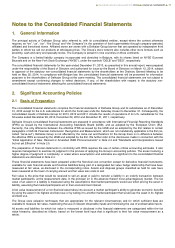

Food Lion 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

recognized as deferred income and recognized in the income statement as “Other operating income” (see Note 27) on a

systematic basis over the expected useful life of the related asset.

Inventories

Inventories are valued at the lower of cost on a weighted average cost basis and net realizable value. Costs of inventory include

all costs incurred to bring each product to its present location and condition. Inventories are regularly reviewed and written down

on a case-by-case basis if the anticipated net realizable value (anticipated selling price in the course of ordinary business less

the estimated costs necessary to make the sale) declines below the carrying amount of the inventories. When the reason for a

write-down of the inventories has ceased to exist, the write-down is reversed.

Delhaize Group receives allowances and credits from suppliers primarily for in-store promotions, cooperative advertising, new

product introduction and volume incentives. These “vendor allowances”, as well as other cash discounts, are included in the cost

of inventory and recognized in the income statement when the product is sold, unless they represent reimbursement of a

specific, incremental and identifiable cost incurred by the Group to sell the vendor’s product in which case they are recorded

immediately as a reduction of the corresponding selling, general and administrative expenses. Estimating rebates from suppliers

requires in certain cases the use of assumptions and judgment regarding the achievement of specified purchase or sales level

and related inventory turnover.

Cash and Cash Equivalents

Cash and cash equivalents include cash on call with banks and on hand, short-term deposits and other highly liquid investments

with an original maturity of three months or less which are readily convertible to known amounts of cash and which are subject to

an insignificant risk of changes in value. Negative cash balances are reclassified on the balance sheet to “Bank overdrafts”.

Impairment of Non-Financial Assets

At each reporting date, the Group assesses whether there is an indication that a non-financial asset (hereafter “asset”) may be

impaired. If such indications are identified, the asset’s recoverable amount is estimated. Further, goodwill and intangible assets

with indefinite lives or that are not yet available for use are tested annually for impairment, which at Delhaize Group is in the

fourth quarter of the year and whenever there is an indication of impairment.

The recoverable amount of an asset or cash-generating unit (CGU) is the greater of its value in use and its fair value less costs

to sell. In assessing value in use, the estimated future cash flows are discounted to their present value using a discount rate that

reflects current market assessments of the time value of money and the risk specific to the asset. As independent cash flows are

often not available for individual assets for the purpose of impairment testing, assets need to be grouped together into the

smallest group of assets that generates cash inflows from continuing use that are largely independent of the cash inflows of other

assets or groups of assets (“cash generating unit” or CGU).

In determining fair value less costs to sell for individual assets or CGUs, appropriate valuation models (see Note 2.1) are used.

Goodwill acquired in a business combination is, for the purpose of impairment testing, allocated to the CGUs that are expected to

benefit from the synergies of the combination and that represent the lowest level within the Group at which the goodwill is

monitored for internal management purposes and that are not larger than an operating segment before aggregation (see Note 6).

An impairment loss of a continuing operation is recognized in the income statement in "Other operating expenses" (see Note 28)

if the carrying amount of an asset or CGU exceeds its recoverable amount. Impairment losses recognized for CGUs are allocated

first to reduce the carrying amount of any goodwill allocated to the units and then to reduce the carrying amounts of the other

assets in the CGU on a pro rata basis.

If the impairment of assets, other than goodwill, is no longer justified in future periods due to a recovery in fair value or value in

use of the asset, the impairment is reversed. An impairment loss is reversed only to the extent that the asset’s carrying amount

does not exceed the carrying amount that would have been determined, net of depreciation or amortization, if no impairment loss

had been recognized. Goodwill impairment is never reversed.

Non-derivative Financial Assets

Delhaize Group classifies its non-derivative financial assets (hereafter “financial assets”) within the scope of IAS 39 Financial

Instruments: Recognition and Measurement into the following categories: loans and receivables and available for sale. Delhaize

Group currently holds no financial assets that would be classified as measured at fair value through profit or loss and held-to-

maturity. The Group determines the classification of its financial assets at initial recognition.

These financial assets are initially recorded at fair value plus transaction costs that are directly attributable to the acquisition or

issuance of the financial assets.

Loans and receivables: Financial assets with fixed or determinable payments that are not quoted in an active market are

classified as loans and receivables. Such financial assets are subsequent to initial recognition carried at amortized cost

using the effective interest rate method. Gains and losses are recognized in the income statement when the loans and

receivables are derecognized or impaired and through the amortization process. The Group’s loans and receivables

comprise “Other financial assets” (see Note 12), “Receivables” (see Note 14) and “Cash and cash equivalents” (see Note

15).

Trade receivables are subsequently measured at amortized cost less an impairment allowance. The allowance for

impairment of trade receivables is established (on a separate allowance account) when there is objective evidence that the

Group will not be able to collect all amounts due according to the original terms of the receivables and the amount of the loss

84

DELHAIZE GROUP ANNUAL REPORT 2013

FINANCIAL STATEMENTS