Food Lion 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176

|

|

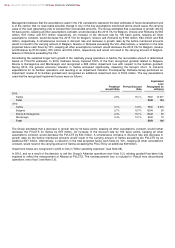

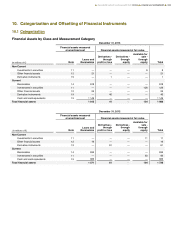

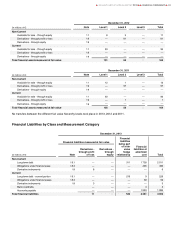

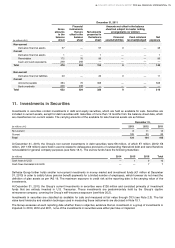

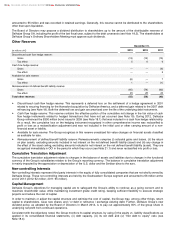

December 31, 2012

(in millions of €)

Financial liabilities measured at fair value

Financial

liabilities

being part

of a fair

value

hedge

relationship

Financial

liabilities at

amortized

cost Total Note

Derivatives -

through profit

or loss

Derivatives -

through

equity

Non-Current

Long-term debt

18.1

—

—

561

1 752

2 313

Obligations under finance lease

18.3

—

—

—

612

612

Derivative instruments

19

10

—

—

—

10

Current

Long-term debt - current portion

18.1

—

—

—

156

156

Obligations under finance leases

18.3

—

—

—

62

62

Derivative instruments

19

4

—

—

—

4

Accounts payable

—

—

—

1 869

1 869

Total financial liabilities

14

—

561

4 451

5 026

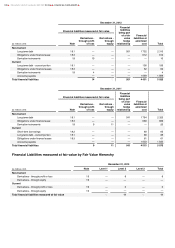

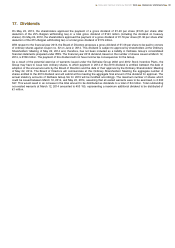

December 31, 2011

(in millions of €)

Financial liabilities measured at fair value

Financial

liabilities

being part

of a fair

value

hedge

relationship

Financial

liabilities at

amortized

cost Total Note

Derivatives -

through profit

or loss

Derivatives -

through

equity

Non-Current

Long-term debt

18.1

—

—

541

1 784

2 325

Obligations under finance lease

18.3

—

—

—

689

689

Derivative instruments

19

9

11

—

—

20

Current

Short-term borrowings

18.2

—

—

—

60

60

Long-term debt - current portion

18.1

—

—

—

88

88

Obligations under finance leases

18.3

—

—

—

61

61

Accounts payable

—

—

—

1 833

1 833

Total financial liabilities

9

11

541

4 515

5 076

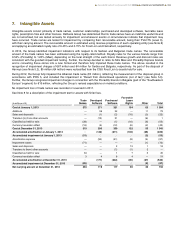

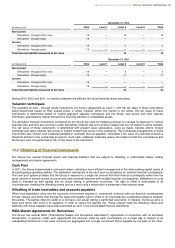

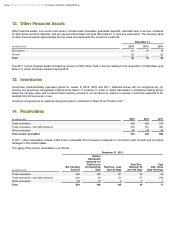

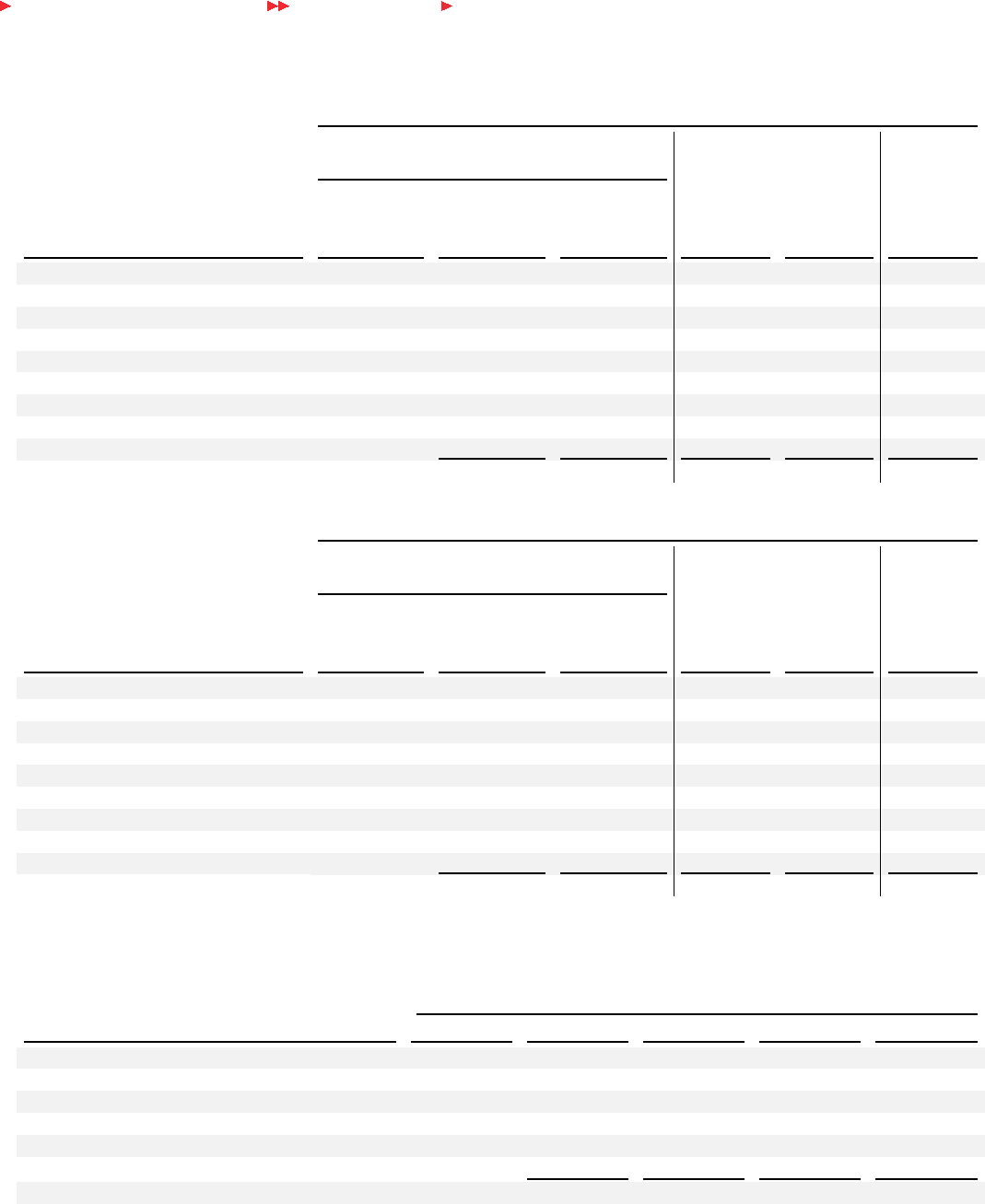

Financial Liabilities measured at fair value by Fair Value Hierarchy

December 31, 2013

(in millions of €)

Note

Level 1

Level 2

Level 3

Total

Non-Current

Derivatives - through profit or loss

19

—

8

—

8

Derivatives - through equity

19

—

—

—

—

Current

Derivatives - through profit or loss

19

—

3

—

3

Derivatives - through equity

19

—

—

—

—

Total financial liabilities measured at fair value

—

11

—

11

112

DELHAIZE GROUP ANNUAL REPORT 2013

FINANCIAL STATEMENTS