Food Lion 2013 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5. Divestitures, Disposal Group / Assets Held for Sale and Discontinued

Operations

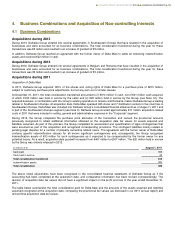

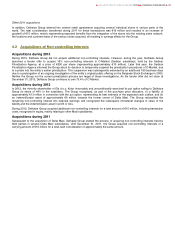

5.1 Divestitures

In 2013, Delhaize Group converted several of its Belgian company-operated City stores into affiliated Proxy stores, operated by

independent third parties. Delhaize Group received a total cash consideration of €12 million and recognized a gain on disposal of

approximately €9 million, classified as “Other operating income”.

In 2012, Delhaize Group reached a binding agreement to sell Wambacq & Peeters SA, a Belgian transport company, to Van

Moer Group. This transaction did not meet the criteria of a “Discontinued Operation” and was completed on April 30, 2012.

Delhaize Group received €3 million in cash and recorded a gain on disposal of €1 million in 2012.

No divestitures took place in 2011.

5.2 Disposal Group / Assets Classified as Held for Sale

Disposal of Delhaize Montenegro

In 2013, Delhaize Group announced the sale of its Montenegrin operations (part of the “Southeastern Europe” segment) to Expo

Commerce and presented the profit and loss as discontinued operations (see also Note 5.3). Comparative information was re-

presented.

Delhaize Group completed the transaction during 2013 for a total sales price of €5 million, subject to customary adjustments.

Disposal of Sweetbay, Harveys and Reid’s

In 2013, Delhaize Group signed an agreement with Bi-Lo Holdings (Bi-Lo) to divest its Sweetbay, Harveys and Reid´s

operations. The total sales price is $267 million (€193 million) in cash, to be reduced by $20 million (€15 million) for restrictions

imposed during the regulatory approval process and subject to other customary adjustments. The estimated fair value of the

disposal group has been classified as a Level 1 fair value, being the exit price in an orderly and binding transaction.

Assets and liabilities relating to these operations (being part of the “United States” segment) are classified as a disposal group

held for sale, including the leases of ten previously closed Sweetbay locations but excluding Sweetbay’s distribution center,

which is not part of the agreement and currently does not meet the criteria for classification as held for sale. The transaction also

meets the definition of discontinued operations. Consequently, the relevant profit or loss after tax has been classified as “Result

of discontinued operations”, with comparative information being re-presented.

The transaction is expected to be completed in 2014. In 2013, the 164 stores currently included in the transaction generated

revenues of approximately $1.7 billion.

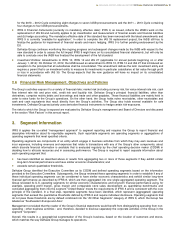

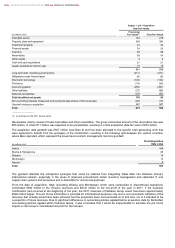

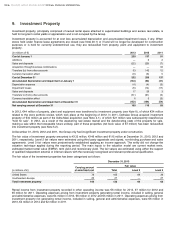

At December 31, 2013, the carrying value of assets classified as held for sale and associated liabilities related to the disposal of

Sweetbay, Harveys and Reid’s were as follows:

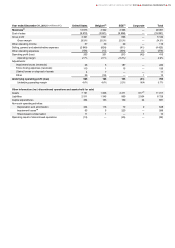

(in millions of €)

2013

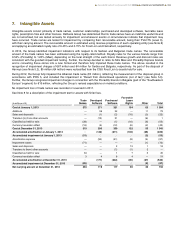

Intangible assets

12

Property, plant and equipment

161

Inventories

65

Receivables and other current assets

3

Cash and cash equivalents

2

Assets classified as held for sale

243

Less:

Obligations under finance lease

(50)

Accounts payable, accrued expenses and other liabilities

(8)

Assets classified as held for sale, net of associated liabilities

185

Disposal of Delhaize Albania SHPK

In 2013, Delhaize Group completed the sale of its Albanian activities (“Delhaize Albania”) for a sales price of €1 million. The

assets and liabilities of Delhaize Albania, that was part of the previously called “Southeastern Europe & Asia” segment had been

presented as “held for sale” as of December 31, 2012 and the operating results of the Albanian company in previous years as

well as the gain of €1 million realized on the sale were classified as “Results from discontinued operations” in the income

statement.

98

DELHAIZE GROUP ANNUAL REPORT 2013

FINANCIAL STATEMENTS