Food Lion 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In order to manage its identified and quantified market risks, Delhaize

Group uses derivative financial instruments such as foreign exchange

forward contracts, interest rate swaps, currency swaps and other

derivative instruments. These financial instruments are not used for

speculative purposes.

Funding and Liquidity Risk

Funding and liquidity risk is the risk that the Group will encounter

difficulty in meeting payment obligations when they come due. Del-

haize Group manages this exposure by closely monitoring its liquidity

resources, consisting of a combination of retained cash flows, bank

facilities, long-term debt and leases, which are essential to fulfil working

capital, capital expenditures and debt servicing requirements.

Delhaize Group operates an international cash-pooling structure in

order to centralize cash on a daily basis wherever possible. At year-end

2013 the Group’s cash and cash equivalents amounted to €1 149 million.

Delhaize Group also monitors the amount of short-term funding, the

mix of short-term funding to total debt and the availability of committed

credit facilities in relation to the level of outstanding short-term debt (see

Note 18.2 “Short-term Borrowings” in the Financial Statements). At year-

end 2013, the Group had committed and undrawn credit lines totalling

€725 million. These credit lines consisted of a syndicated multicurrency

credit facility of €600 million for the Company and certain of its subsidi-

aries including Delhaize America, LLC and €125 million of bilateral credit

facilities for the European entities. In addition, the Group had €25 million

of committed credit facilities for letters of credit and guarantees of

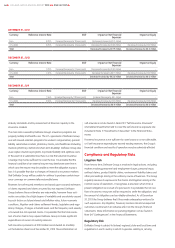

which €9 million was used. At December 31, 2013, the maturities of the

committed credit facilities were as follows: €25 million maturing in 2014,

€75 million maturing in 2015 and €650 million maturing in 2016.

Delhaize Group pro-actively monitors the maturities of its outstanding debt

in order to reduce refinancing risk. At December 31, 2013, the expected

redemption values of the long-term debt through 2018 were €210 million

in 2014, €1 million in 2015, €7 million in 2016, €325 million in 2017 and

€400 million in 2018 after the effect of interest rate swaps and cross-cur-

rency interest rate swaps. As described in Note 18.1 ”Long-term Debt” in the

Financial Statements the debt maturing in 2014 has been largely refinanced

and no significant principal payment of financial debt is due until 2017.

Delhaize Group’s long-term issuer ratings from Standard & Poor’s and

Moody’s are BBB- (stable) and Baa3 (stable) respectively. These credit

ratings are supported by cross-guarantee arrangements among

Delhaize Group and substantially all of Delhaize Group’s U.S. subsidi-

aries, whereby the entities are guaranteeing each other’s financial debt

obligations. Delhaize Group leverages its investment grade credit rating

to optimally refinance maturing debt.

As also described in Notes 18.1 ”Long-term Debt” and 18.2 “Short-term

Borrowings” in the Financial Statements, the Group is subject to certain

financial and non-financial covenants related to its long- and short-term

debt instruments, which contain certain accelerated repayment terms

that are detailed in these Notes.

Interest Rate Risk

Interest rate risk arises on interest-bearing financial instruments and

represents the risk that the fair value or the associated interest cash

flows of the underlying financial instrument will fluctuate because of

future changes in market interest rates.

Delhaize Group’s interest rate risk management objectives are to

reduce earnings volatility, to minimize interest expense over the long

term, and to protect future cash flows from the impact of material

adverse movements in interest rates.

Delhaize Group reviews its interest rate risk exposure on a quarterly

basis and at the inception of any new financing operation. As part of its

interest rate risk management activities, the Group may enter into inter-

est rate swap agreements (see Note 19 ”Derivative Financial Instruments

and Hedging” in the Financial Statements). At the end of 2013, 74.3% of

the financial debt after swaps of the Group carried a fixed interest rate

(2012: 75.8%; 2011: 75.1%).

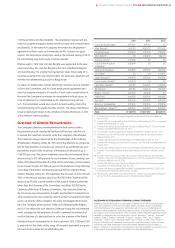

The sensitivity analysis presented in the table on the page 66 estimates

the impact on the net financial expenses (with all other variables held

constant) and equity of a parallel shift in the interest rate curve. The shift

in that curve is based on the standard deviation of daily volatilities of the

“Reference Interest Rates” (Euribor 3 months and Libor 3 months) during

the year, within a 95% confidence interval.

Currency Risk

Delhaize Group’s foreign currency risk management objectives are to

minimize the impact of currency fluctuations on the Group’s income

statement, cash flows and balance sheet, using foreign exchange con-

tracts, including derivative financial instruments such as currency swaps

and forward instruments (see Note 19 ”Derivative Financial Instruments

and Hedging” in the Financial Statements).

Translation exposure

The results of operations and the financial position of each of Delhaize

Group’s entities outside the euro zone are accounted for in the relevant

local currency and then translated into euros at the applicable foreign

currency exchange rate for inclusion in the Group’s consolidated

financial statements, which are presented in euros (see also Note 2.3

”Summary of Significant Accounting Policies” in the Financial Statements

with respect to translation of foreign currencies).

Delhaize Group does not hedge this “translation exposure”. However,

the Group aims to minimize this exposure by funding the operations of

Delhaize Group’s entities in their local currency, wherever feasible.

If the average U.S. dollar exchange rate had been 1 cent higher/lower

and all other variables were held constant, the Group’s net profit would

have increased/decreased by €1 million in 2013 (€2 million in 2012 and

2011), solely due to the translation of the financial statements denom-

inated in U.S. dollars. The effect from the translation of the functional

currency to the reporting currency of the Group does not affect the cash

flows in local currencies.

In 2013, 64% of the Group’s EBITDA was generated in U.S. dollars (63%

and 69% in 2012 and 2011, respectively). At December 31, 2013, 69% of

64

DELHAIZE GROUP ANNUAL REPORT 2013

RISK FACTORS