Food Lion 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DELHAIZE GROUP ANNUAL REPORT 2013 REMUNERATION REPORT

55

is to establish target compensation levels that, as a general rule, are at or

around the median market level. The reference companies are those in

the retail industry in Europe and the United States, as well as other com-

parably sized companies in both Europe and the United States, where

benchmarking more broadly is appropriate for the position of an exec-

utive. This market-based information, together with the experience and

scope of responsibilities are taken into account, along with internal equity

factors, to determine each executive’s target total direct compensation.

The variable performance-based components of the total compensation

package are the most significant portion of total direct compensation.

As of March 11, 2014 Delhaize Group modified its Remuneration Policy

to take account of changes approved in January 2014 to the Compa-

ny’s short-term and long-term incentive plan design. The Remuneration

Policy includes principles related to unvested equity-based compensa-

tion recovery from an officer who has committed a fraud or wrongdo-

ing that results in a restatement of the Company’s financial results. The

changes in the Remuneration Policy followed a thorough analysis of

its plans for Executive Management to ensure that the design of these

plans support the Company’s strategy and remain aligned with market

practices.

Executive Compensation Roles and Analysis

Role of the Board of Directors

The Board of Directors, upon the recommendation of the RNC, deter-

mines the remuneration of directors and the members of Executive

Management.

Role of the Remuneration & Nomination Committee

The role of the RNC is to, among other matters, advise and make recom-

mendations to the Board of Directors on compensation matters. In March

2014, the Board approved dividing the work of the RNC as of May 2014

into two separate committees, the Governance and Nomination Commit-

tee, and the Remuneration Committee. The roles and responsibilities of

the Remuneration Committee are described in its Terms of Reference and

are set forth as Exhibit C to the Corporate Governance Charter.

Role of certain Executive Committee members

in Executive Compensation Decisions

The Company’s CEO makes recommendations concerning compensa-

tion for Executive Management. These compensation recommendations

reflect the results of an annual performance review for each executive.

The Company’s Executive Vice President for Human Resources (“CHRO”)

assists the CEO in this process. The CHRO also supports the RNC in its

evaluation of the CEO’s performance and compensation recommen-

dations, and the General Counsel provides legal advice concerning

applicable laws and governance matters.

Executive Management Compensation

The compensation of Executive Management includes the following

components:

• Annual Base Salary;

• Annual Short-term Incentive (“STI”) awards;

• Long-term Incentive (“LTI”) awards; and

• Other benefits, retirement and post-employment benefits.

When determining compensation for Executive Management, the RNC

considers all of these elements.

In general, these components can be categorized as either fixed or

variable. The base salary and other benefits, such as retirement and

post-employment benefits that are specified contractually or by law, are

considered fixed compensation. The short-term incentive award and

the different components of the long-term incentive award are consid-

ered variable compensation.

Delhaize Group believes that the current proportion of fixed versus

variable compensation offers members of Executive Management the

right balance of incentives to optimize both the short- and long-term

objectives of the Company and its shareholders.

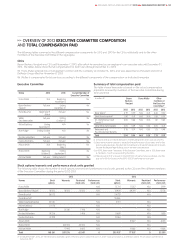

The following graphs illustrate the proportion of fixed versus variable

compensation for the CEO and other members of Executive Commit-

tee. These charts reflect base salary and target amounts for STI and LTI

awards granted in 2013.

BARON BECKERS-

VIEUJANT

FRANS MULLER OTHER MEMBERS OF

EXECUTIVE COMMITTEE

Variable Fixed

39% 35% 42%

61% 65% 58%

Annual Base Salary

Base salary is a key element of the compensation package. The Com-

pany determines short-term incentive awards and long-term incentive

awards as percentages of base salary.

Base salary is established and adjusted as a result of an annual review

process. This review process considers market practices as well as

individual performance.