Food Lion 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

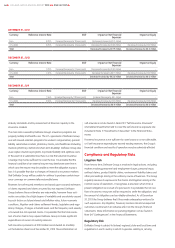

Communications and Sustainability. His employment agreement pro-

vides for a payment equal to twelve months of total cash compensation

and benefits, in the event the Company terminates his employment

agreement without cause or if terminated by Mr. Croonen for good

reason. The termination would also result in the forward vesting of all of

his outstanding long-term equity incentive awards.

Effective April 1, 2014, Dirk Van den Berghe was appointed to the Exec-

utive Committee. Mr. Van den Berghe is the CEO of Delhaize Belgium

and Luxembourg. His employment agreement does not provide for a

severance payment in case of termination. His severance payment will

therefore be determined pursuant to Belgian law.

For sake of completeness, Kostas Macheras continues to be a member

of Executive Committee, and his Greek employment agreement pro-

vides for a payment equal to 24 months of total cash compensation in

the event the Company terminates his employment without cause, in

case of retirement or, if terminated by Mr. Macheras for good rea-

son. The termination would also result in forward vesting of all of his

outstanding long-term equity incentive awards. The above-mentioned

Greek employment relates to the activities of Kostas Macheras as CEO

of the relevant Greek subsidiary.

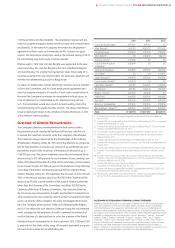

Overview of Director Remuneration

The Company’s directors are remunerated for their services with a

fixed annual amount, decided by the Board of Directors, which is not

to exceed the maximum amounts set by the Company’s shareholders.

The maximum amount approved by the shareholders at the Ordinary

Shareholders’ Meeting of May 26, 2011 is (i) to the directors as compensa-

tion for their positions as directors, an amount of up to €80 000 per year

per director, and (ii) to the Chairman of the Board, an amount of up to

€160 000 per year. The above-mentioned amounts are increased by an

amount of up to €10 000 per year for each member of any standing com-

mittee of the Board (other than the chair of the committee), and increased

by an amount of up to €15 000 per year for the Chairman of any standing

committee of the Board. The Board proposes that the Ordinary Share-

holders’ Meeting of May 22, 2014 approves the increase, as from May 22,

2014, of the amount paid per year (i) by €40,000 to the Chairman of the

Board, (ii) by €5,000 to each member of the Audit & Finance Committee

(other than the Chairman of the Committee), and (iii) by €10,000 to the

Chairman of the Audit & Finance Committee. Non-Executive Directors

do not receive any remuneration, benefits, equity-linked consideration or

other incentives from the Company other than their remuneration for their

service as Director of the Company. For some non-Belgian Board mem-

bers, the Company pays a portion of the cost of preparing the Belgian

and U.S. tax returns for such directors. Delhaize Group has not extended

credit, arranged for the extension of credit or renewed an extension of

credit in the form of a personal loan to or for any member of the Board.

Individual director remuneration for the fiscal years 2013, 2012 and 2011

is presented in the table on this page. All amounts presented are gross

amounts before deduction of withholding tax.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

Statements that are included or incorporated by reference in this Remuneration Report,

other than statements of historical fact, which address activities, events and develop-

ments that Delhaize Group expects or anticipates will or may occur in the future are

“forward-looking statements” within the meaning of the U.S. federal securities laws that

are subject to risks and uncertainties. These forward-looking statements generally can be

identified as statements that include phrases such as “guidance,” “outlook,” “projected,”

“believe,” “target,” “predict,” “estimate,” “forecast,” “strategy,” “may,” “goal,” “expect,”

“anticipate,” “intend,” “plan,” “foresee,” “likely,” “will,” “should” or other similar words or

phrases. Although such statements are based on current information, actual outcomes

and results may differ materially from those projected depending upon a variety of

factors. Delhaize Group disclaims any obligation to announce publicly any revision to any

of the forward-looking statements contained in this Remuneration Report.

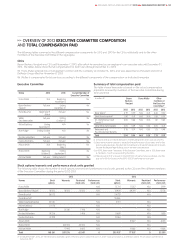

2011 2012 2013

Count Jacobs de Hagen(1) €175 000 €69 231 €0

Mats Jansson(2) €53 901 €138 352 €170 000

Claire Babrowski €90 000 €90 000 €90 000

Shari Ballard(3) €0 €48 352 €86 071

François Cornélis(4) €32 088 €0 €0

Count de Pret Roose de

Calesberg(5)

€36 099 €0 €0

Jacques de Vaucleroy(6) €85 989 €90 000 €90 000

Liz Doherty(7) €0 €0 €54 643

Hugh Farrington(8) €90 000 €93 022 €95 000

Count Goblet d'Alviella(9) €45 000 €0 €0

Jean-Pierre Hansen(10) €47 912 €86 044 €45 000

Bill McEwan(11) €47 912 €86 044 €90 000

Robert J. Murray(12) €80 000 €31 648 €0

Didier Smits €80 000 €80 000 €80 000

Jack Stahl €95 000 €95 000 €95 000

Baron Luc Vansteenkiste €90 000 €90 000 €90 000

Baron Beckers - Vieujant(13) €80 000 €80 000 €80 000

Total €1 128 901 €1 077 693 €1 065 714

(1) Prorated: Count Jacobs de Hagen resigned from the Board of Directors effective

May 24, 2012.

(2) Prorated: Mr Jansson joined the Board of Directors effective May 26, 2011 and became

Chairman effective May 24, 2012.

(3) Prorated: Mrs Ballard joined the Board of Directors effective May 24, 2012 and joined

the R&N Committee effective May 23, 2013.

(4) Prorated: Mr Cornélis resigned from the Board of Directors effective May 26, 2011.

(5) Prorated: Count de Pret Roose de Calesberg resigned from the Board of Directors

effective May 26, 2011.

(6) Prorated: Mr de Vaucleroy joined the R&N Committee effective May 26, 2011.

(7) Prorated: Mrs Doherty joined the Board of Directors and the Audit Committee effective

May 23, 2013.

(8)

Prorated

: Mr Farrington became chairman of the R&N Committee effective May 24, 2012

.

(9)

Prorated: Count Goblet d’Alviella resigned from the Board of Directors effective June 30,

2011.

(10) Prorated: Mr Hansen joined the Board of Directors effective May 26, 2011, became

member of the Audit Committee effective May 24, 2012 and resigned from the Board

of Directors effective June 30, 2013.

(11) Prorated: Mr McEwan joined the Board effective May 26, 2011 and became member

of the R&N Committee effective May 26, 2012.

(12) Prorated: Mr Murray resigned from the R&N Committee effective May 25, 2011 and

from the Board of Directors effective May 24, 2012.

(13) The amounts solely relate to the remuneration as director and exclude his compensa-

tion as CEO that is separately disclosed in this Remuneration Report.

DELHAIZE GROUP ANNUAL REPORT 2013 REMUNERATION REPORT

61