Food Lion 2013 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

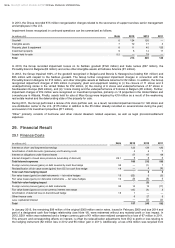

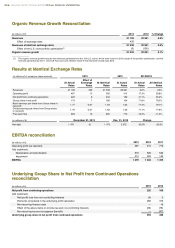

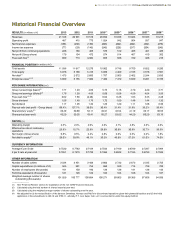

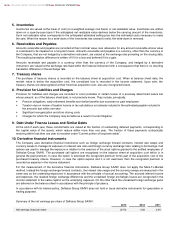

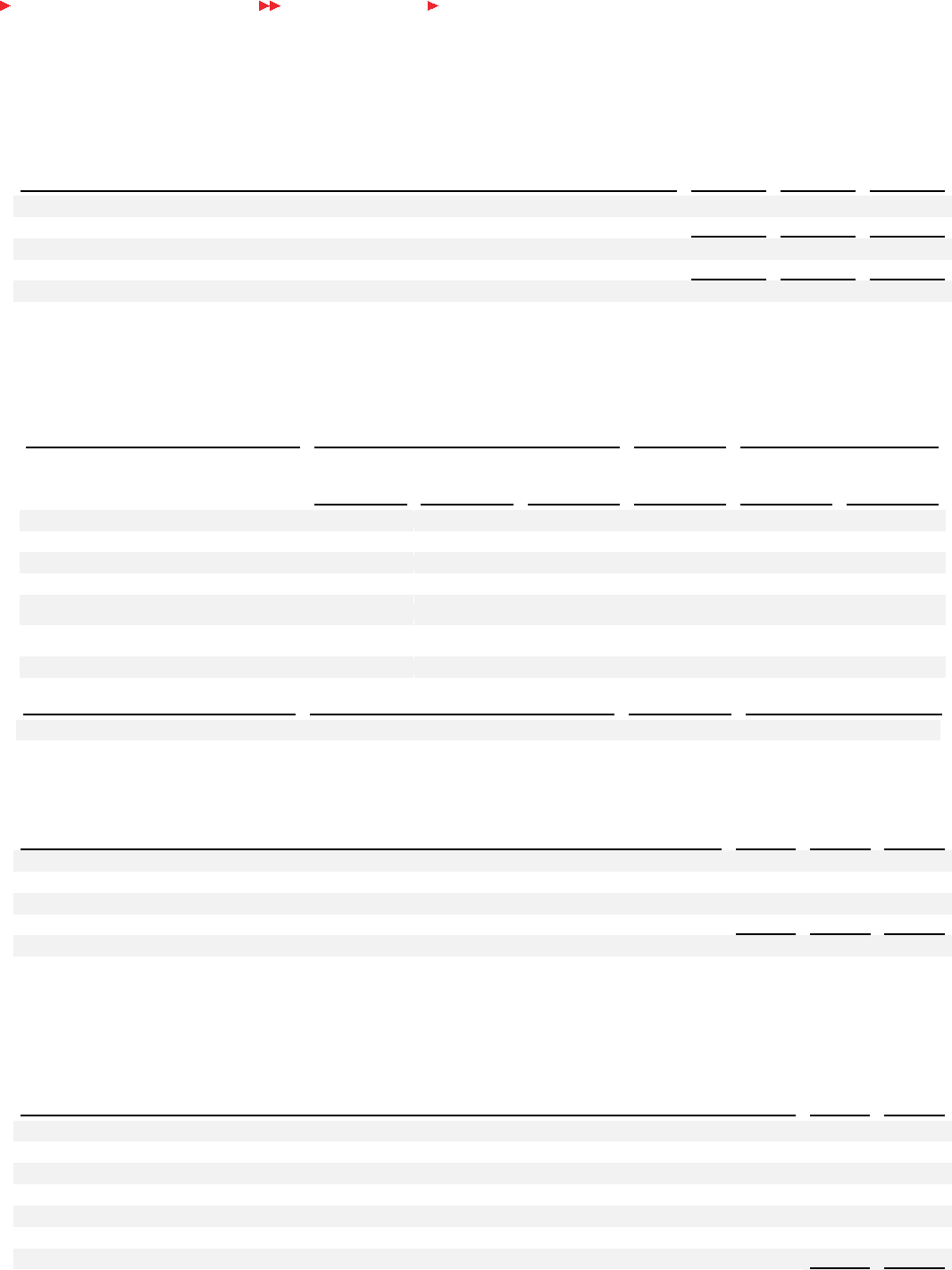

Organic Revenue Growth Reconciliation

(in millions of €) 2013 2012 % Change

Revenues

21 108

20 991

0.6%

Effect of exchange rates

430

Revenues at identical exchange rates

21 538

20 991

2.6%

Effect of the U.S. store portfolio optimization(1)

(5)

(100)

Organic revenue growth

21 533

20 891

3.1%

_____________

(1) The organic revenue growth excludes the revenues generated from the 126 U.S. stores, which were closed in 2012 as part of the portfolio optimization, and the

revenues generated by the 11 stores (8 Food Lion and 3 Bottom Dollar Food) that were closed early 2013.

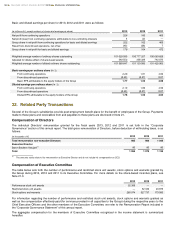

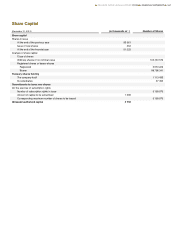

Results at Identical Exchange Rates

(in millions of €, except per share

amounts)

2013

2012

2013/2012

At Actual

Rates

Effect of

Exchange

Rates

At Identical

Rates

At Actual

Rates

At Actual

Rates

At Identical

Rates

Revenues

21 108

430

21 538

20 991

0.6%

2.6%

Operating profit

487

15

502

415

17.3%

20.8%

Net profit from continuing operations

226

8

234

160

41.1%

46.2%

Group share in net profit

179

7

186

104

71.8%

78.5%

Basic earnings per share from Group share in

net profit

1.77 0.07 1.84 1.03 71.4% 78.1%

Diluted earnings per share from Group share

in net profit

1.76 0.07 1.83 1.03 71.1% 77.8%

Free cash flow

669

16

685

773

-13.4%

-11.3%

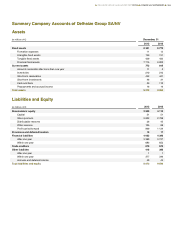

(in millions of €)

December 31, 2013

Dec. 31, 2012

Change

Net debt

1 473

(1)

1 472

2 072

-28.9%

-29.0%

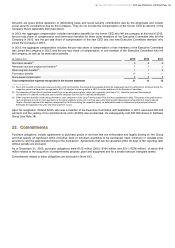

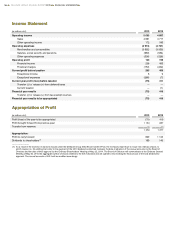

EBITDA reconciliation

(in millions of

€)

2013

2012

2011

Operating profit (as reported)

487

415

775

Add (substract):

Depreciation and amortization

579

599

540

Impairment

213

220

140

EBITDA

1 279

1 234

1 455

Underlying Group Share in Net Profit from Continued Operations

reconciliation

(in millions of €)

2013

2012

Net profit from continuing operations

226

160

Add (substract):

Net (profit) loss from non-controlling interests

(4)

2

Elements considered in the underlying profit calculation

266

370

Non-recurring finance costs

—

19

Effect of the above items on income tax and non-controlling interests

(35)

(78)

Non-recurring income tax expense (benefit)

—

(47)

Underlying group share in net profit from continued operations

453

426

158

DELHAIZE GROUP ANNUAL REPORT 2013

FINANCIAL STATEMENTS